Global Markets Decline Amid Peace Talk Delays and AI Sector Concerns (December 2025)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

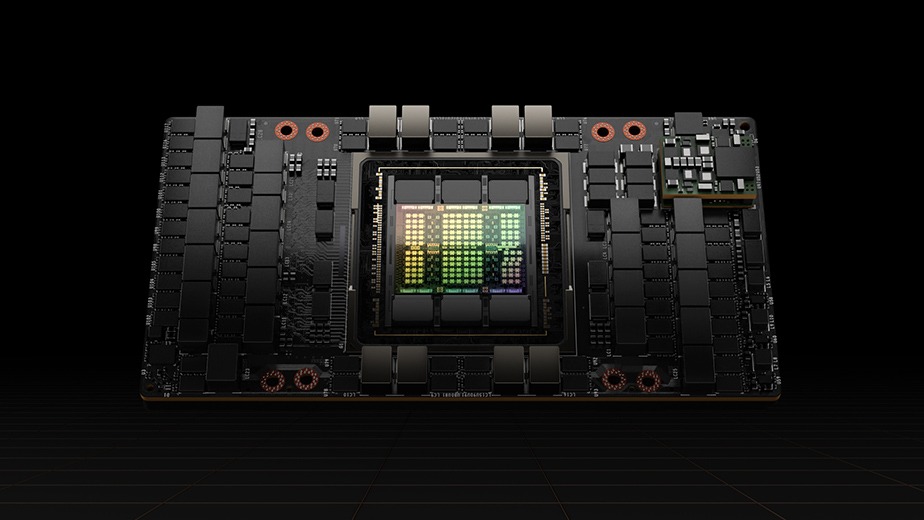

On December 15-16, 2025, U.S. and global markets experienced broad declines driven by two interconnected factors: unresolved geopolitical negotiations and growing anxiety about AI sector fundamentals. [1] U.S. equity indices closed lower on December 15, with the tech-heavy NASDAQ Composite suffering the sharpest drop (-1.17%)—a reflection of mounting AI-related concerns. The S&P 500 (-0.64%) and Dow Jones Industrial (-0.37%) also declined, indicating broader market unease. [0] European futures fell 0.7% as investors awaited clarity from Berlin-based Ukraine-U.S. peace talks, where limited progress was reported but core issues (security guarantees, territorial disputes) remained unresolved, fueling regional risk aversion. [2][4][5] Compounding these pressures, Jim Chanos highlighted a potential depreciation “time bomb” for AI infrastructure companies (CoreWeave, Oracle) relying on NVIDIA chips, citing a 28% YoY drop in Hopper chip rental rates as evidence of rapid hardware obsolescence—conflicting with the 6-year depreciation schedules used by these firms. [3]

- The NASDAQ’s steep decline (-1.17%) underscores the tech sector’s vulnerability to AI-specific concerns, given the index’s heavy weighting in AI-related stocks. [0]

- European markets exhibit exceptional sensitivity to Ukraine-related geopolitical developments, with even incremental delays in peace talks immediately impacting futures prices. [2]

- The 28% YoY drop in GPU rental rates reveals a critical mismatch between current depreciation practices and the actual obsolescence cycle of AI hardware, which could reshape valuations in the AI infrastructure space. [3]

- AI Hardware Obsolescence: A shift to shorter depreciation schedules for AI chips could increase operating expenses and reduce profitability for firms like CoreWeave and Oracle, pressuring their valuations. [3]

- Geopolitical Volatility: Prolonged peace talks or a breakdown in negotiations may sustain market turbulence, particularly in European equities. [2][4][5]

- Tech Sector Correction: The NASDAQ’s decline may signal a potential correction in overvalued AI stocks, requiring close monitoring of earnings reports and corporate guidance. [0]

- Resolution of Ukraine-U.S. peace talks could trigger a relief rally in European markets, though this remains contingent on meaningful progress in negotiations.

- U.S. index performance (December 15): NASDAQ Composite (-1.17%), S&P 500 (-0.64%), Dow Jones Industrial (-0.37%) [0]

- European futures decline (December 16): 0.7% due to peace talk delays [2]

- AI sector concern: 28% YoY drop in Hopper chip rental rates; Chanos warns of depreciation risks for CoreWeave, Oracle [3]

- Peace talks status: Ukraine-U.S. negotiations in Berlin showed limited progress but unresolved core issues [4][5]

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.