Analysis of the Reasons for Annie Shares (002235) Hitting the Daily Limit and Its Market Impact

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

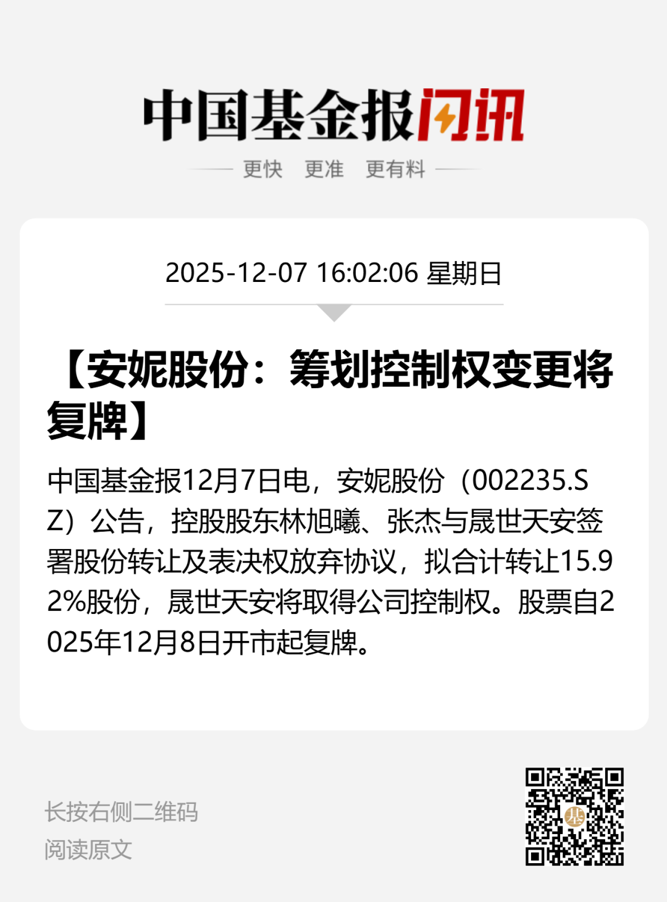

Annie Shares (002235) hit the daily limit on December 8 primarily due to the

From the perspective of market sentiment, the attention to Annie Shares on social media such as stock bars has increased significantly, and institutional funds have actively participated through large sealed orders, indicating that the market is optimistic about the company’s prospects after the control transfer [0]. At the same time, most of the stocks that hit the daily limit today are targets with major positive news such as restructuring and equity transfer, and Annie Shares’ performance is in line with the current market’s pursuit of high-quality asset restructuring concepts [0].

-

Significance of One-Word Daily Limit: One-word daily limit is the strongest daily limit pattern in the A-share market, usually accompanied by major positive news, reflecting the market’s high consensus on positive events [0]. Annie Shares’ one-word daily limit and over 1 million lots of sealed orders show that buying power is far greater than selling power, and short-term bullish sentiment is strong.

-

Potential Impact of Control Transfer: If Shengshi Tian’an can inject high-quality assets or bring advanced operation and management concepts to Annie Shares in the future, the company’s fundamentals are expected to be substantially improved [0]. However, it should be noted that control transfer needs to pass regulatory approval, which has certain uncertainty, and the specific business plan of Shengshi Tian’an needs to be focused on in the follow-up.

-

Linkage of Market Environment: Annie Shares’ daily limit is not an isolated event. Recently, the market has shown high enthusiasm for themes such as restructuring and control transfer. This phenomenon reflects investors’ strong expectations for the improvement of listed companies’ fundamentals, and at the same time, we need to be alert to short-term fluctuations caused by theme speculation [0].

- Regulatory Approval Risk: Control transfer needs to pass the approval of regulatory agencies. If the approval is not passed, it will directly affect the company’s future development, and the stock price may回调 sharply [1][2].

- Valuation Pressure Risk: If there are no substantive business improvement measures in the follow-up, the valuation increase brought by the short-term daily limit may not be sustainable, and there will be回调 pressure [0].

- Sentiment Reversal Risk: After a large short-term increase, if market sentiment cools down, profit-taking orders may pour out concentratedly, leading to a decline in stock price [0].

- Information Asymmetry Risk: Investors need to pay attention to the specific business plans and asset injection actions of Shengshi Tian’an in the follow-up to avoid blind following [0].

- Fundamental Improvement Opportunity: If Shengshi Tian’an can bring high-quality assets or advanced management experience to the company, Annie Shares’ fundamentals are expected to be improved, and long-term value will be revealed [0].

- Theme Speculation Opportunity: Against the background of the current market’s pursuit of asset restructuring concepts, Annie Shares may continue to receive capital attention, and there is still room for short-term growth [0].

The core reason for Annie Shares (002235) hitting the one-word daily limit on December 8 is the major positive announcement of control transfer. The current market sentiment is optimistic, and the number of sealed orders exceeds 1 million lots, showing a strong willingness to buy. However, risks such as regulatory approval, valuation pressure, and sentiment reversal need to be watched. In the follow-up, we need to focus on the specific business plan of Shengshi Tian’an, the approval progress of control transfer, and the situation of the stock price breaking through the previous resistance level. Investors should combine their own risk tolerance, analyze rationally, and make decisions carefully.

西部材料(002149)涨停原因及市场分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.