Analysis of the Strong Performance of Zhenlei Technology (688270)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The core drivers behind Zhenlei Technology’s (688270) strong performance today include:

- Better-than-expected fundamental growth: From January to September 2025, it achieved revenue of 302 million yuan, a year-on-year increase of 65.76%; net profit attributable to parent company was 101 million yuan, a year-on-year surge of 598.09%[1], far exceeding market expectations.

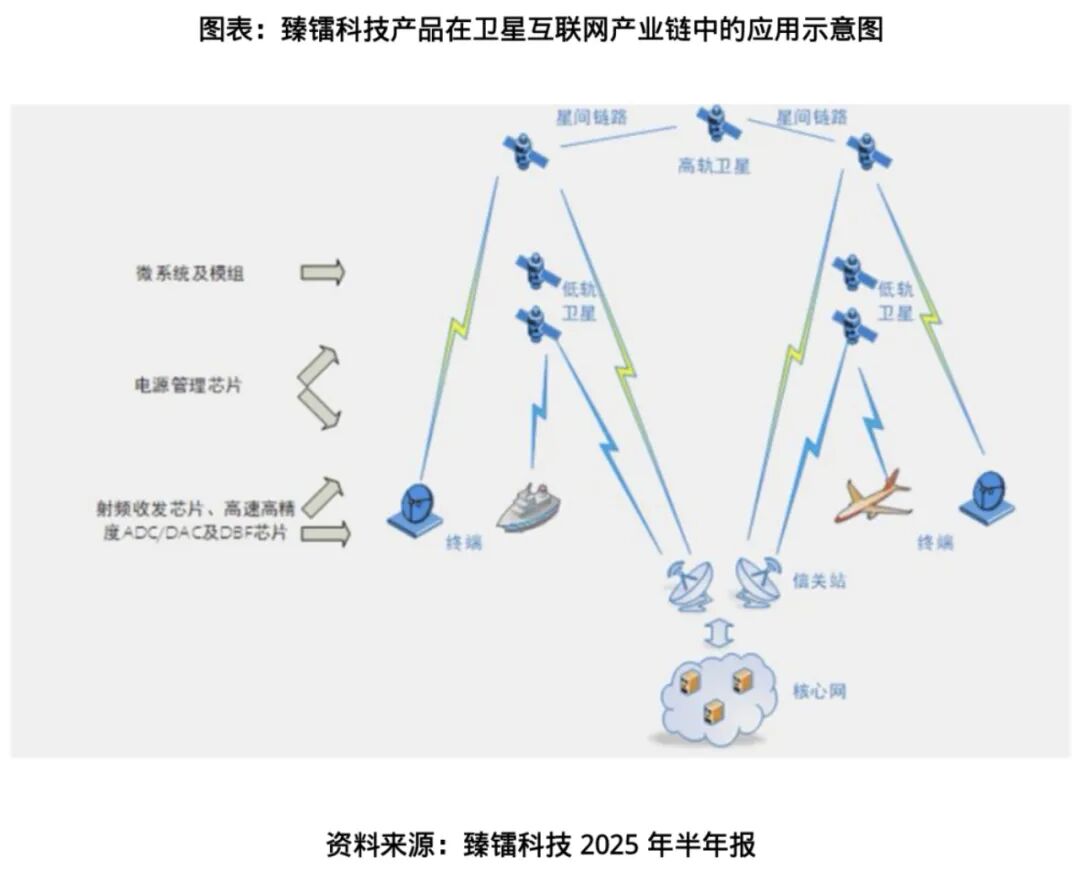

- Superimposition of multiple popular concepts: The company is involved in current market hot concepts such as satellite internet, 6G, military informatization, domestic chips, and drones[1], benefiting from relevant policies and industry development trends.

- Active inflow of institutional capital: On December 11, northbound funds net bought 83.0491 million yuan, with Goldman Sachs (China) as the main buyer[2], indicating institutional confidence in the company’s prospects.

- Industry catalyst: Kaiyuan Securities recommended it as a beneficiary in the satellite industry and space computing sector[3], strengthening the market’s positive expectations for the company.

From a technical perspective, the company’s stock price has performed strongly in the short term: up 17.40% in 1 day, 27.55% in 5 days, and 44.37% in 1 month[0]; today’s trading volume was 35.35M, far higher than the 30-day average of 12.67M[0], with both volume and price rising; the current stock price of 90.88 yuan is significantly higher than the 20-day moving average of 66.71 yuan[0], staying in an upward channel.

- Resonance between concepts and performance: The company has both popular concepts and solid performance growth; this resonance is an important factor driving the sharp rise in stock price.

- Synergy between institutional and retail funds: Active buying by institutions such as northbound funds has attracted the attention of retail investors, and the number of shareholders has increased by 93.15% recently[1], forming a capital synergy.

- Technical breakout signal: The significant increase in trading volume and the stock price moving away from the 20-day moving average indicate strong short-term momentum, but attention should be paid to the recent resistance level of 92.88 yuan[0].

- High valuation risk: The current P/E ratio is 186.26x, EV/OCF is 406.86x[0], and the valuation is at a high level.

- Low ROE: Only 4.78%[0], reflecting that the company’s profit quality needs to be improved.

- Profit-taking pressure: Recent margin trading data shows a net outflow[1], and short-term funds may face pressure to exit.

- Industry volatility: The semiconductor and military industries are sensitive to policy changes, so there is a risk of volatility.

- Continue to benefit from the development of emerging industries such as satellite internet and 6G.

- Long-term holdings by institutional funds may promote further valuation repair of the company.

The strong performance of Zhenlei Technology (688270) is jointly driven by fundamental growth, concept superimposition, institutional inflows, and industry favorable factors. Technically, it shows strong short-term upward momentum, but attention should be paid to risks such as high valuation, low ROE, and profit-taking. Investors should pay attention to the resistance level of 92.88 yuan and the support level of 80.00 yuan[0], and make a comprehensive judgment based on industry development and the company’s subsequent performance.

[0] Jinling Analysis Database

[1] Zhenlei Technology rose 17.40% on December 11; Changsheng National Defense and Military Industry Quantitative Hybrid A Fund holds heavy positions in this stock

[2] Dragon and Tiger List Data for Zhenlei Technology (688270) on December 11: Northbound Funds Net Bought 83.0491 Million Yuan

[3] Kaiyuan Securities: “Cost Reduction and Efficiency Improvement” Becomes Key to Market Scaling; Highly Optimistic About China’s Commercial Aerospace Investment Opportunities

南京商旅(600250)强势表现原因与持续性分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.