Zhaoxin Co., Ltd. (002256) Limit-Up Reason and Subsequent Trend Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Zhaoxin Co., Ltd. (002256) hit the limit-up on December 12, 2025, driven by two main catalysts:

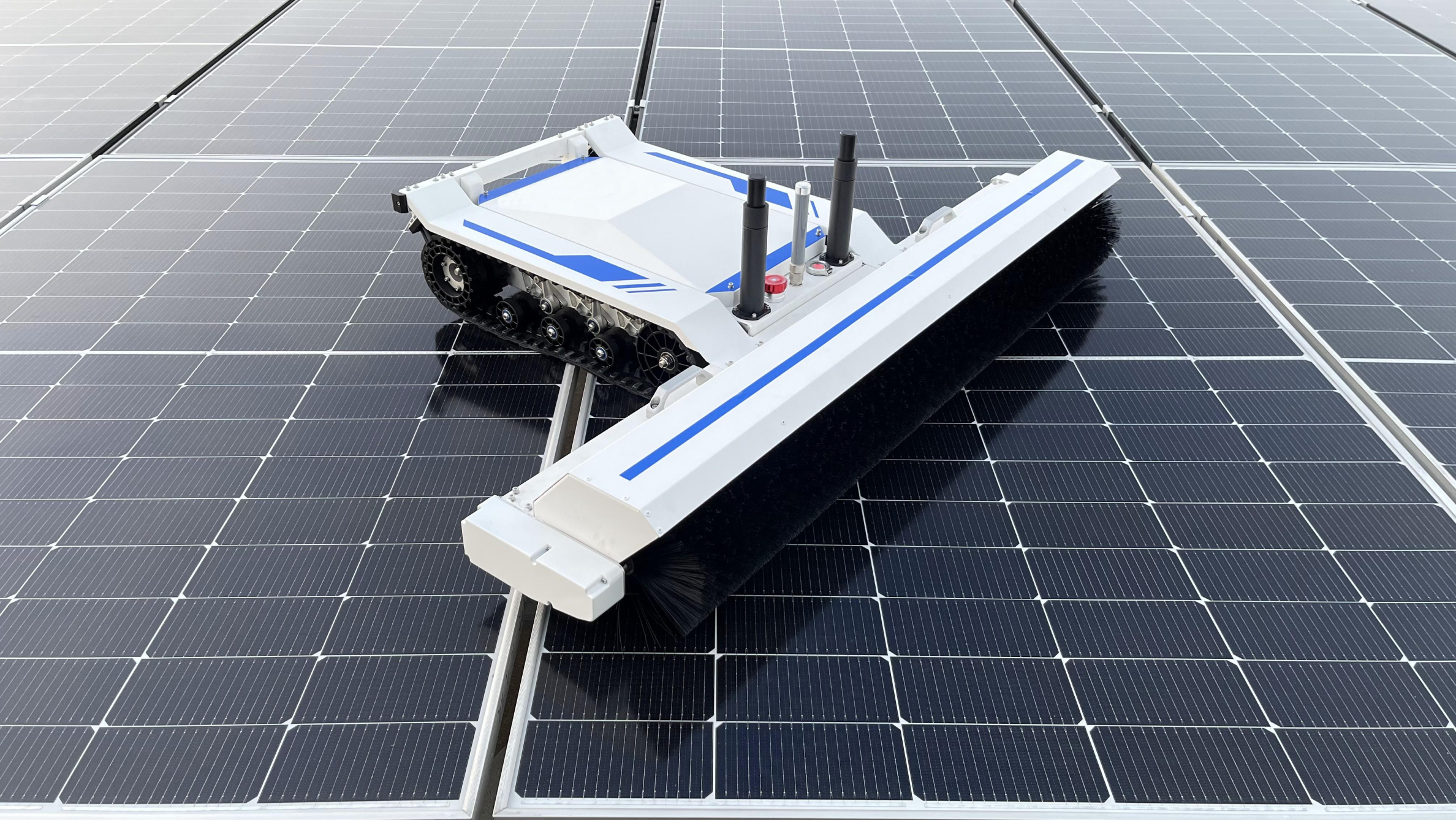

- Major Acquisition Announcement: On the evening of December 11, the company announced its plan to acquire 70% equity of Youde New Energy in cash. Youde New Energy is a leading domestic third-party new energy asset operation and management company, operating over 2000 power stations with a capacity of more than 10GW, and is a drafter of national standards for photovoltaic operation and maintenance. This acquisition will push the company to transform from a single power station operator to an integrated smart energy service provider, targeting an operation scale of 10GW [1].

- Photovoltaic Sector Performance: On that day, the CSI Photovoltaic Industry Index rose by 1.98%, the sector continued to attract capital layout, and the China Asset Management Photovoltaic ETF had a net inflow of over 290 million yuan in the past 10 trading days, providing a good industry environment for the stock’s limit-up [2][4].

Price and volume: The closing price was 3.91 yuan (+10.14%), with a trading volume of 1.5095 million shares, an increase of 37.40% compared to the 5-day average [3]. Medium-term perspective: The company’s stock price has risen by 63.60% in 6 months, approaching the 52-week high of 4.37 yuan, indicating strong short-to-medium-term momentum [0].

- New Energy Transformation is Core Logic: Acquiring Youde New Energy is a key step for the company to transform from the dual main business of “fine chemical + new energy” to new energy services, aligning with industry development trends, and the market has responded positively to this strategic adjustment.

- Significant Sector Linkage Effect: The overall strength of the photovoltaic sector is an important auxiliary factor for the limit-up, and the continuous capital layout in the photovoltaic track has amplified the market response to the stock’s positive news.

- Contradiction Between Fundamentals and Valuation: The company’s current P/E ratio is -155.14x and ROE is -4.35%, with weak profitability, but the acquisition expectation has driven valuation up, with P/B reaching 6.75x, which is at a historically high level, reflecting the market’s game on the transformation prospects [0].

- Acquisition Uncertainty: This transaction is a framework agreement, and there are uncertainties in the final terms, audit evaluation, and the company’s review procedures; the transaction may fail [1].

- Fundamental Risks: The company’s profit situation is poor, and the specific impact of the acquisition on performance is unclear.

- Callback Risk: The short-term stock price has risen significantly (5 days +18.13%), approaching the 52-week high, with profit-taking pressure [0].

- New Energy Service Market Space: Youde New Energy’s operation and maintenance experience and scale will help the company quickly expand into the new energy service field; if the transformation is successful, it is expected to open up new growth space.

- Continuous Positive Sector News: Policy support for the photovoltaic industry and expectations of demand growth may provide continuous market environment support for the company.

This limit-up was jointly driven by the major acquisition announcement and the strong performance of the photovoltaic sector. Short-term market sentiment is positive, but attention should be paid to the acquisition progress, fundamental improvement, and valuation risks. Key price levels include: limit-up price of 3.91 yuan (short-term resistance), 52-week high of 4.37 yuan (psychological resistance), 5-day MA of 3.65 yuan (short-term support), and 20-day MA of 3.52 yuan (medium-term support) [3].

The company is currently in a critical period of business transformation; investors should closely follow the subsequent progress of the acquisition, new energy business layout, and changes in financial status, and formulate decisions based on sector trends and their own risk preferences.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.