Analysis of Strong Performance and Trend Judgment for Zhongci Electronics (003031.SZ)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

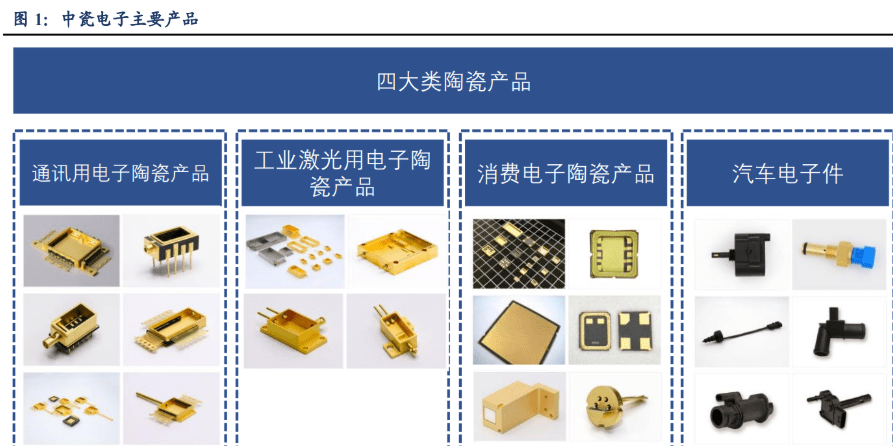

The strong performance of Zhongci Electronics (003031.SZ) is mainly driven by both technical and industry factors:

- Technical Trigger: The stock price broke through the recent resistance level of $65.31, with a daily trading volume of 2.90M slightly higher than the 5-day average of 2.85M. Short-term momentum has attracted investors’ attention [0].

- Industry Background: The semiconductor packaging segment benefits from the growing demand for electronic components in AI, 5G and other fields. As a key supporting segment, the electronic ceramic packaging industry’s prosperity has improved [1][2].

- Market Performance: The stock rose 10.01% in 1 day, 25.11% in 5 days, and 20.59% in 1 month, showing a rapid upward trend [0]. Technical indicators show that KDJ and RSI are in the overbought range, with a support level at $54.64. After breaking through the resistance level, the next target level is $67.08 [0].

- Technical and Industry Resonance: Although no latest announcements or news directly benefiting the company were found [3], the expectation of increased industry demand and technical breakthrough have formed a resonance, driving the stock price up.

- Valuation vs Momentum: The current P/E ratio is 48.04x, which is higher than the industry average (valuation is expensive) [0]. However, short-term momentum may still attract speculative funds, so it is necessary to pay attention to whether there are fundamental catalysts to support it in the future.

- Risks: KDJ and RSI indicators are in the overbought range, increasing the probability of short-term correction [0]; valuation pressure is large; the rise may have a certain speculative nature [3].

- Opportunities: The demand for the semiconductor packaging industry continues to grow. If the stock price maintains the breakthrough momentum, it is expected to move towards the next target level of $67.08 [0].

The recent strong performance of Zhongci Electronics (003031.SZ) is driven by technical breakthroughs and increased industry demand, with short-term market sentiment being positive. Investors need to pay attention to overbought risks, valuation pressure, and the sustainability of industry trends, and make cautious decisions based on their own risk preferences.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.