NVIDIA (NVDA) Valuation and TPU Competition: Reddit Discussion Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

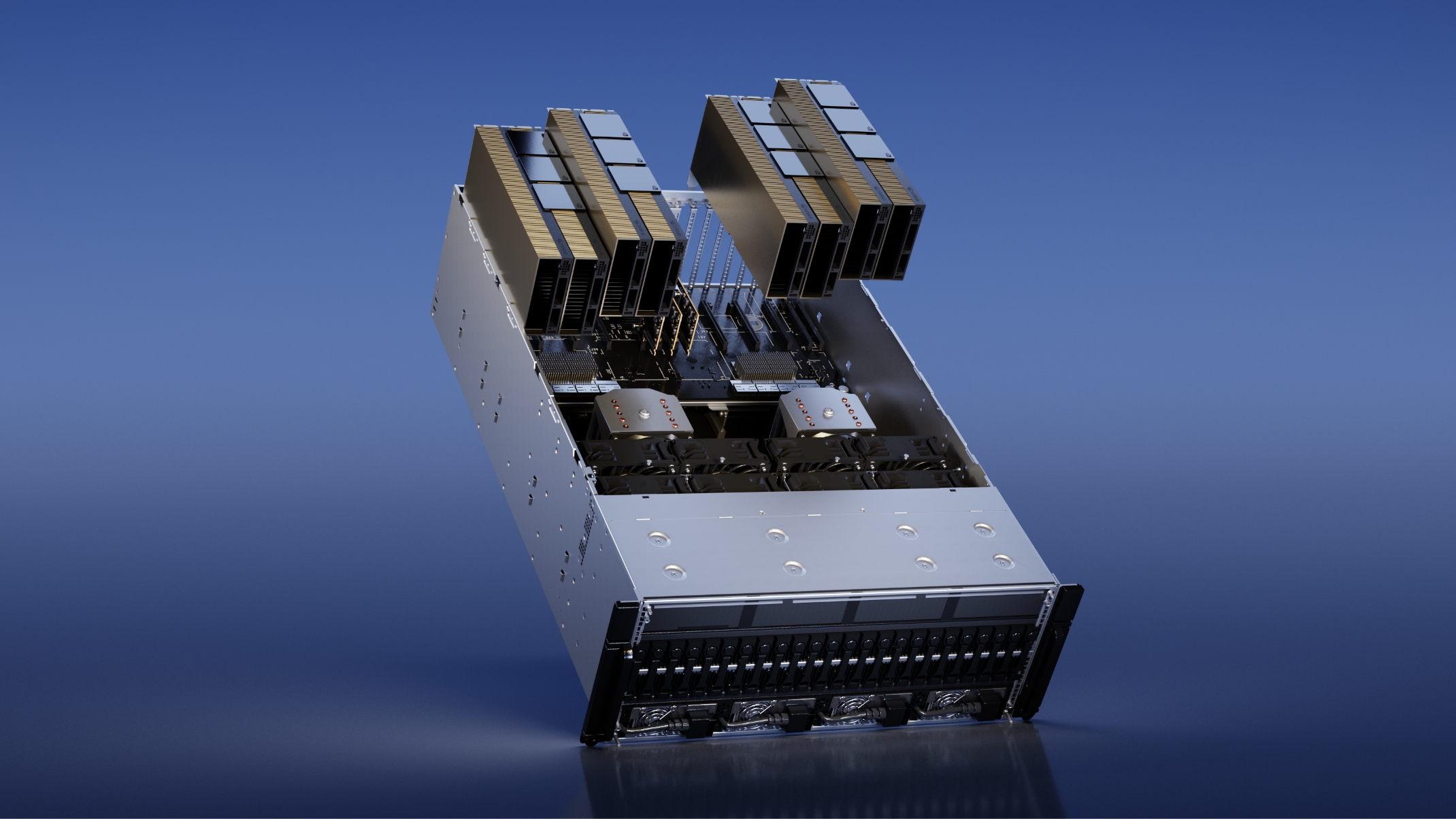

This analysis is based on a Reddit discussion posted on November 28, 2025 [0], which debated NVIDIA’s (NVDA) valuation and competition from Google’s Tensor Processing Units (TPUs). The OP argued NVDA is undervalued at $180, projecting it to reach $210 by year-end and $260 next year, noting TPUs are specialized for deep learning/LLMs but not “GPU killers” due to NVDA’s broader use cases (training, inference, graphics, scientific computing) and dominant CUDA ecosystem relied on by AI/ML engineers and infrastructure [0].

Key discussion points included:

- Bullish: NVDA’s ecosystem lead (score 14) and cost-effectiveness of Blackwell/Rubin chips (score 1)

- Bearish: PE ratio (~50) being high for a mature company (score 3) and TPU competition reducing margins (score 1)

- Neutral: TPU power efficiency (score 9) and AMD as an alternative (score 2)

Market impact analysis shows NVDA’s stock declined slightly post-discussion, closing at $180.26 on November 28, 2025, and dropping to $176.51 by December 1 (-2.08%) [0], likely due to concerns about a potential Meta-Google TPU deal [2][4]. In the medium term, NVDA is expected to maintain its moat from the CUDA ecosystem, general-purpose GPUs, and robust sales growth [1], though Google’s Ironwood TPU (7th gen), with 2x performance per watt of TPU v5p [3][5], poses a technical challenge if TPU access is broadened. Long-term, the AI chip market will grow, with GPUs and ASICs like TPUs playing complementary roles, while NVDA’s diversified product portfolio (data center, gaming, automotive) provides resilience [0].

- CUDA Ecosystem Moat Outweighs TPU Technical Advantages: NVDA’s CUDA platform, relied on by a vast base of AI/ML developers, remains its primary competitive edge, mitigating concerns about TPU performance or efficiency [1][0].

