Analysis of AMD's 15% Tax on China AI Chip Shipments and Regulatory Developments

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

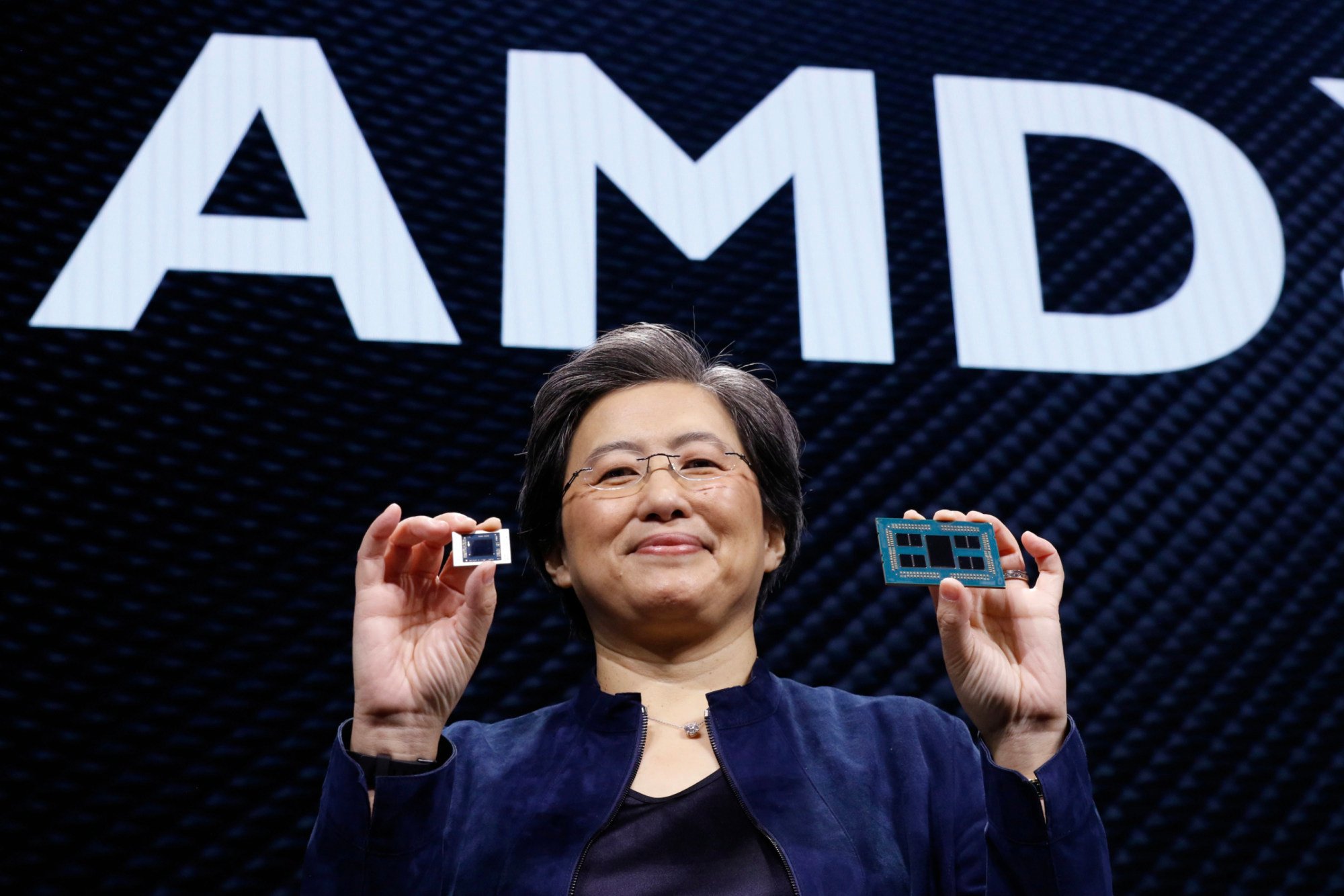

This analysis is based on verified news sources covering the December 4, 2025 (20:11:44 EST) announcements [1][2][3][4][5][6]. AMD CEO Lisa Su stated the company has obtained licenses to ship some MI 308 AI chips to China and will pay a 15% tax to the U.S. government, part of an August 2025 agreement between the Trump administration, AMD, and NVIDIA [1][2]. Concurrently, a bipartisan Senate bill was introduced to block NVIDIA’s high-end chips (H200/Blackwell) from China for 30 months, with potential implications for AMD’s high-end shipments [4][5][6].

Market performance data shows AMD closed at $215.98 on December 4, 2025, down 0.74% from the previous close, with trading volume (23.70M) significantly below the 59.14M average [0]. In contrast, NVIDIA closed up 2.11% at $183.38, likely due to investor interpretation that the company will maintain partial Chinese market access despite the new bill [0]. The 15% tax raises concerns about AMD’s profit margins, though the exact impact depends on shipment volume and pricing power [1][3]. The MI 308 is a lower-end AI chip compared to NVIDIA’s restricted models, limiting AMD’s share in China’s advanced AI sector [1][3]. Legal experts also question the tax’s constitutionality (violating the U.S. export tax ban), adding uncertainty [1][2].

- Contrary to the Reddit post’s bearish framing of AMD relative to NVIDIA, NVIDIA’s stock rose, indicating market confidence in its ability to navigate the regulatory environment.

- The bipartisan bill’s current focus on NVIDIA’s high-end chips may not immediately affect AMD’s MI 308 shipments, but its provision to restrict more powerful processors than currently approved could expand to impact AMD’s products later.

- The 15% tax’s financial impact is highly uncertain due to missing details on calculation methods (e.g., revenue vs. unit price), implementation timing, and license volume restrictions [1][2][3].

- Regulatory Risk: The bipartisan bill could expand restrictions on AMD’s chip exports beyond the MI 308 model, limiting market access [6].

- Legal Risk: The 15% tax may face constitutional challenges, potentially disrupting AMD’s planned shipments [1][2].

- Competitive Risk: NVIDIA’s dominance in high-end AI chips and potential favorable export terms could limit AMD’s growth in China [1][3].

- Geopolitical Risk: Escalating U.S.-China tensions could lead to additional export restrictions or retaliatory measures affecting both companies [4][5][6].

- AMD gains access to the Chinese AI chip market (albeit with lower-end chips), which could generate revenue to offset the 15% tax if demand is strong.

- Event Date: December 4, 2025 (20:11:44 EST)

- AMD Announcement: Licenses for MI 308 AI chip shipments to China, 15% U.S. government tax.

- NVIDIA Context: Part of the same August 2025 administration deal; targeted by a new bipartisan bill for high-end chip sales.

- Market Performance: AMD (down 0.74%, low volume); NVIDIA (up 2.11%).

- Critical Uncertainties: Exact license details, tax calculation methods, bill progression, and Chinese market demand for AMD’s MI 308 chips.

- Key Risks: Regulatory expansion, legal challenges, competitive pressure, and geopolitical tensions.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.