Synopsys Pre-Market Surge and Strategic Partnership with Nvidia: Market Implications

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

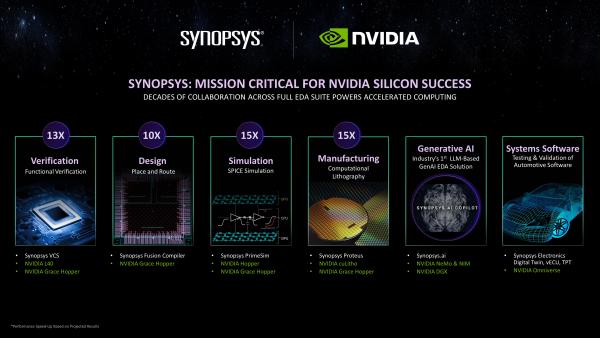

The event centers on Synopsys’ pre-market rise of 7% on December 1, 2025, triggered by Nvidia’s $2 billion investment at $414.79 per share and an expanded non-exclusive strategic partnership [1]. In regular trading, SNPS closed up 4.73% while NVDA gained 1.45% [0]. The collaboration combines Synopsys’ leadership in electronic design automation (EDA) with Nvidia’s AI and accelerated computing capabilities to target industries like semiconductors, aerospace, and automotive, with initiatives including CUDA-X acceleration for Synopsys apps, agentic AI engineering, and digital twin solutions [1].

From a financial perspective, Synopsys has a market cap of $81.32B, a P/E ratio of 35.05x, and a strong net profit margin of 31.07% [0]. A current ratio of 1.62 indicates short-term solvency [0], while analyst consensus rates SNPS a “Buy” with a 23.9% upside from the current price [0]. The $414.79 investment price is slightly below the previous day’s close of $418.01 but above November’s average price [0].

- The partnership represents a convergence of EDA and AI/accelerated computing, potentially revolutionizing design workflows across multiple industries [1].

- Nvidia’s investment acts as a significant vote of confidence, which may counter Synopsys’ 26.05% drop over the past three months [0].

- The non-exclusive nature of the agreement opens the door for similar collaborations between competitors, but Synopsys’ early integration could establish a market edge [1].

- Opportunities: Integrated solutions may drive new revenue streams, enhance product capabilities, and expand market share in high-growth industries [1].

- Risks: The non-exclusive partnership limits competitive moats, while a high EV/OCF ratio of 65.06x raises concerns about potential overvaluation [0]. Additionally, Synopsys’ recent 3-month decline indicates underlying market volatility [0].

This event highlights a strategic alignment between two leaders in semiconductor-related technology, with positive short-term market reactions. The partnership leverages complementary strengths to address industry-wide design challenges, while financial metrics show Synopsys’ robust profitability and market analyst confidence. However, investors should monitor valuation risks and the impact of non-exclusivity on long-term competitive positioning.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.