NVDA: Bank of America’s Bullish Stance Amid Reddit Sentiment Divisions

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

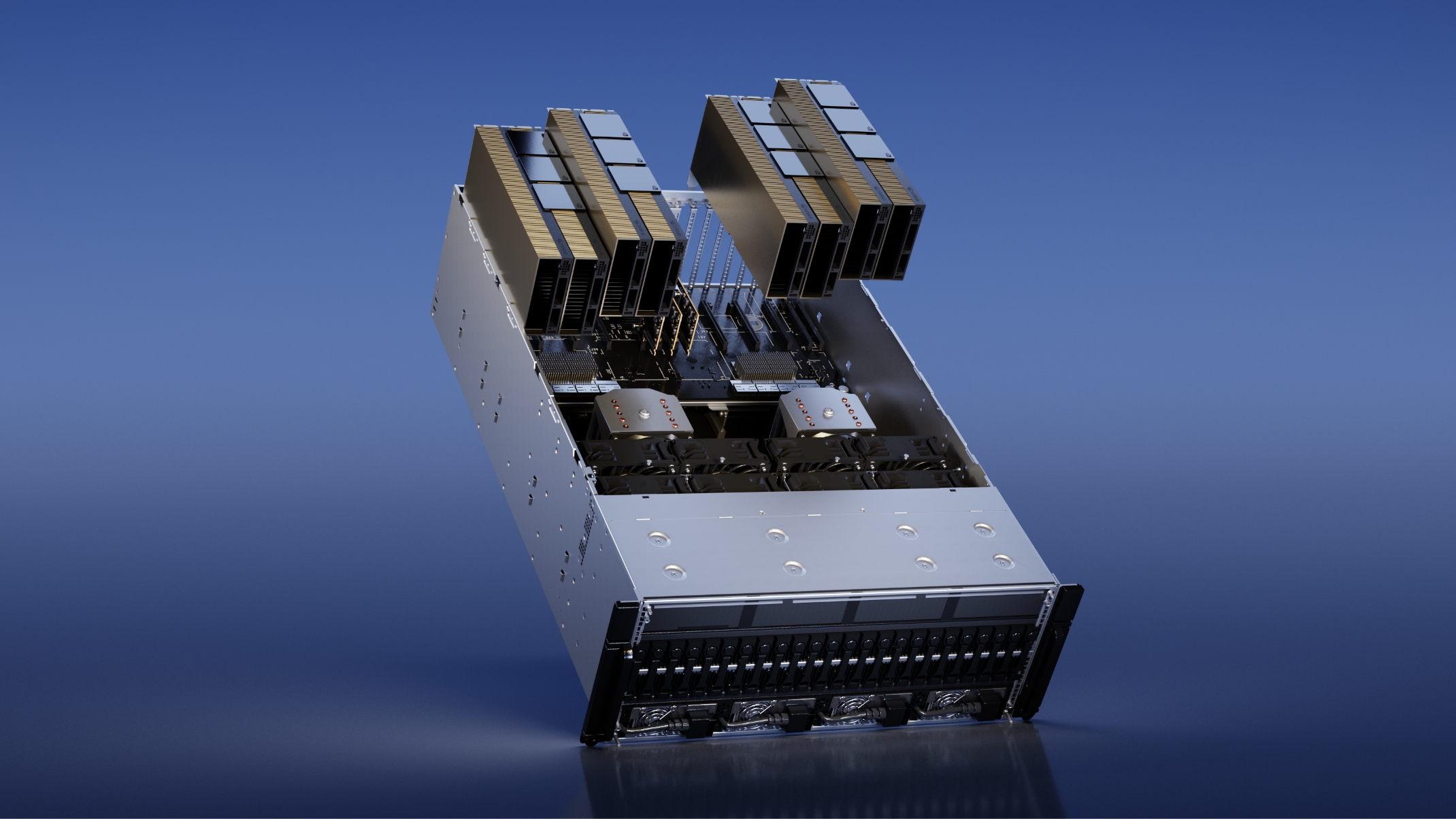

This analysis leverages BofA’s bullish reaffirmation (via Reddit [1]), Reddit user sentiment, and internal Technology sector performance data [0]. BofA highlighted key tailwinds for NVDA: robust AI server demand, potential revenue from China-compliant chips, supply chain diversification via an Intel partnership, and competitive advantages in the data-center GPU ecosystem. However, the Reddit OP also noted risks: elevated valuation concerns, potential hyperscaler spending slowdowns, delayed China revenue, and competition from Google TPUs and AMD MI chips.

Reddit user sentiment was mixed. A minority predicted NVDA would improve in December to close the year (low upvotes), while others criticized analyst recommendations as untrustworthy due to hidden motives (comparing current bullishness to Cramer’s flawed Lehman Bros call) and raised exit liquidity concerns. The Technology sector rose 0.50891% on 2025-11-30 [0], offering context for NVDA’s November performance.

- Institutional bullishness (BofA) contrasts with retail skepticism (Reddit) regarding analyst motives and long-term market risks, reflecting a divide in perception between professional and retail investors.

- NVDA’s Intel partnership and China-compliant chip strategy address critical supply chain and market access challenges, but near-term risks (valuation, competition) persist.

- Reddit’s focus on historical prediction track records and new narratives like circular funding reflects broader retail market concerns about market dynamics and analyst credibility.

- Opportunities: AI-driven demand expansion, supply chain resilience from the Intel partnership, and potential China market access via compliant chips.

- Risks: Elevated valuation, volatility in hyperscaler spending, delayed China revenue, competition from Google/AMD, and retail-driven concerns about exit liquidity and analyst trust.

NVDA operates in a mixed landscape with institutional tailwinds and retail skepticism. Positive sector performance provides a supportive broader market backdrop, but specific risks (competition, valuation) and sentiment divisions merit ongoing monitoring to understand the stock’s near-term and long-term trajectory.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.