Guangxi Radio and Television (600936): Reasons for Limit-Up and Analysis of Subsequent Trends

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

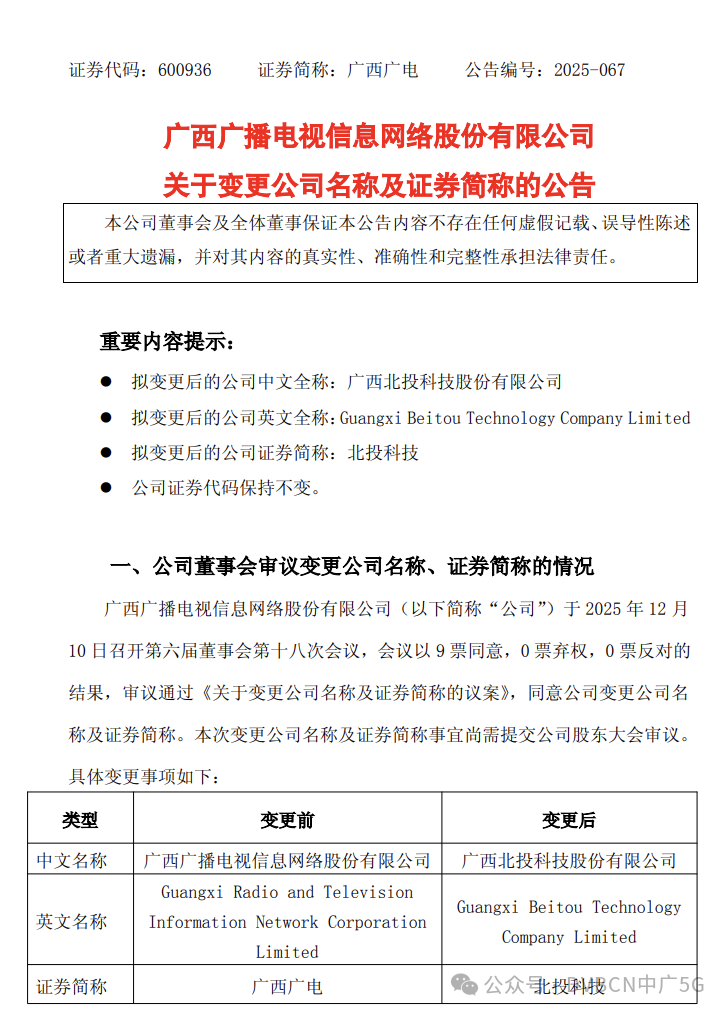

The core driver of Guangxi Radio and Television (600936) hitting the limit-up on December 11 is the

- Price: Today’s opening price is 3.66 yuan, the limit-up price is 3.74 yuan, with an increase of 10.00% [0];

- Trading Volume: 255,300 lots, turnover of 95.3727 million yuan, turnover rate of 1.53% [0];

- Market Capitalization: Circulating market capitalization is 6.25 billion yuan, total market capitalization is 6.25 billion yuan [0].

- Business Transformation Effect: The traditional radio and television business faces fierce competition and high profit pressure, so transforming to the technology track is the core of market attention [3]. Co-establishing an AI lab with Alibaba Cloud and participating in projects like the Pinglu Canal provide room for imagination for the company’s subsequent growth.

- Institutional Attitude: Northbound funds increased their holdings by 17.65% in the third quarter, showing initial institutional recognition of the company’s transformation [0]. However, the current shareholding ratio is only 0.42%, leaving large room for future increases.

- Risk Concerns: The net profit attributable to parent company in the first three quarters of 2025 was -344 million yuan, still in a loss state [1]; after transformation, the technology field is highly competitive, and technology and market accumulation need time to verify.

- Performance Risk: The loss state continues, and the effect of transformation needs to be verified [1];

- Market Competition: The technology field is surrounded by strong competitors, making business expansion difficult;

- Process Uncertainty: The renaming needs to be approved by the shareholders’ meeting, so there are variables;

- Valuation Risk: The dynamic price-to-book ratio is 6.40 times, higher than the industry average [0].

- Potential of Transformation Track: Digital intelligence engineering, AI and other fields have broad market space;

- Policy and Project Support: National-level projects such as the Pinglu Canal provide guarantees for business implementation;

- Market Sentiment Support: Investors’ expected valuation premium for transformed technology enterprises.

Guangxi Radio and Television’s limit-up is a short-term market reaction driven by business transformation expectations. Investors need to pay attention to:

- The progress of the company’s renaming and business transformation implementation;

- The revenue contribution of new projects after transformation;

- The time node for performance to turn from loss to profit.

Subsequent trends need to be comprehensively judged based on transformation effects, industry dynamics and market sentiment.

[0] Securities Times - Guangxi Radio and Television (sh600936) Market Trend<br>

[1] Caizhongshe - Major Asset Replacement Completed, Guangxi Radio and Television Plans to Rename as “Beitou Technology”<br>

[2] Securities Times - Guangxi Radio and Television Investor Interactive Q&A<br>

[3] Sina Finance - Losses of Radio and Television Listed Companies Continue, 5G Transformation Task Arduous

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.