01137.HK (Hong Kong Technology Exploration) Popular Stock Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

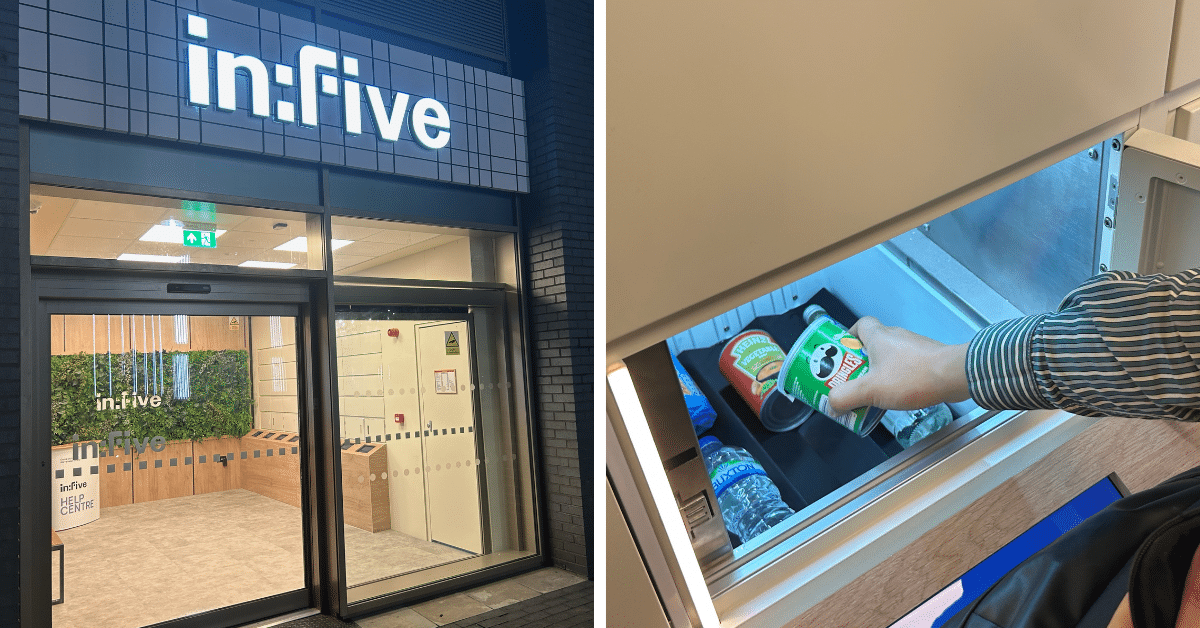

Hong Kong Technology Exploration (01137.HK) is an online retail sector company. On December 9, 2025, it became a popular stock due to being on the East Money App Hong Kong Stock Surge List [4]. On that day, the company’s stock closed at HK$1.45, up 0.69% from the previous day [1]. Notably, the company just released negative news on December 8, 2025, about the suspension of its first UK unmanned store “In:Five” [2][3].

Possible reasons for the stock price rise include: the market has already priced in the negative expectations of the UK project suspension in advance; momentum trading driven by short-term speculative funds; and the amplified price fluctuation effect against the backdrop of low trading volume. The trading volume on that day was only about 133,000 shares, significantly lower than its historical average [1], and the price fluctuation range was small (highest price HK$1.45, lowest price HK$1.44).

Due to the lack of clear positive catalysts to support the stock price rise and the company’s recent release of negative news, the overall market sentiment shows characteristics of uncertainty and speculation. Discussions on social media and financial platforms mainly focus on the failure of the company’s UK project and future strategic adjustments [2][3].

- Divergence Between Negative News and Upward Trend: After the release of negative news, the stock price rose, indicating that the market has already reflected the negative expectations of the UK project in advance, and short-term speculative behavior dominated the price fluctuations.

- Low Trading Volume Reveals Weak Consensus: The low trading volume on that day (133,000 shares) indicates that investors’ participation in this rise is low, there is no clear bullish consensus, and the sustainability of the upward trend is questionable.

- Fundamental Risk: The failure of the UK unmanned store project exposes the technical and regulatory challenges faced by the company’s international expansion. The 2024 annual report shows that there are major technical obstacles in the development of UK unmanned stores [2].

- Liquidity Risk: Low trading volume makes the stock price vulnerable to small amounts of capital, which may exacerbate price fluctuations [1].

- Speculative Risk: The current stock price rise lacks fundamental support and may be a short-term speculative behavior with uncertain sustainability.

If the company can adjust its international expansion strategy, optimize its business model, and improve its fundamental performance, there may be long-term development opportunities in the future, but no relevant positive signals have emerged yet.

- Current Price: HK$1.45 [1]

- Daily Change: +0.69% [1]

- Daily Trading Volume: Approximately 133,000 shares [1]

- Short-term Support Level: HK$1.40 (recent price bottom area)

- Short-term Resistance Level: HK$1.50 (3-month high)

- Key Focus: Changes in trading volume in the next 3-5 trading days, and whether the company releases new strategic adjustment announcements.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.