Apple AI Leadership Shakeup: Giannandrea Departure and Subramanya Appointment Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

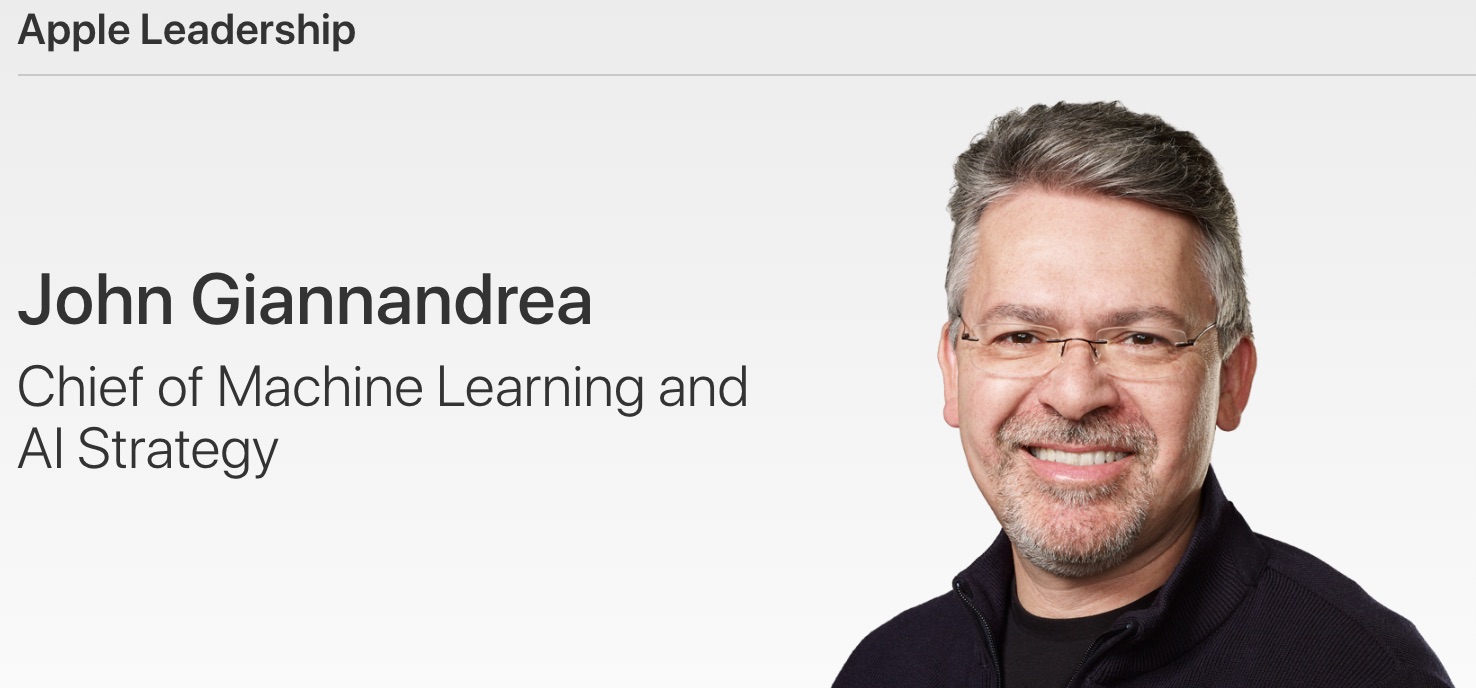

On December 1, 2025 (EST), Apple (NASDAQ: AAPL) announced John Giannandrea, its senior vice president for Machine Learning and AI Strategy, will step down and retire in spring 2026, to be replaced by Amar Subramanya—a former Microsoft AI executive and Google DeepMind researcher with expertise in LLMs like Gemini [1][2][3]. This leadership shakeup follows persistent criticism of Apple Intelligence (launched 2024) for poor user reviews and delayed features, including an improved Siri update pushed to spring 2026 [4][5].

Market reaction was immediately positive: AAPL closed at $283.10, up 1.83% with moderate trading volume (44.98M shares, slightly below the 51.43M average) [0]. This optimism likely stems from Subramanya’s track record in developing consumer AI products (e.g., Microsoft Copilot) and foundation models, which could address Apple’s perceived AI capability gaps [3]. Reports of a potential partnership with Google to use a custom Gemini model for Siri further support near-term improvement expectations [4][5]. However, AAPL’s high P/E ratio (37.78x) aligns with Reddit claims of potential overvaluation [0], contrasting with the 61.5% analyst Buy consensus and $300 target price [0].

- Urgency to Address AI Lag: The leadership change—coming after Apple Intelligence setbacks and earlier reports of CEO Tim Cook’s lost confidence in Giannandrea—signals Apple’s recognition of its AI competitiveness gap and commitment to corrective action [4].

- Synergy of External Talent and Partnerships: Subramanya’s background in Google DeepMind and Microsoft aligns with the reported Google Gemini partnership, suggesting a strategy to leverage external expertise while building internal AI capabilities.

- Valuation-Strategy Tension: AAPL’s $4.18T market cap and elevated P/E ratio place significant pressure on Subramanya to deliver tangible AI improvements to justify investor expectations [0].

- AI Competitiveness Lag: Apple trails Google, Microsoft, and Meta in AI functionality, risking eroded product appeal if Siri and Apple Intelligence improvements are delayed beyond 2026 [1].

- High Valuation Vulnerability: The 37.78x P/E ratio makes AAPL sensitive to negative news about AI execution or product delays [0].

- Google Dependency Risk: Over-reliance on Google’s Gemini model could limit Apple’s long-term independence in AI development and data privacy control [4].

- Leadership Expertise: Subramanya’s experience in LLMs and consumer AI could accelerate Apple’s foundation model research, AI safety efforts, and feature delivery under software chief Craig Federighi [3].

- Siri Revamp as Reputation Reset: The spring 2026 improved Siri launch is a high-stakes opportunity to reverse Apple Intelligence’s negative perception and demonstrate AI progress.

This analysis synthesizes Apple’s AI leadership change, market reaction, and underlying AI challenges. AAPL’s 1.83% price increase reflects investor optimism about Subramanya’s potential to revitalize Apple’s AI efforts, while concerns about AI lag, valuation, and Google dependency remain. Key metrics include a $4.18T market cap, 37.78x P/E ratio, and 61.5% analyst Buy rating. Stakeholders should monitor Subramanya’s strategic moves, the 2026 Siri launch, and updates on the Google partnership to assess long-term AI progress.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.