Analysis of Bank of America’s Bullish NVDA Stance Amid Reddit Market Discussion (Nov 29, 2025)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

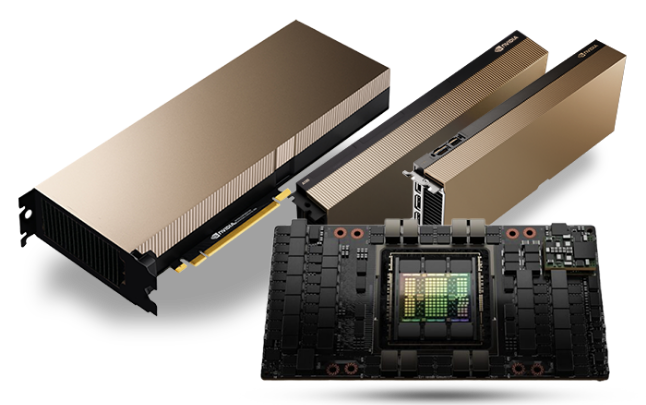

This report integrates insights from a November 29, 2025 Reddit discussion [0] and market data on Bank of America’s bullish reaffirmation of NVIDIA (NVDA). BofA cited core tailwinds: robust AI server demand, potential revenue from China-compliant chips, supply chain diversification via an Intel partnership, and NVDA’s dominant data-center GPU market share [1][2]. However, the Reddit post and market analysis also highlight risks: NVDA’s premium valuation (trailing 12-month P/E of 43.8x, above sector average), hyperscaler spending slowdowns, delays in China revenue, and competition from Google TPUs and AMD MI chips [0][2].

Reddit user sentiments added context: some expressed bullish expectations for NVDA’s December performance to close the year strong, while others criticized analyst recommendations as untrustworthy due to hidden motives, drawing parallels to past failures like Jim Cramer’s Lehman Bros call [0]. Neutral observations included Reddit’s poor historical market prediction track record compared to broader market trends [0].

Market price trends show NVDA’s stock declined 11.72% month-over-month as of November 28, 2025, likely due to concerns about AI growth sustainability, but rebounded 1.66% on November 25, possibly reflecting initial investor response to BofA’s bullish commentary [0]. BofA’s $275 price target implies 53.8% upside from the November 28 close, aligning with the broader analyst consensus (median target $250, +41.0% upside) [0][1].

- Analyst-Community Sentiment Gap: BofA’s long-term bullish stance contrasts with Reddit users’ short-term skepticism of analyst motives, highlighting a disconnect between institutional and retail market perspectives [0][1].

- Supply Chain Resilience: NVDA’s $5 billion investment in Intel, framed as supply chain diversification, addresses potential production scalability risks, which could support sustained long-term growth amid rising AI demand [3].

- China Market Uncertainty: The potential for China-compliant chip sales is a material upside but remains contingent on U.S. regulatory approval, creating a critical timing risk for revenue realization [3].

- AI TAM Growth Justification: BofA’s projection of the AI data center total addressable market (TAM) growing to $1.2 trillion by 2030 (5x current levels) provides a long-term fundamental basis for NVDA’s premium valuation, countering short-term valuation concerns [2].

- Regulatory Risks: U.S.-China export control changes could disrupt NVDA’s China revenue (13.1% of FY2025 revenue) [0][3].

- Competition: Adoption of alternative AI chips (Google TPUs, AMD MI chips) by major customers could erode NVDA’s dominant market share [2].

- Valuation Risk: At 43.8x P/E, NVDA’s stock is vulnerable to downward revaluation if growth slows below analyst projections [0].

- Supply Chain Volatility: Delays in Blackwell GPU production or Intel partnership execution could hinder revenue growth [0][3].

- AI Market Expansion: The projected $1.2 trillion AI data center TAM by 2030 offers significant growth potential for NVDA [2].

- China Revenue Upside: Approval for China-compliant chip sales could unlock new revenue streams [3].

- Sector Spillover: BofA’s positive outlook may buoy other AI-focused semiconductor stocks (e.g., AVGO, AMD), strengthening the sector’s overall sentiment [2].

- NVDA Financials: 88.3% of FY2025 revenue from the Data Center segment; net profit margin of 53.01% [0].

- BofA Stance: $275 price target with 53.8% upside from November 28 close; cites AI server demand, China-compliant chips, and Intel partnership as tailwinds [1].

- Reddit Sentiments: Mixed—bullish on December performance, bearish on analyst credibility, neutral on Reddit’s prediction track record [0].

- Price Trends: 11.72% MoM decline (Nov 28, 2025) with a 1.66% rebound on Nov 25 [0].

This summary provides objective market context and data for decision-making support, avoiding prescriptive investment recommendations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.