Tesla's Strategic Pivot: Reassessing Valuation from EV to AI/Robotics Platform

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

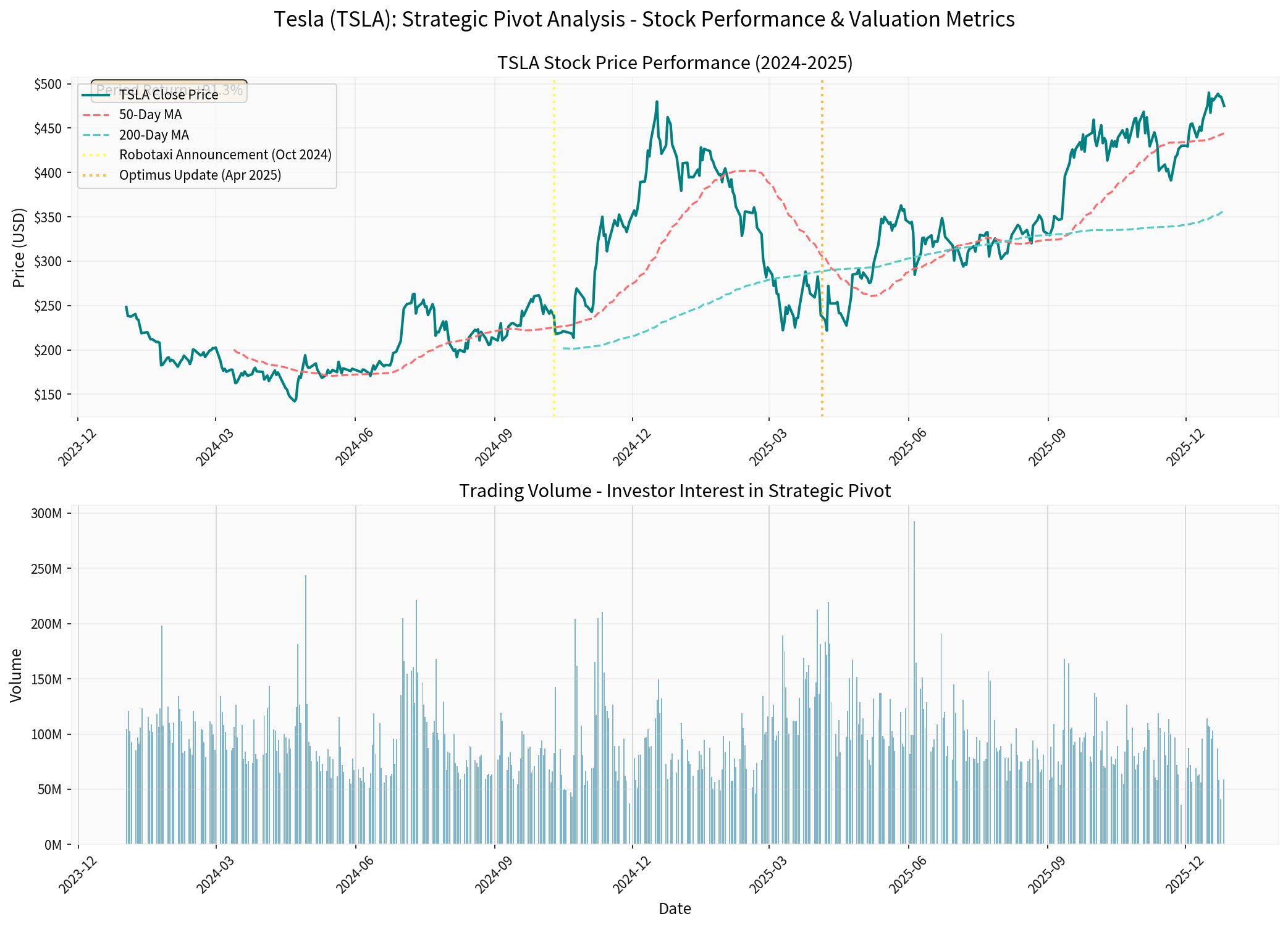

Tesla is undergoing a fundamental transformation from an electric vehicle manufacturer to an AI and robotics company. With its market capitalization at $1.53 trillion[0] and stock up 90% over the past two years[0], investors are already pricing in this strategic shift. However, the current valuation presents a complex challenge: Tesla’s P/E ratio of 291x[0] reflects extraordinary growth expectations, yet 78.9% of revenue still comes from automotive sales[0].

This analysis examines how investors should reassess Tesla’s valuation framework as the company pivots toward robotaxis and Optimus humanoid robots.

