Evaluation of Tesla's AI/Robotics Narrative and Valuation Amid Declining Auto Sales

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on my comprehensive analysis of Tesla’s current market position and strategic narrative shift, here’s a detailed evaluation of whether the AI/robotics story justifies its valuation amid declining auto sales:

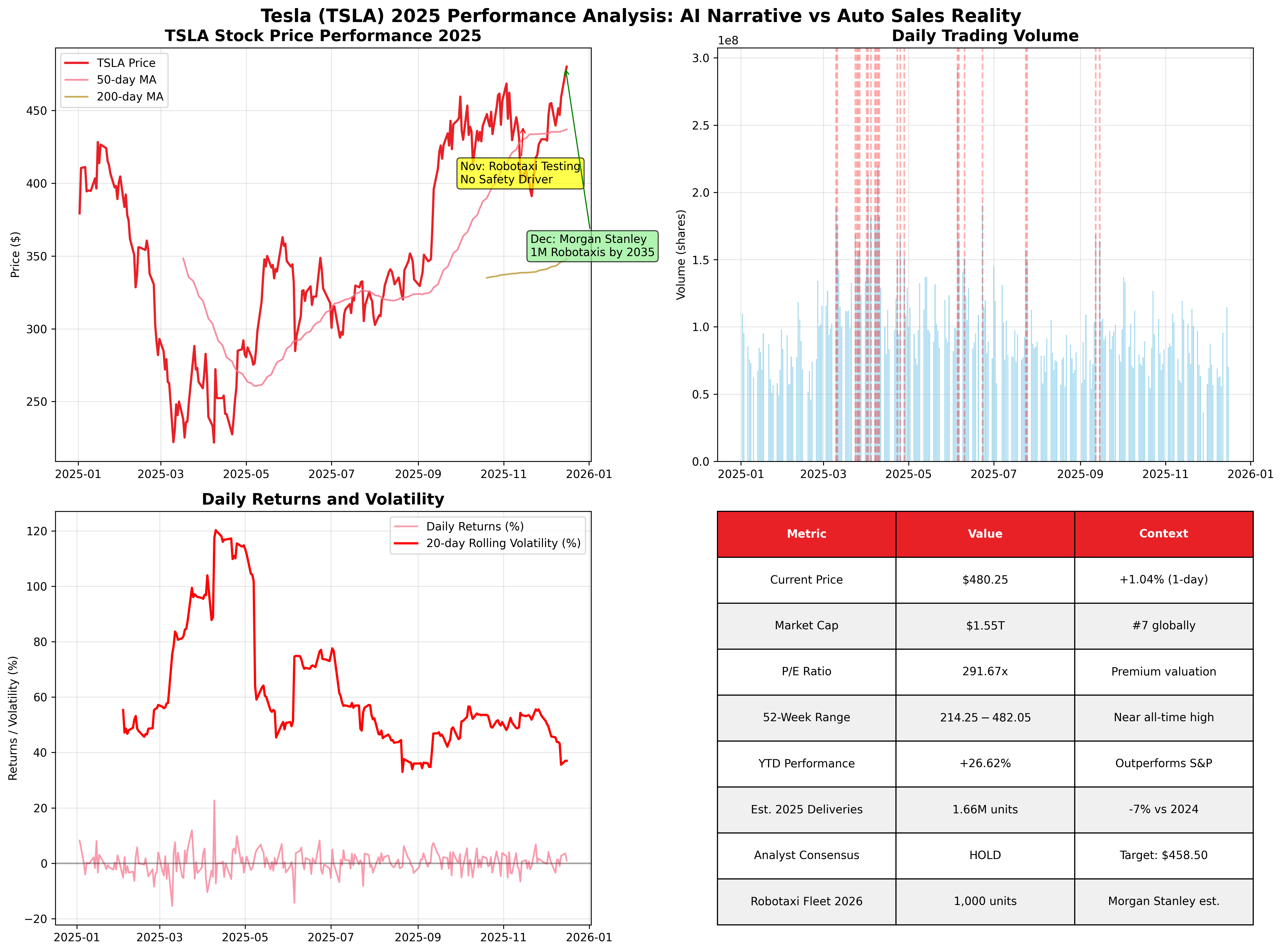

Tesla is trading at $480.25, just 1% below its all-time high of $488.54, with a market capitalization of $1.55 trillion, making it the 7th most valuable company globally [0]. Despite this premium valuation, the company’s traditional automotive business faces significant challenges.

