Analysis of the Reasons for the Strong Performance and Prospects of Huashi Technology (301218)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Layout in Intelligent Robot Track Becomes Main Catalyst: On November 25, 2025, Huashi Technology announced a strategic investment of 22.5 million yuan in Hangzhou Yuchuang Robot Technology Co., Ltd. (holding 15% equity), combining its smart city technology with Yuchuang Robot’s core technologies of spatial intelligence and embodied intelligence to expand AI scenario applications [1].

- Driven by Sector Popularity and Market Sentiment: Recently, the intelligent robot sector has received widespread attention; institutions predict that the humanoid robot industry will usher in an investment opportunity from “0 to 1”, with optimistic market sentiment [2].

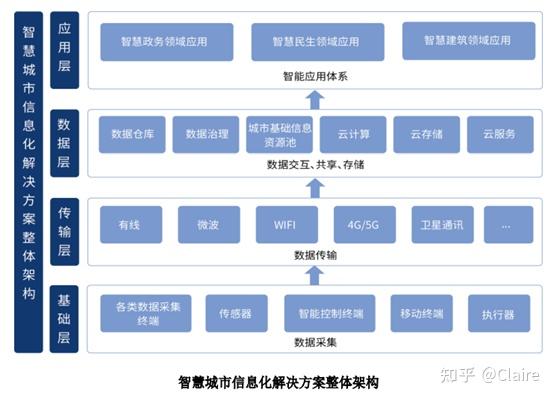

- Smart City Business Provides Stable Support: The company’s main business is information system integration and technical services in the smart city field, covering smart port and shipping, smart supervision, and other areas. China’s smart city ICT market is expected to reach 1,232.54 billion yuan by 2028, providing stable demand for the company [1].

- Technical Aspect: On December 8, Huashi Technology closed at 21.83 yuan, with a -0.41% increase, but recently the stock price broke through the annual line and is overall in an upward channel; the day’s turnover rate was 4.89%, and the trading volume was 34,200 lots, which was higher than the previous period, indicating increased investor attention [3][4].

- Fundamental Aspect: The company expands new growth drivers by laying out the intelligent robot track, but the business of Yuchuang Robot (the invested company) is still in the early stage, so the impact on performance is uncertain; the third-quarter net profit declined year-on-year, with great performance pressure [1].

Recent strong performance is mainly driven by the popularity of the robot sector and the company’s strategic layout, but attention should be paid to: 1) The implementation progress of the invested business; 2) The sustainability of sector sentiment; 3) The improvement of the company’s performance. If the robot business can achieve technical synergy or order breakthroughs, the strong performance is expected to continue; otherwise, if the sector’s popularity fades or performance continues to decline, a correction may occur.

- Cross-sector Synergy Effect to Be Verified: The combination effect of the company’s smart city technology and robot technology will be a key variable for future performance growth.

- Sector Volatility Risk to Be Alerted: The intelligent robot sector is in the early stage of development, with high uncertainty in technology research and development and order implementation, leading to large sector volatility [2].

- Valuation and Performance Divergence: The company’s dynamic P/E ratio is -99.33, with high valuation, which diverges from the current fundamental of declining net profit, and there is a risk of valuation regression [3].

- Business Uncertainty: Yuchuang Robot’s business is still in the early stage, so the actual contribution to the company’s performance is uncertain.

- Sector Volatility Risk: The intelligent robot sector is greatly affected by sentiment and fluctuates frequently.

- Valuation Risk: High P/E ratio and declining performance form a divergence, with great pressure for valuation regression [3].

- Large Growth Potential of Intelligent Robot Track: Institutions predict that the humanoid robot industry has a broad market space, and the company’s layout is expected to share the industry’s growth dividends [2].

- Stable Growth of Smart City Business: Market demand continues to expand, providing performance guarantee for the company [1].

Huashi Technology recently entered the strong stock pool mainly due to its layout in the intelligent robot track, sector popularity, and support from smart city business. The technical breakthrough of the annual line shows a strong trend; fundamentally, there are new track opportunities but also face business uncertainty, high valuation, and sector volatility risks. Investors need to pay attention to the progress of business synergy, performance changes, and sector sentiment trends, and carefully evaluate investment risks and opportunities.

天孚通信(300394)强势表现分析报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.