2025 AI Bubble Debate: Component Demand Surge vs. ROI Shortfalls & Market Risks

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

On 2025-11-23 UTC, a Reddit discussion sparked debate about the existence of an AI bubble, with the original poster (OP) claiming no bubble due to surging demand for AI components (RAM/GPU shortages) and overwhelmed supply chains. Critics countered that the bubble critique focuses on

Verified data supports key claims from both sides:

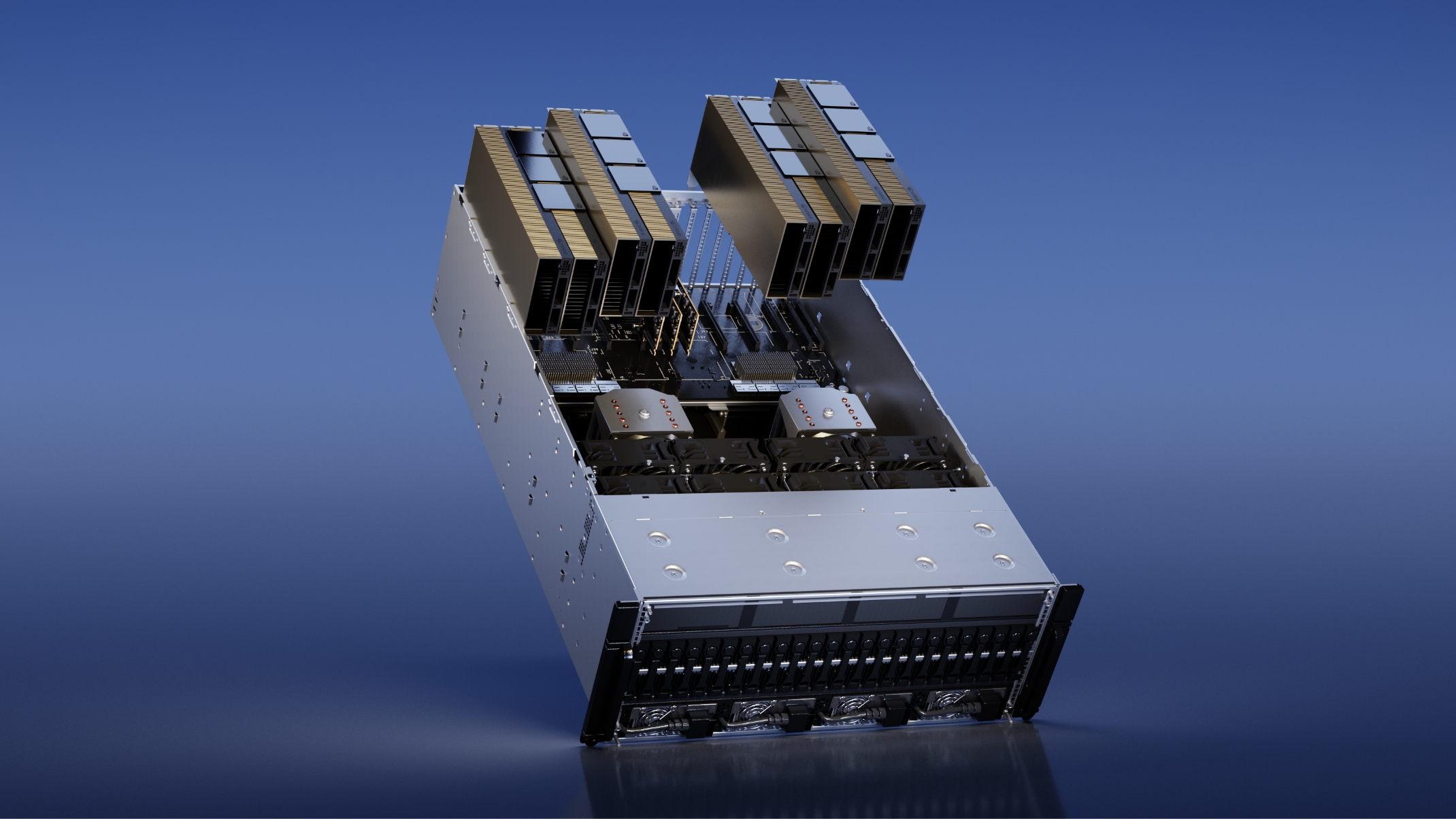

- RAM prices tripled/quadrupled from September to November 2025 (32GB DDR5 kits: $82 → $310; 64GB: $190 → $700), confirming component demand [1].

- NVIDIA’s accounts receivable surged 89% in Q3 2025, indicating the company is extending credit to maintain “high demand” metrics [0].

- A KPMG report (Nov 2025) found 93% of companies use AI, but only 2% realize generative AI ROI, validating the core bubble critique [4].

Expert perspectives add context to the debate:

- Liz Ann Sonders noted AI differs from the dot-com bubble because current AI leaders (NVIDIA, Microsoft) are large, profitable companies [2].

- Bill Gates and Sam Altman acknowledged AI frenzy parallels to the dot-com bubble (but less extreme than tulip mania) [3].

- Rajiv Jain (GQG Partners) argued AI is “worse than dot-com” due to lower expected EPS growth and broader market exposure [5].

- Debate Misalignment: The OP’s focus on component demand overlooked the core bubble argument (ROI vs. investment), highlighting a critical misrepresentation of the issue.

- NVIDIA’s Hidden Risk: The 89% accounts receivable surge suggests “high demand” may be inflated by credit extensions, exposing the company to potential customer payment defaults [0].

- Adoption-ROI Disconnect: The gap between near-universal AI adoption (93%) and minimal ROI (2%) indicates a significant market imbalance, a classic bubble precursor [4].

- Bubble Parallels with Caveats: While current AI leaders’ profitability distinguishes this from the dot-com bubble, high valuations and unmet growth expectations align with historical bubble dynamics [2][3][5].

- Short-Term Market Impact: Spiking component prices may slow AI infrastructure buildouts, delaying widespread AI deployment [1].

- Long-Term Correction Risk: If ROI expectations remain unmet, investor confidence could collapse, leading to a market correction [2][5].

- Business Financial Risk: Early AI adopters face pressure to continue spending without tangible returns, straining financial resources [4].

- Regulatory Scrutiny: Governments may increase oversight of AI investments to mitigate systemic risks from a potential bubble burst [3].

- Long-Term AI Value: Despite near-term ROI gaps, AI’s transformative potential could deliver sustained value if adoption matures and ROI improves.

- Component Supply Chain Growth: The surge in component demand creates growth opportunities for memory and chip manufacturers, provided demand remains sustainable [1].

- Component Demand: RAM prices increased 3-4x (Aug-Nov 2025) due to AI infrastructure demand [1].

- NVIDIA Financials: $4.38T market cap, 89% Q3 2025 accounts receivable surge, 44.12x P/E ratio [0].

- AI ROI: 93% company AI adoption, 2% generative AI ROI realization [4].

- Expert Consensus: Mixed views, with most acknowledging hype outpacing near-term value creation [2][3][5].

- Information Gaps: Need global ROI data (KPMG’s report covers Canadian companies only), NVIDIA customer payment terms, and long-term AI value timelines.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.