- Reddit PE Ratio Claim Inflated: The discussion cited a ~50x PE ratio, but actual TTM PE is 43.29x, with a robust 53.01% net profit margin (higher than the 30% feared in the discussion) [0].

- Analyst Consensus Remains Bullish: 73.4% of analysts rate NVDA as a Buy, with a $250 consensus price target (+41.6% from current) [0], despite competition concerns.

- TPUs Complement, Don’t Replace, GPUs: The OP’s argument that TPUs are specialized (not GPU killers) is supported by market dynamics, as GPUs serve broader use cases beyond AI training [0].

- Increased Competition: Google’s TPUs, Amazon’s Trainium, and AMD’s growth could erode NVDA’s market share or pricing power [2][3][4].

- Supply Chain Vulnerability: Reliance on TSMC for manufacturing poses disruption risks [0].

- Regulatory Tensions: US-China tensions could impact ~13% of NVDA’s revenue from Chinese customers [0].

- Market Sentiment Volatility: NVDA’s stock is sensitive to AI-related news, with negative sentiment potentially leading to price swings [0].

- AI Chip Market Growth: The expanding AI market will drive demand for both GPUs and custom chips [0].

- Product Diversification: NVDA’s presence across data center, gaming, and automotive sectors provides revenue resilience [0].

- R&D Investment: High R&D spending (as noted by CEO Jensen Huang) will support continued innovation to counter competition [6].

The Reddit discussion highlighted contrasting views on NVDA’s valuation and TPU competition, with the ecosystem lead as a key bullish factor. Market data shows a short-term price dip, but NVDA maintains a strong moat from its CUDA platform, solid financials (43.29x TTM PE, 53% margin), and bullish analyst consensus. Competition from TPUs and other players remains a risk, but the AI chip market’s growth and NVDA’s diversification provide long-term resilience. Decision-makers should monitor TPU adoption rates, the Meta-Google deal, and NVDA’s R&D strategies for future insights.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.