Metric |

Value |

Analysis |

|---|---|---|

| Market Cap | $1.53 trillion | Among “Magnificent Seven” tech giants |

| Current Price | $475.19 | Near 52-week high of $498.83 |

| P/E Ratio | 291.09x | Extremely high vs traditional automakers (5-15x) |

| P/B Ratio | 19.18x | Reflects intangible value expectations |

| Revenue (FY2024) | ~$95B | 75% from EV sales, declining for second year[2] |

| Net Margin | 5.51% | Constrained by heavy R&D investment |

| Free Cash Flow | $3.58B | Limited by capex for AI/robotics infrastructure |

- 2-Year Return:+90.02% (significantly outperforming S&P 500)

- YTD 2025:+25.29%

- 52-Week Range:$214.25 - $498.83 (132% range)

- Volatility:4.00% daily standard deviation

The stock’s dramatic 2024-2025 rally coincides with Tesla’s increased emphasis on AI and robotics initiatives, suggesting investors have already begun repricing the company as a technology platform rather than a traditional automaker[1].

- EV sales declining for second consecutive year in 2025[2]

- Intense competition from Chinese manufacturers (69% market share)[3]

- Margin pressure from price wars

- Still generates ~75% of current revenue[2]

- If valued solely as EV maker: Worth roughly $150-200B

- Implied AI/Robotics Premium:$1.3+ trillion

- Operating in Austin without human safety monitors (as of late 2025)[1]

- Analysts expect fleet to grow from low-hundreds to ~1,000 vehicles by 2026[1]

- Targeting expansion to 30+ U.S. cities in 2026[2]

- Wedbush analyst Dan Ives projects robotaxis could become a “mega-product” eclipsing Tesla’s entire automotive segment[1]

- Bull case scenario: Could drive Tesla to $2-3 trillion market cap by 2026[2]

- Revenue model: Per-mile fees vs vehicle ownership (higher margins than manufacturing)

- Waymo (Alphabet):Only operator providing fully driverless service across multiple U.S. cities; ~150,000 weekly paid rides by late 2024; targeting 1M weekly rides[4]

- GM Cruise & Amazon Zoox:Limited fare-free trials, smaller scale[4]

- Tesla’s Advantage:Lower sensor costs (~$400 vs Waymo’s $12,650 per vehicle)[4]; massive existing fleet for data collection

- Tesla’s Challenge:Still reliant on human supervision in many deployments; Waymo already fully unsupervised[4]

- If robotaxis generate $10-20B in high-margin revenue by 2027: Worth $200-400B

- In development/testing phase

- Elon Musk predicts it could make Tesla “the most valuable company in the world”[1]

- Morgan Stanley added $60/share in equity value from humanoid robotics in sum-of-the-parts analysis[3]

- Humanoid robotics market potentially worth hundreds of billions by 2030s

- Industrial automation, manufacturing, logistics applications

- Competitors: Figure AI, Unitree (Chinese company), Boston Dynamics (less commercial focus)[5]

- Limited production/testing in 2025-2026

- Volume manufacturing unlikely before 2027-2028

- Meaningful revenue contribution post-2028

- Current valuation assumes 100% success in commercialization

- Realistically worth $100-300B in optimistic scenario, $0-50B in base/bear case

Metric Traditional Auto Multiple Tesla Current (Dec 2025)

---------------- ------------------------- ------------------------

P/E Ratio 5-15x 291x

Price/Sales 0.5-2x ~16x

EV/Revenue 0.5-2x ~16x

EV/EBITDA 6-12x ~97x

Implied Market Cap $100-200B $1.53T

Morgan Stanley’s recent analysis adopted this approach[3]:

Business Segment |

Base Case Value |

Bull Case |

Bear Case |

Multiple Type |

|---|---|---|---|---|

| Legacy Auto/EV | $100-150B | $200B | $50-75B | 5-10x EBITDA |

| Energy Storage | $30-50B | $80B | $15-20B | 10-15x EBITDA |

| Robotaxis (FSD) | $300-500B | $800B-1T | $100-200B | Platform multiple |

| Optimus (Humanoid) | $150-250B | $500B | $0-50B | Option value |

TOTAL SOTP |

$580-950B |

$1.58-2.8T |

$165-345B |

|

Current Market Cap |

$1.53T |

|||

Upside/Downside |

+60% to -85% |

+0% to +83% |

-89% to -77% |

If valued as an AI/robotics platform company (comparable to Nvidia, Alphabet, cloud platforms):

