Jiarong Technology (301148) Analysis of Limit-Up Reasons and Market Sentiment

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

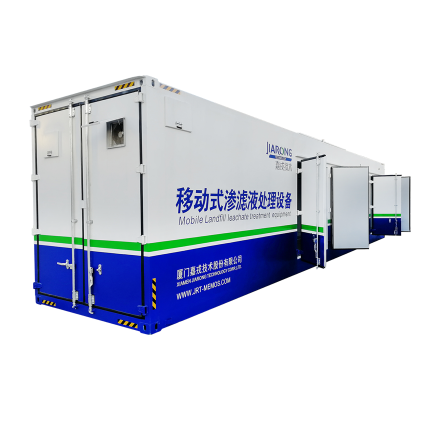

Jiarong Technology (301148) is a GEM-listed company in the environmental protection sector, whose main business is membrane separation technology-related wastewater treatment. On December 1, 2025, after resuming trading, its stock rose by the daily limit. The core driving factors were two major announcements disclosed by the company the previous night: a plan to issue shares to purchase 100% of Hangzhou Lanran’s shares and raise supporting funds, and the change of actual controller to Hu Dianjun [0]. Hangzhou Lanran focuses on electrodialysis technology; after integration, Jiarong Technology will have comprehensive solution capabilities for the ‘pressure-driven + electric-driven’ membrane combination process, and its business scope and technical strength will be significantly expanded [0].

From the perspective of price and trading volume analysis, the company’s stock opened with a one-word limit-up, rising 20.01% to 39.64 yuan per share, with a total market value of 46.18 billion yuan [0]. The one-word limit-up pattern reflects highly positive market sentiment; investors have relatively consistent expectations for the restructuring and change of actual controller, and trading willingness is strong [0].

This limit-up event is not only a reaction to a single restructuring event but also reflects the environmental protection sector’s attention to technology integration and business upgrading. Membrane separation technology is one of the core technologies in the environmental protection field; the ‘pressure-driven + electric-driven’ combination process will enable the company to have stronger competitive advantages in wastewater treatment, resource recovery, and other fields, possibly changing the competitive pattern of the segmented market [0].

In addition, the change of actual controller also brings new development expectations for the company. The background and resources of the new actual controller Hu Dianjun may provide support for the company’s subsequent strategic planning and business expansion, further enhancing investor confidence [0].

- Synergistic effects from business integration: The combination of Hangzhou Lanran’s electrodialysis technology and Jiarong Technology’s membrane separation technology will enhance the company’s competitiveness in high-difficulty wastewater treatment and resource recovery fields [0].

- Continuous market attention to technological upgrading in the environmental protection sector: As environmental protection requirements increase, enterprises with comprehensive technical capabilities will be more favored by the market [0].

- Restructuring uncertainty: The audit and evaluation work involved in this restructuring has not yet been completed, and there may be risks of plan adjustment or termination in the future [0].

- Performance integration risk: The company previously had a performance decline; after the restructuring is completed, the effect of business integration and the progress of performance release still need to be observed [0].

Jiarong Technology (301148)'s limit-up is mainly due to the positive announcements of major asset restructuring and change of actual controller, with positive market sentiment. After the restructuring is completed, the company will form a ‘pressure-driven + electric-driven’ membrane combination process, enhancing comprehensive technical capabilities and market competitiveness. Going forward, attention should be paid to the progress of the restructuring, audit and evaluation results, business integration effects, and strategic changes brought by the new actual controller [0].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.