- Global vehicle deliveries expected to decline 7% in 2025 (to ~1.66 million units) compared to 1.78 million in 2024 [1]

- US sales plummeted 23% in November 2025 to 39,800 vehicles, the lowest since 2022 [1]

- This decline is partly attributed to the Trump administration discontinuing the $7,500 EV tax credit in September [1]

- Automotive revenue represents 78.9% of total revenue ($77.07B in FY2024) [0]

- Current P/E ratio of 291.67x suggests extreme premium pricing [0]

- Analyst consensus price target of $458.50 suggests 4.5% downside from current levels [0]

- Tesla began testing robotaxis in Austin without safety monitors in late 2025 [2]

- Morgan Stanley projects Tesla’s Robotaxi fleet will grow to 1,000 vehicles in 2026 and reach 1 million by 2035[2]

- Tesla’s FSD miles between interventions jumped from 441 to over 9,200 miles with v14.1 update in October 2025 [3]

- The Robotaxi app has been installed 529,000 times as of December 12, 2025 [3]

- Tesla demonstrated significant progress with Optimus achieving human-like running capabilities by December 2025 [4]

- Elon Musk plans to produce 5,000 Optimus robots in 2025 for internal factory use [5]

- Production targets reach 50,000 units by 2026 [5]

- The robots share core technologies with Tesla’s EV business: batteries, AI chips, sensors, and autonomous navigation [4]

- Tesla’s pivot toward robotics leverages existing manufacturing capabilities

- AI development for autonomous driving directly applies to humanoid robotics

- Vertical integration provides cost advantages and technology control

-

Massive Addressable Markets:

- Robotaxi market could generate recurring revenue streams

- Humanoid robotics represents a potential trillion-dollar opportunity

-

First-Mover Advantages:

- Tesla has real-world driving data from millions of vehicles

- Manufacturing expertise for scaling robotics production

-

Technological Convergence:

- EV and robotics industries share foundational technologies

- Tesla’s battery expertise provides competitive advantage

-

Execution Risk: History of missed deadlines (Musk claimed 1 million robotaxis by 2025) [3]

-

Competitive Pressure: Waymo already operates 24/7 autonomous service in multiple cities with 96 million autonomous miles driven [3]

-

Valuation Disconnect: Current automotive fundamentals don’t support $1.55T valuation without AI/robotics success

Tesla’s narrative shift represents a

- Near-term (6-12 months): Stock likely remains volatile around narrative updates

- Medium-term (2-3 years): Need tangible Robotaxi fleet scaling and Optimus production

- Long-term (5+ years): Robotics revenue must become significant to justify current multiples

- Q1 2026: Cybercab production start (targeted for April 2026) [2]

- 2026 Progress: Robotaxi fleet expansion to 1,000 vehicles [2]

- 2025 Targets: 5,000 Optimus robots for internal use [5]

While Tesla’s AI/robotics narrative is compelling and shows genuine technical progress, it

- Conservative investors: Wait for clearer execution milestones and profitability evidence

- Growth-oriented investors: Position size should reflect high execution risk

- Speculative investors: Current valuation prices in near-perfect execution across multiple ambitious projects

The AI/robotics pivot represents Tesla’s best path to justifying its $1.55T valuation, but success is far from guaranteed. Investors should demand concrete evidence of scaling and profitability before embracing the narrative at current price levels [0].

[0] Ginlix API Data - Tesla real-time quote, company overview, financial analysis, and stock data

[1] Morningstar - “Tesla just posted rare growth in China. Here’s what sparked the sales momentum” (December 2025)

[2] Teslarati - “Tesla gets bold Robotaxi prediction from Wall Street firm” (December 9, 2025)

[3] TheStreet/CNBC - “Tesla Robotaxi hits big milestone, but questions remain” (December 15, 2025)

[4] Interesting Engineering - “Elon Musk’s Optimus humanoid robot achieves human-like smooth movement” (December 2025)

[5] Built In - “Tesla’s Robot, Optimus: Everything We Know” (Updated December 2025)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.