Analysis of the Limit-Up Event of Yongding Co., Ltd. (600105) on December 11, 2025

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Yongding Co., Ltd. (600105) hit the limit-up on December 11, 2025 (increase of 9.98%, closing price 21.04 yuan [0]), triggered by a combination of multiple factors.

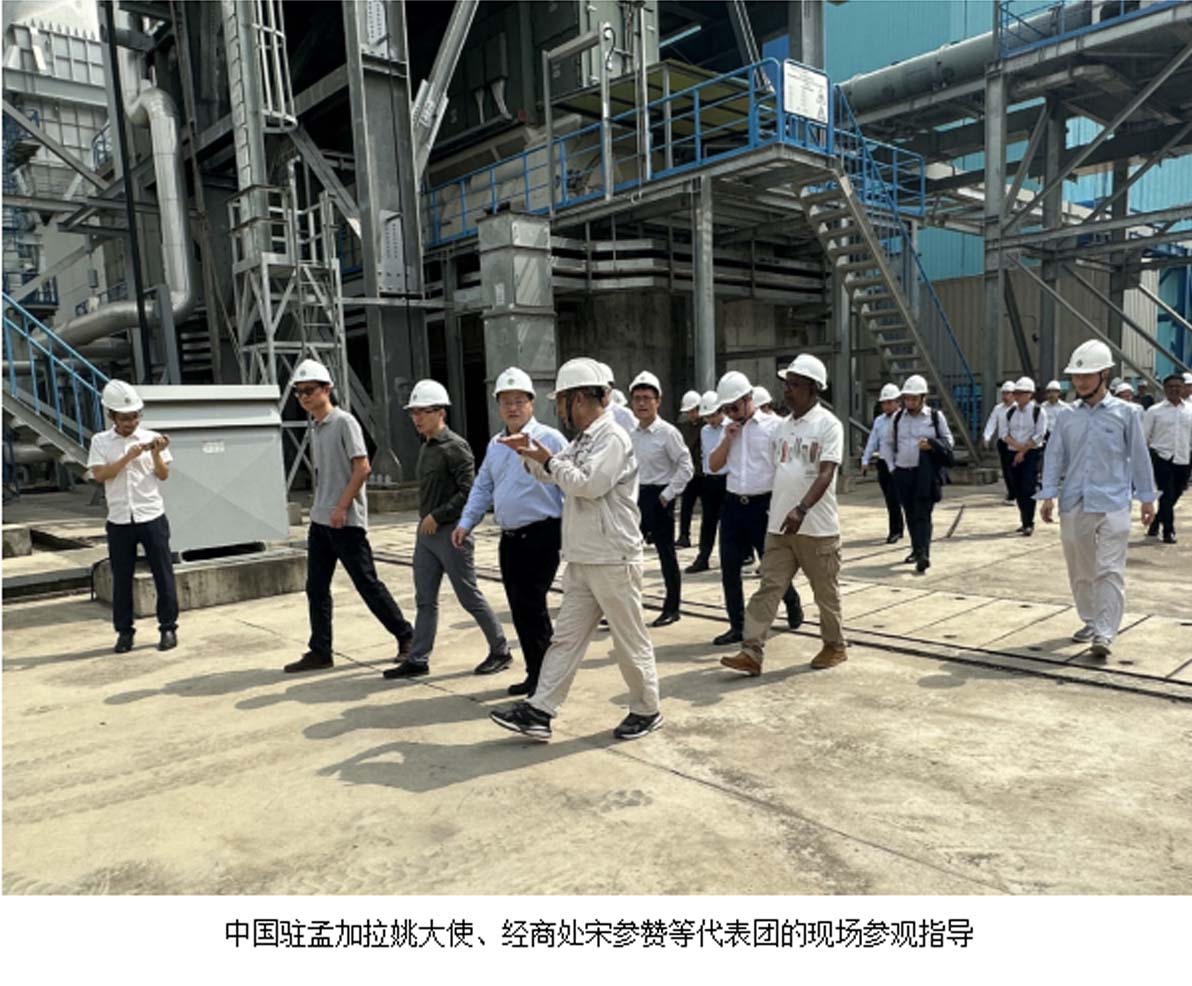

- Business Fundamentals Support: The automotive wiring harness business has stable profitability (Suzhou/Shanghai Jinting’s first-half net profit was 86.27 million yuan); the overseas Bangladesh power project is progressing smoothly, with confirmed revenue of 3.35 billion yuan and 497 million US dollars received, boosting performance expectations [2].

- Concept Sector Linkage: Concepts such as optical communication, superconductivity, and controllable nuclear fusion it belongs to were sought after by funds on the day. The aerospace/optical communication sector was a concentrated area for limit-up stocks, with significant sector linkage effects [3][4][5].

- Technical and Capital Drivers: The MACD indicator formed a golden cross, with a clear short-term bullish trend; the net inflow of main funds ranked among the top 5 limit-up stocks on the day, and the latest holdings of northbound funds increased by 16.4358 million shares compared with the previous period [0][2][5].

- Corporate Governance Optimization: Recently, internal systems such as the “Director Resignation Management System” have been improved, and the mechanism for protecting the rights and interests of minority shareholders has been enhanced, boosting market confidence [2].

In terms of price and trading volume, the stock price has been rising continuously since December 5, with a cumulative increase of over 35% in 5 trading days. The trading volume has increased significantly since December 5, reaching 1.6477 million shares on December 11 (close to the 60-day average trading volume of 1.9008 million shares [0]), and the closing price hit a record high [5].

- Concept stock linkage is one of the core drivers of this limit-up. Capital inflows into hot sectors such as optical communication and superconductivity have strongly supported Yongding Co.'s stock price.

- The record-high stock price indicates positive market expectations for the company’s future development, but the short-term nature of concept speculation and valuation bubbles need to be vigilant.

- The increase in retail participation (the number of shareholders increased by 12.32% compared with the previous period [3][4]) coexists with the inflow of main funds, and the divergence of market sentiment may intensify short-term fluctuations.

- Overvaluation: The current PE (TTM) reaches 95.64, significantly higher than the industry average, and the hidden danger of valuation bubbles needs to be vigilant [0].

- Concept Speculation Risk: Concepts such as superconductivity and controllable nuclear fusion have not yet been commercialized on a large scale, and the ebb of short-term speculation sentiment may trigger a correction.

- Short-term Volatility Risk: The stock price has risen too fast recently, technical indicators are in the overbought area, and there is great pressure for correction.

- The steady progress of the automotive wiring harness business and overseas power projects is expected to support long-term performance growth.

- The optimization of corporate governance may attract more attention from institutional investors.

The limit-up of Yongding Co., Ltd. (600105) is driven by multiple factors including fundamentals, concept sectors, technical funds, and governance optimization. The stock price hit a record high with high market attention. However, overvaluation, concept speculation, and short-term volatility risks need to be concerned. The subsequent trend needs to be comprehensively judged based on the sustainability of trading volume, fundamental progress, and changes in sector sentiment.

兴源环境(300266)涨停原因及市场影响分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.