Analysis of Rising Popularity of Deling Holdings (01709.HK)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Deling Holdings (01709.HK) is a Hong Kong-based financial services group covering multiple areas such as financial consulting, securities trading, and family office services [1][2]. Recently, this stock made it to the Hong Kong stock hot list on the East Money App. Although there is a lack of real-time or historical price data, analysis shows it is mainly related to two core factors:

-

Explosive growth in interim results: On November 27, 2025, the company released its interim financial report, with net profit reaching HK$2.02 billion (a year-on-year increase of 2511%), main operating revenue of HK$1.18 billion (a year-on-year increase of 43%), and other income of HK$1.94 billion (a year-on-year increase of 528%) [3]. This better-than-expected performance provided strong support for the market.

-

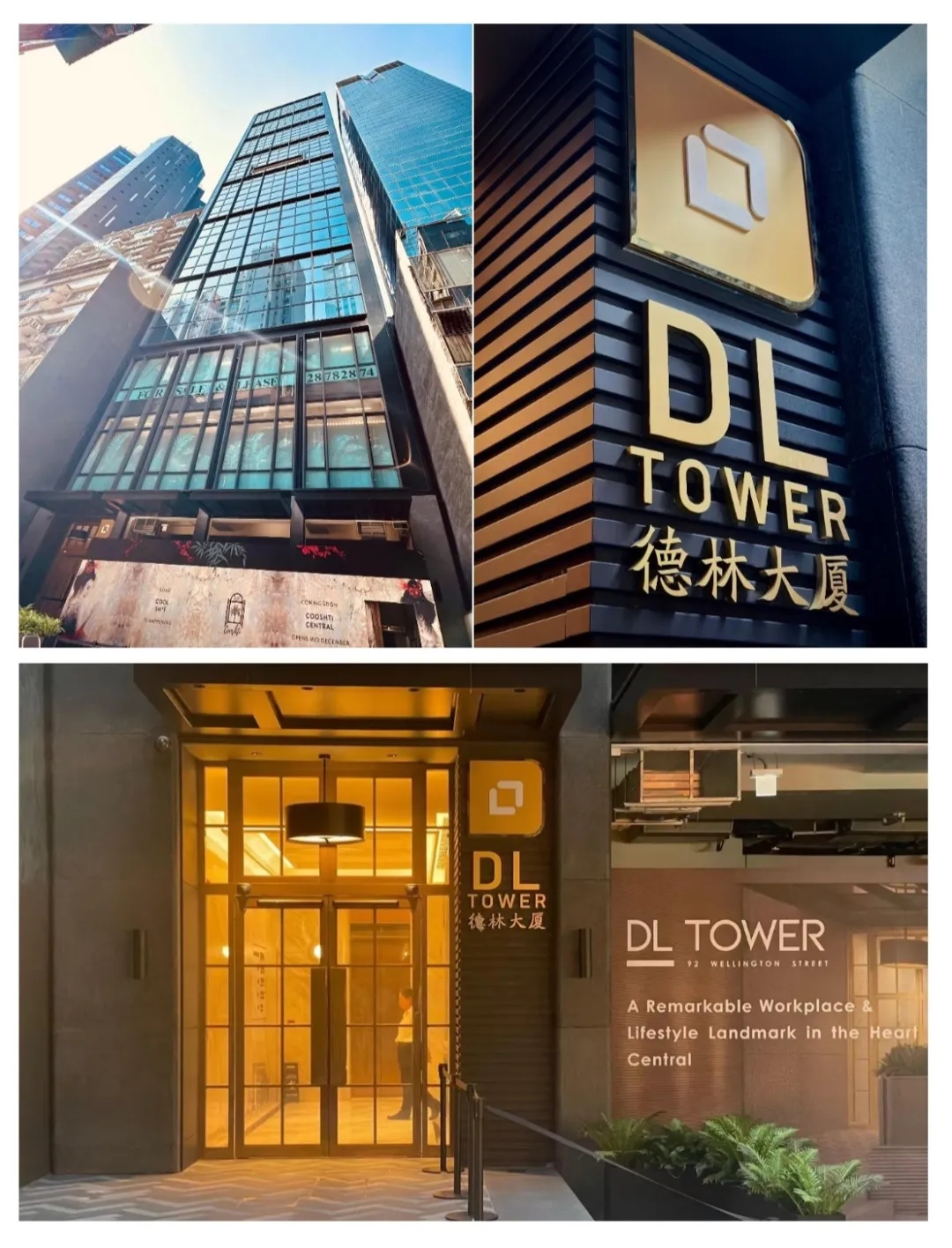

Strategic layout strengthens market confidence: The company is accelerating its digital finance strategy, including asset tokenization (such as Deling Building and the ONE Carmel real estate project in California, USA), and has invested HK$3.2 billion in high-performance mining machines, gold tokens, and digital assets like NeuralFin [3]. Meanwhile, it has become the largest institutional shareholder of Swiss-listed company Youngtimers AG, marking accelerated global expansion [3].

Although there is no price data available, Deling Holdings has a market capitalization of HK$4 billion, a price-to-earnings ratio of 26.79 times, and a profit margin of 83.27%, indicating strong profitability [4]. Its performance surge is closely tied to its strategic transformation (from traditional financial services to the digital finance sector), which may bring long-term growth potential to the company.

Deling Holdings (01709.HK) has become a popular Hong Kong stock due to its strong interim results and proactive strategic layout. Its investment in the digital finance sector and global expansion plans are worthy of attention, while potential risks from industry regulation and competition need to be noted.

Citation Notes: [0] indicates internal database analysis; [1][2][3][4] indicate external sources

长飞光纤光缆(06869.HK)港股热门分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.