Analysis of Strong Performance of Hangyu Technology (688239)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

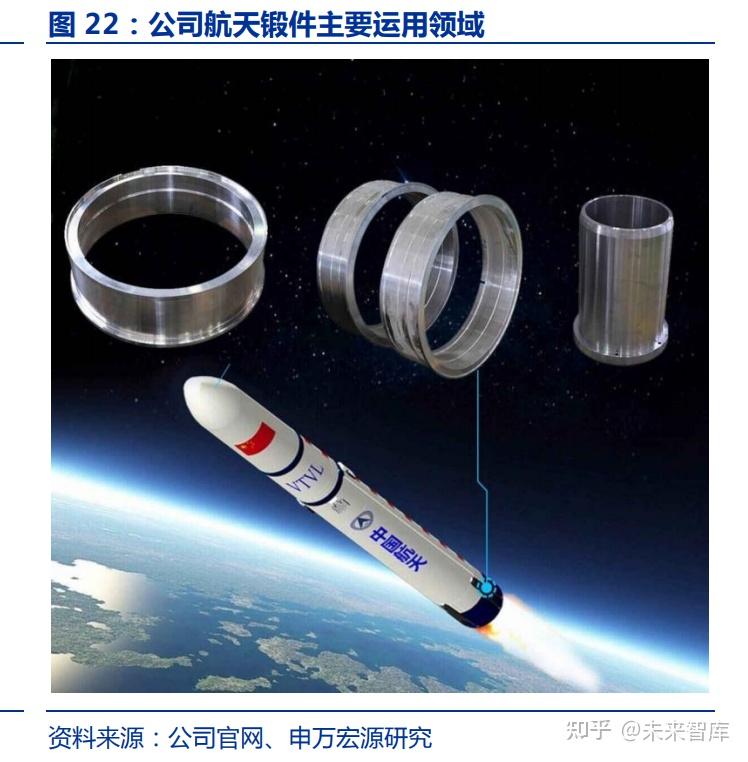

The strong performance of Hangyu Technology (688239) is the result of the combined effect of policy, fundamentals, and market sentiment. Policy-wise, the national “Action Plan for Promoting High-Quality and Safe Development of Commercial Aerospace” directly catalyzed the commercial aerospace sector, boosting market confidence in this field [0]. Fundamentally, the company’s Q3 2025 revenue increased by 47% YoY, with breakthroughs in overseas customers for its gas turbine business, sufficient order backlog, and rapid expansion in commercial aerospace, which is highly aligned with policy directions, showing a continuous improvement in fundamentals [0]. Technically, as of December 7, 2025, the company’s share price closed at 53.99 yuan, up 5.80% from the previous trading day, in the upper-middle range of its 52-week fluctuation (29.93-61.47 yuan). Analysts’ target price is 53.6859 yuan, with an overall rating of strong buy, and technicals indicate it is currently in an upward channel [0].

In terms of cross-domain correlation, policy support for commercial aerospace and the company’s business expansion in this field form a positive cycle, becoming the core driver of the stock price increase; the breakthrough in overseas gas turbine customers not only reflects the international competitiveness of the company’s products but also opens up new space for long-term performance growth [0]. In deeper terms, the rapid growth of Q3 revenue indicates that the company’s business structure adjustment has initially shown results. Although military product business fluctuations in 2024 and performance decline in H1 2025 bring short-term pressure, the layout in commercial aerospace and overseas gas turbine markets has injected sufficient momentum for subsequent development [0].

Risks: Fluctuations in military product business in 2024 led to revenue decline, and revenue and net profit in H1 2025 decreased YoY; performance stability still needs continuous observation [0]. Opportunities: Increased policy support for commercial aerospace, the company’s expansion in this field, and breakthroughs in overseas gas turbine markets provide broad space for future performance growth; analysts’ unanimously optimistic ratings and the upward technical channel also support short-term market conditions [0].

The strong performance of Hangyu Technology (688239) is driven by policy catalysis, fundamental improvement, and active sector momentum, with technicals and analyst ratings supporting short-term market conditions. The company’s layout in commercial aerospace and overseas gas turbine markets brings opportunities for long-term development, but attention should be paid to the risk of performance fluctuations.

联特科技(301205)强势表现分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.