Analysis Report on the Strong Performance of Shijia Photonics (688313)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Shijia Photonics (688313) entered the strong stock pool on December 12, 2025, with strong performance that day, rising 11.45% and reaching a total market value of 50.009 billion yuan [1]. Its strong performance is driven by the resonance of multiple catalysts:

- Concept and Industry Drivers: As a multi-concept target in CPO (Co-Packaged Optics), F5G, Chip, and Data Center, the company directly benefits from the global optical communication technology upgrade and the domestic data center construction demand boom [1].

- Fundamental Support: The 2025 Q3 report shows that Q1-Q3 revenue was 1.56 billion yuan, a year-on-year increase of 113.96%; net profit attributable to parent company was 300 million yuan, a year-on-year increase of 727.74%, showing a high-speed growth trend [2].

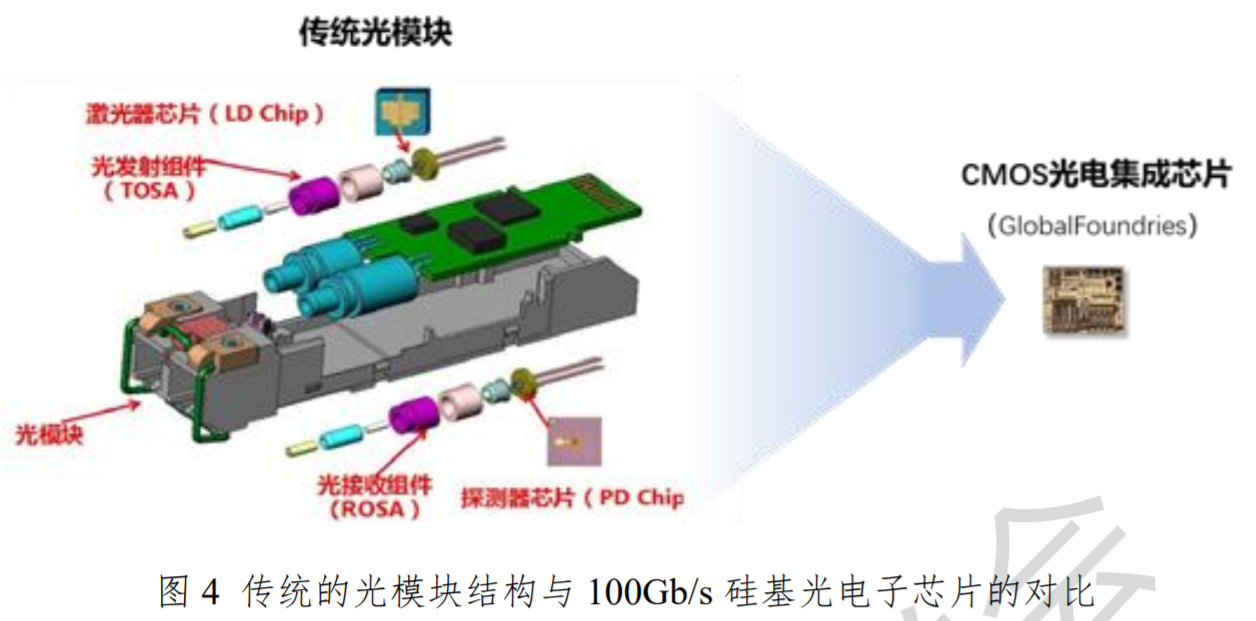

- Technical and Industry Status: The company has established an IDM full-process system covering chip design, wafer manufacturing, packaging and testing, has a “passive + active” process platform, and cooperates with multiple equipment manufacturers in the F5G field to promote high-end products [1].

Technical analysis shows that on December 12, the turnover was 5.761 billion yuan, about 1.66 times that of the previous day, and the turnover rate was 12.24%, significantly higher than the 5-day average (6.89%) [0], indicating high market sentiment and high capital participation.

- Institutional and Capital Recognition: In the past 90 days, 10 institutions have given ratings, 8 buy and 2 overweight; funds such as Yongying, AVIC, and E Fund entered the top 10 tradable shareholders in Q3 [1], reflecting long-term institutional confidence. On December 11, the net financing purchase was 72.4491 million yuan, and the financing balance increased by 6.02%, with continued positive capital flows [3].

- Technical and Capacity Advantages: The IDM full-process system and cooperation with equipment manufacturers ensure the company maintains competitiveness in the iteration of optical communication technology and supports sustained fundamental growth [1].

- Opportunities: The technological upgrade of the optical communication industry and the growth in demand for data center construction provide long-term opportunities for the company’s development; the superposition of multiple concepts attracts market attention, and there is still upside potential driven by short-term funds.

- Risks: Currently, the dynamic PE is 110.33x, TTM PE is 134.24x, PB is 29.87x, significantly higher than the industry average, with large valuation pressure [1]; high turnover rate and concept-driven characteristics easily lead to short-term sharp fluctuations in stock prices; the optical chip industry has rapid technological iteration, requiring continuous R&D investment to maintain leadership [1].

Shijia Photonics’ strong performance is supported by concept popularity, fundamental growth, and technical industry status, with high recognition from institutions and capital. In the short term, we need to pay attention to the 90 yuan support level and the 113 yuan resistance level [0]; in the long term, we need to track industry demand and the company’s R&D and capacity progress.

江苏神通(002438)强势表现分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.