AI Bubble Debate Analysis: Component Demand vs. ROI Concerns

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Reddit discussion [internal] and supporting data, focusing on the AI bubble debate centered around two main arguments: strong current component demand (supporting the “no bubble” claim) and poor long-term ROI (supporting bubble concerns).

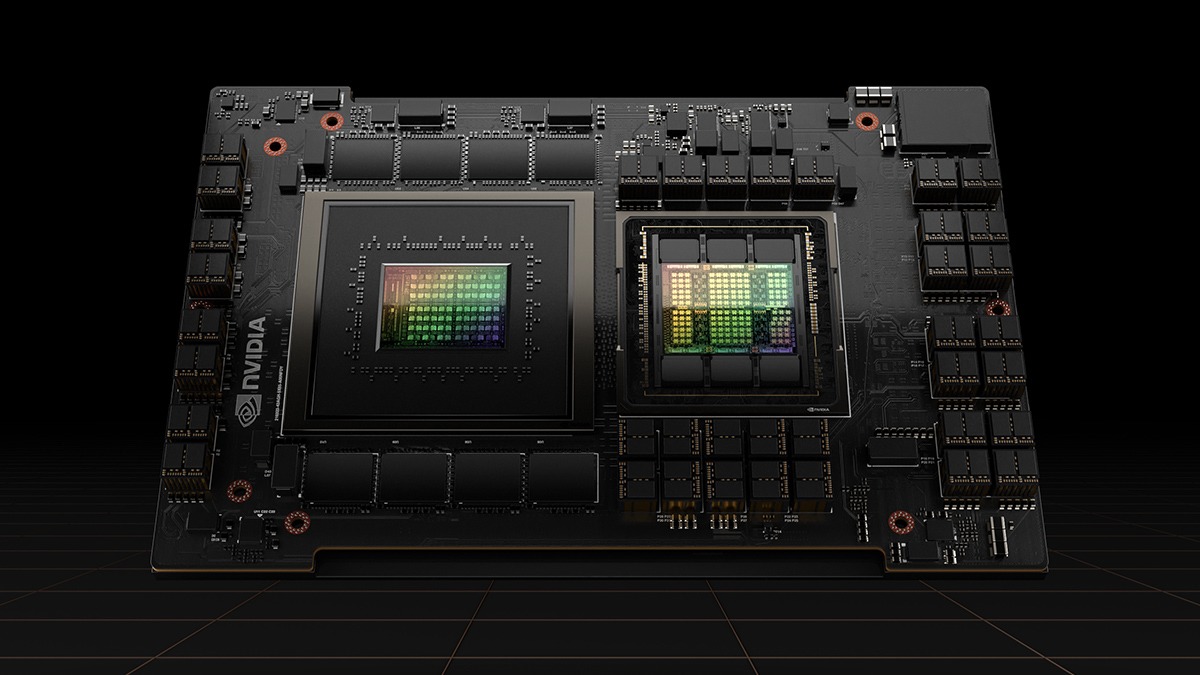

The Reddit OP cited RAM prices tripling and NVIDIA’s unmet GPU demand as proof against an AI bubble. This is validated by a 500% increase in global memory prices since October 2025 due to AI demand [1], with NVIDIA reporting record data center revenue of $51.2 billion in Q3 2025 and sold-out cloud GPUs [0]. The surging component demand is also impacting consumer markets, as PC builders like CyberPowerPC raise gaming PC prices due to memory shortages [1].

Critics in the Reddit thread argued the bubble is about ROI, not demand—comparing to the dot-com bubble where demand existed but returns did not materialize. Finextra Research confirms this, noting that AI services often operate at a loss; for example, OpenAI loses money per user despite its premium tiers [3]. NVIDIA’s Q3 2025 report shows accounts receivable increased by $10.3 billion to $33.39 billion since January 2025 [0], raising concerns about “IOUs” mentioned in the Reddit discussion. Short sellers like Jim Chanos have also highlighted circular financing and debt risks in the AI infrastructure sector [2].

The discussion also revealed differing views on bubble criteria. One commenter argued bubbles involve pre-revenue/non-product companies (not current AI market leaders), while critics drew parallels to tulip mania (where demand was also unmet) and the dot-com bubble (where demand didn’t translate to returns) [internal].

- Core Debate Tension: The AI bubble argument is not about whether demand exists, but whether that demand will generate sustainable returns.

- NVIDIA’s Dual Position: While the company is the biggest beneficiary of AI component demand, its growing accounts receivable signal potential financial risks.

- Cross-Market Impact: AI demand is already affecting consumer prices (gaming PCs), showing the breadth of its market influence.

- Historical Parallels: Critics’ comparisons to the dot-com bubble and tulip mania highlight the timeless nature of bubble concerns centered on demand vs. value creation.

- ROI Gap: Continued losses by AI service providers could lead to reduced hardware demand in the long term [3].

- Financial Instability: NVIDIA’s rising accounts receivable and concerns about circular financing may increase market volatility [0][2].

- Consumer Backlash: Surging component prices could reduce consumer access to high-end technology [1].

- Supply Chain Expansion: The component shortage creates opportunities for memory and chip manufacturers to expand production capacity.

- AI Efficiency Improvements: Pressure to improve ROI may drive innovation in AI technology and business models.

The analysis shows strong current demand for AI components (validating the OP’s claim), but significant concerns about long-term ROI and financial sustainability (supporting counterarguments). The debate hinges on differing definitions of what constitutes a “bubble” and whether current demand can translate to sustainable value. Market participants should consider both the short-term demand dynamics and long-term profitability risks when evaluating the AI market.

NVIDIA’s financials (rising accounts receivable) and surging RAM prices are critical data points in this debate, along with differing perspectives from analysts and short sellers. The European Central Bank has also noted AI’s transformative potential alongside historical bubble patterns, indicating regulatory attention may follow [5].

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.