Analysis of Jianrong Technology (301148) Limit-Up Event: Environmental Stock Rally Driven by Restructuring Expectations

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

-

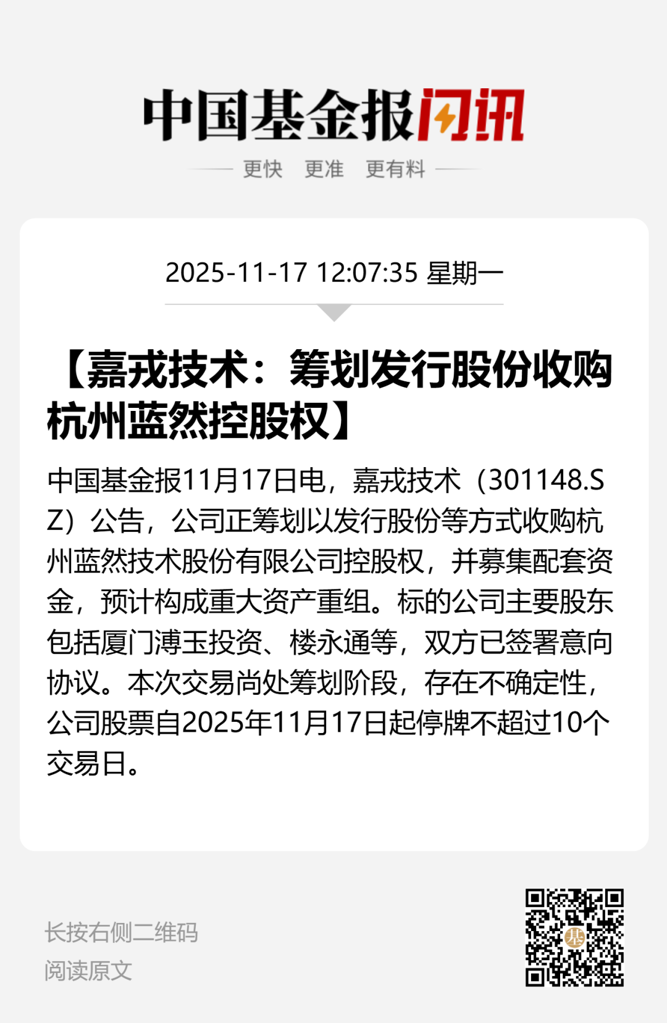

Core Reason for Limit-Up: Jianrong Technology (301148) announced a major restructuring plan on November 30, 2025 [1], intending to acquire 100% equity of Hangzhou Lanran Technology via issuing shares and paying cash, and raise supporting funds not exceeding 1 billion yuan. Hangzhou Lanran Technology focuses on the R&D and application of electrodialysis technology, with products covering new energy lithium batteries, biomedicine, silicon and semiconductors industries. Upon completion of the acquisition, it will significantly expand Jianrong Technology’s business areas and market space. After a two-week suspension (November 17-November 30), the company’s stock resumed trading on December 1 and closed directly at the 20% limit-up price of 39.64 yuan [0].

-

Price-Volume and Capital Performance: On the limit-up day, the trading volume was 9,614 lots, and the market capitalization reached 4.618 billion yuan [0]; the main capital had a net purchase of 155,500 yuan [0], indicating a positive market response to the restructuring plan. As a ChiNext stock, the 20% limit-up magnitude reflects the intensity of market sentiment.

-

Market Sentiment Analysis: The environmental protection industry has shown a differentiated trend recently, but the restructuring event triggered market expectations for Jianrong Technology’s transformation and expansion into high-boom tracks (such as lithium batteries, semiconductors) [0]. The business field of the restructuring target Hangzhou Lanran Technology is highly aligned with the currently popular new energy and semiconductor industries, which has become the core logic of market attention.

-

Track Synergy Effect: Jianrong Technology originally focused on membrane separation technology and environmental protection equipment [0], which has technical synergy with Hangzhou Lanran’s electrodialysis technology in industrial wastewater treatment, resource recovery and other fields. After the acquisition is completed, the company will form a “membrane separation + electrodialysis” dual technology platform, and its competitiveness in high-boom tracks such as new energy and semiconductors is expected to be significantly improved.

-

Valuation Reconstruction Expectation: The current market gives higher valuations to targets in the new energy and semiconductor fields [0]. If the restructuring is successful, Jianrong Technology’s valuation system is expected to switch from a traditional environmental protection stock to a technology-driven growth stock, which is the deep logic driving this limit-up.

- After the restructuring is implemented, the company’s business scope will extend to the high-growth new energy and semiconductor fields, and the market space will be significantly expanded [0].

- The synergy effect of the dual technology platform is expected to increase the company’s market share in high-end environmental protection equipment and resource recovery fields [0].

- The restructuring process has uncertainties; if the transaction fails to proceed as planned, it may trigger a stock price correction [0].

- There is a risk whether the performance commitments of the acquired target can be achieved; attention should be paid to the details of the transaction plan disclosed later [0].

- Changes in market sentiment and fluctuations in sector trends may affect the short-term stock price trend [0].

Jianrong Technology (301148) this limit-up is driven by restructuring expectations; the acquisition of Hangzhou Lanran Technology will expand the company’s business in high-boom tracks. The current market sentiment is positive, and the main capital inflow is obvious. In the future, we need to focus on the detailed content of the restructuring transaction plan, the performance commitments of the target company, and the market’s recognition of the dual-main-business synergy effect.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.