AI Bubble Debate: Component Demand vs. ROI and Market Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

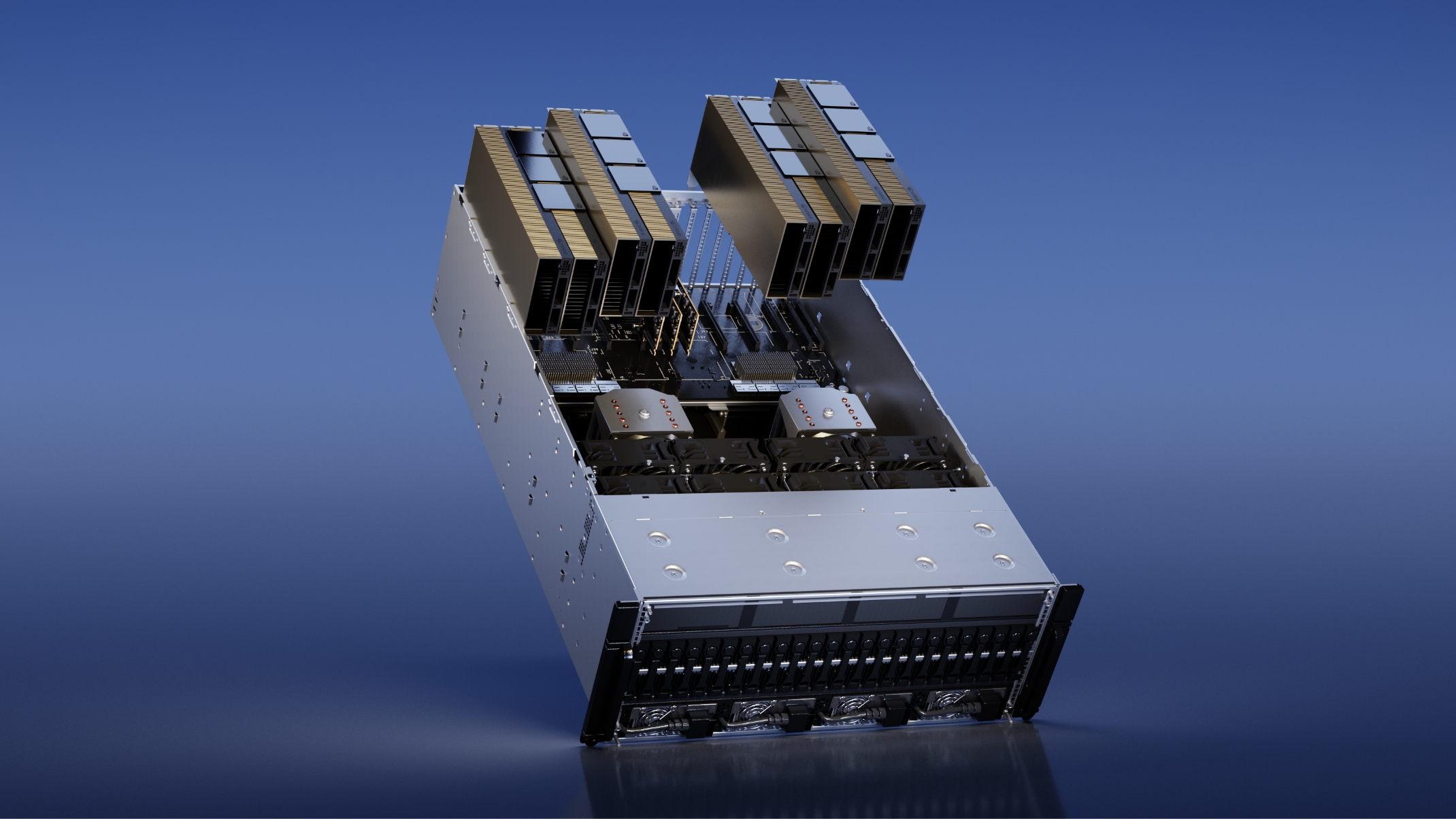

The Reddit discussion (Nov 23, 2025 UTC) centers on conflicting definitions of an AI bubble. The original poster (OP) defines a bubble as low component demand or unused hardware, citing tripling RAM prices and Nvidia’s inability to meet GPU demand as evidence against a bubble. Independent data confirms RAM price surges: DDR5 kits jumped 278% in three months (Technology Org [4]), while CyberPowerPC cited 500% memory cost increases (Tom’s Hardware [3]). G. Skill’s Trident Z5 NEO RGB RAM doubled from $125 to $270 (GamersNexus [1]), indicating overwhelmed supply chains for AI components.

Top comments reject the OP’s definition, arguing an AI bubble stems from lack of ROI for firms investing in AI—comparable to the dot-com bubble, where website demand existed but failed to deliver returns (Reddit user [2]). They also highlight Nvidia’s rising accounts receivable ($33.39B in Q3 2025, up from $23.07B at year-start) [0], though this is a common metric for large tech firms. However, the 53.3-day Days Sales Outstanding (DSO) (Technology Org [4]) suggests potential payment delays, adding risk. Market indices reflect growing anxiety: the NASDAQ Composite (tech-heavy) fell 7.01% from Nov 1-21, 2025 [0].

- Bubble definition conflict: The core dispute is whether a bubble is defined by current component demand (OP’s view) or long-term ROI (commenters’ view), highlighting differing market perspectives on AI’s value.

- Component prices as a double-edged sword: RAM price spikes confirm strong AI infrastructure demand but could collapse if companies cut AI spending due to unproven ROI.

- Nvidia’s financial metrics require scrutiny: While accounts receivable growth is normal for high-revenue periods, the longer DSO raises concerns about customer payment delays amid AI investment uncertainty.

- Market anxiety despite demand: The NASDAQ pullback shows investor caution about AI bubble risks, even as component demand remains robust.

- Risks:

- Component price collapse if AI spending cuts follow low ROI [1][3][4].

- Sharp correction in Nvidia’s stock, which has risen 1244% in 5 years on AI demand [0].

- Slowed AI adoption as companies become cautious with unprofitable investments.

- Opportunities:

- Strong component demand signals long-term AI potential if ROI is proven.

- The current market pullback could create entry points for long-term investors.

- The discussion occurred amid late 2025 RAM price spikes [1][3][4] and after Nvidia’s record Q3 AI revenue ($57.01B) [0].

- The debate hinges on conflicting bubble definitions: current component demand vs. long-term ROI.

- Key data includes RAM price increases (278-500%), Nvidia’s Q3 accounts receivable ($33.4B), and a 7% NASDAQ pullback.

- Information gaps include specific ROI data for AI projects and the proportion of Nvidia’s accounts receivable from AI customers.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.