Analysis of Reddit Bullish Due Diligence on Barrick Mining ($B) and Market Context

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On December 1, 2025, a Reddit user published a bullish due diligence (DD) on Barrick Mining ($B) citing catalysts such as S&P 500 inclusion (expected to drive forced buying), the high-efficiency Fourmile gold mine, resolved Mali geopolitical issues, analyst price targets averaging $46, and gold’s upward trend. The user projected short-term ($72) and long-term ($110+ if gold reaches $5k/oz) price targets and recommended a buy-and-hold strategy[1]. Discussion counterpoints included concerns about buying near the top, Newmont Mining ($NEM) being a better alternative due to lower PE and higher margins, and the post coming late after $B’s 175% run-up[1].

Market data shows $B has surged 165.06% YTD and 145.96% over 1 year[0], driven by gold’s 40% YTD rally (its best since 1979)[4]. The stock traded at $42.33 near its 52-week high of $43.08 when the DD was published[0].

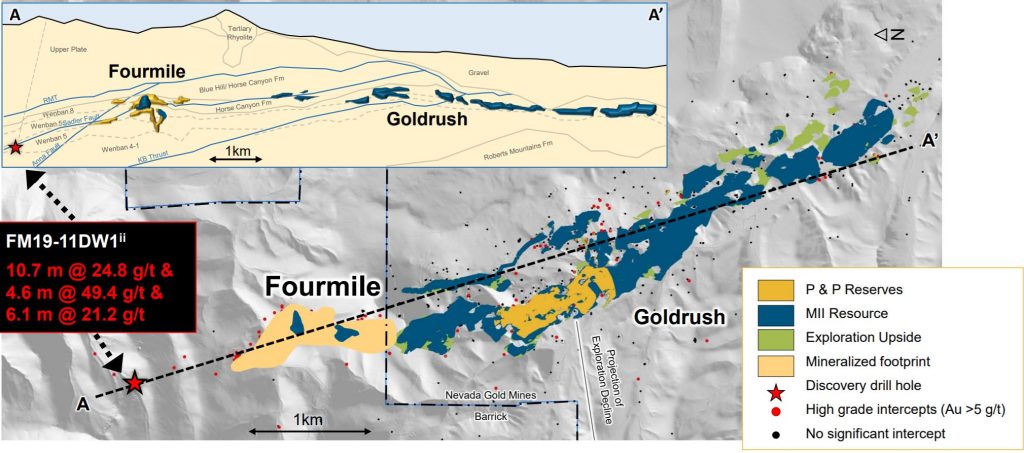

Validated catalysts include the resolved Mali Loulo-Gounkoto mine dispute on November 25, 2025, where $B paid $430 million to settle the 2-year conflict, removing a significant geopolitical risk[2]. Updated studies on the Fourmile mine confirm it is a high-grade (11.8-14.1g/t) project with low-cost production potential (LOM AISC $650-$750/oz) and industry-leading cash flows, positioning it as a top-tier gold asset[3].

Counterpoints are partially validated: $NEM has a lower PE (14.28x vs. $B’s 20.12x) and higher net profit margin (33.82% vs. $B’s 24.53%)[0]. $B’s 250-day gain of 143.70%[0] aligns with the 175% run-up mentioned in the Reddit discussion.

Notably, some DD claims lack confirmation: no public verification of $B’s S&P 500 inclusion[0]; analyst consensus price target is $43.00[0], not $46; and $5k/oz gold is an extreme scenario (current ~$4,270/oz[0]) with no mainstream analyst support, making the long-term $110+ target speculative.

- The resolved Mali dispute is a critical de-risking catalyst for $B, eliminating operational uncertainty that had weighed on the stock.

- The Fourmile mine’s potential as a high-grade, low-cost asset could drive long-term value if exploration and development targets are met.

- $B’s current price ($42.33) is just 1.6% below the analyst consensus target of $43.00[0], limiting short-term upside and contrasting the user’s optimistic $72 target.

- Gold price volatility remains the dominant factor for $B’s performance due to its strong correlation with the precious metal.

- Risks:

- Near-term overvaluation: $B is trading near its 52-week high with limited upside to analyst consensus targets[0].

- Gold price correction: A pullback in gold (40% YTD rally) could trigger a stock decline[4].

- Fourmile mine execution risk: The project is in exploration stages; delays or lower-than-expected grades could impact performance[3].

- Competitive pressure: $NEM’s superior financial metrics may attract investors away from $B[0].

- Opportunities:

- Long-term gains if gold prices continue their upward trend[4].

- Potential upside from Fourmile mine production exceeding expectations[3].

- Bullish Q4 2025 earnings (suggested in the DD) could drive short-term momentum.

- Barrick Mining ($B) has experienced significant YTD (165.06%) and 1-year (145.96%) gains driven by gold’s strong performance[0].

- Validated bullish catalysts include the resolved Mali mine dispute and the Fourmile mine’s high-grade, low-cost potential[2][3].

- Counterpoints about $NEM’s better financial metrics and $B’s substantial run-up are supported by market data[0].

- Unconfirmed claims (S&P 500 inclusion, $46 price target, $5k gold) require further verification.

- Decision-makers should monitor gold price trends, Q4 2025 earnings, Fourmile mine updates, and S&P 500 inclusion status.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.