Metric Platform Company Tesla Current

Range (Dec 2025)

---------------- ---------------- -------------

Price/Sales (Forward) 8-15x (hypergrowth) TBD (dependent on new revenue streams)

EV/Revenue 10-20x ~16x current

Growth Rate Required 30-50% CAGR Unclear transition period

- Robotaxi fleet reaches 50,000+ vehicles by 2027

- $15-25B in high-margin robotaxi revenue (80%+ gross margin)

- Optimus enters limited production, $5-10B revenue by 2028

- EV business stabilizes at $80-90B revenue

- Total revenue: $120-140B by 2028, 30%+ CAGR

- Margins expand to 15-20% on software/platform revenue

- Robotaxi deployment proceeds but slower: 5,000-10,000 vehicles by 2027

- $3-5B in robotaxi revenue by 2027

- Optimus still pre-revenue or minimal commercialization

- EV business declines modestly to $70-80B

- Total revenue: $90-100B by 2028, flat vs current

- Margins compressed by continued investment

- Robotaxi commercialization delayed or fails to achieve scale

- Optimus remains experimental/limited

- EV business continues declining to $60-70B

- Revenue: $80-90B, declining

- Margin pressure from price wars, high R&D

- Autonomous Driving:Tesla’s vision-based approach vs Waymo’s LiDAR/map-based strategy; Tesla behind in fully unsupervised deployment[4]

- Regulatory Hurdles:Robotaxi approvals city-by-city; safety incidents could derail expansion

- Liability Issues:Accident liability framework still evolving

- Waymo:Technologically ahead, fully operational in multiple cities, backed by Alphabet’s resources[4]

- Chinese Competitors:BYD, others in EVs; Chinese humanoid robotics companies emerging[5]

- Tech Giants:Alphabet, Meta, Amazon investing heavily in AI/robotics

- Capital Intensity:Robotaxi fleet requires massive capex

- Manufacturing Complexity:Optimus mass production at scale unproven

- Management Bandwidth:Elon Musk distracted by X (Twitter), SpaceX, other ventures

- Already Priced to Perfection:At 291x P/E, limited margin for error

- Execution Gaps:Any delay in robotaxi/Optimus could trigger 30-50% correction

- EV Decline:Core business deterioration not fully priced in

-

Is Tesla an AI company or an automaker?

- Current reality: 75% automaker, 25% option value on future

- Market pricing: Treating as AI/platform company

- Gap:Misalignment between current fundamentals and valuation

-

What probability of success is priced in?

- At $1.53T, implies 60-70%+ probability of robotaxi success AND 40-50%+ probability of Optimus success

- Historical tech platform success rates: <20% achieve expectations

- Verdict:Expectations likely too high

-

What are the catalysts and timeline?

- Near-term (2026):Robotaxi fleet expansion to 30 cities, production volume ramp[2]

- Mid-term (2027):Proof of robotaxi unit economics (profitability per vehicle)

- Long-term (2028+):Optimus commercialization

- Risk:Long investment horizon with limited near-term catalysts

-

How to monitor progress?

- Robotaxi Metrics:Fleet size, rides/week, utilization rates, revenue/vehicle

- FSD Take Rate:Percentage of Tesla owners subscribing to FSD software

- Optimus:Production prototypes, pilot deployments, commercial agreements

- EV Business:Stabilization of deliveries and margins

-

Take Profits on Partial Position:At $475, stock prices in significant success across all new initiatives. Consider trimming 20-30% of holdings to lock in gains and reduce exposure to execution risk.

-

Monitor Key Catalysts:

- Q1 2026: Update on 30-city robotaxi expansion progress[2]

- Q2 2026: Initial robotaxi fleet economics data

- Q4 2026: Optimus commercialization timeline

-

Set Stop-Loss Levels:Given 132% 52-week range[0] and high volatility, consider protective stops at $380-400 to limit downside to 15-20%.

-

Wait for Better Entry Point:At 291x P/E, risk/reward unfavorable. Wait for:

- Pullback to $350-400 range (more reasonable valuation)

- Concrete robotaxi revenue data (Q2 2026+)

- Stabilization of core EV business

-

If Buying Now:

- Treat as venture capital investment in AI/robotics

- Expect 3-5 year holding period

- Position size: 2-5% of portfolio maximum

Hedge with Put Options:Given volatility, consider protective puts or buy-write strategies

-

Adopt Sum-of-the-Parts Valuation:Model robotaxis, Optimus, and EV as separate businesses with distinct multiples[3]

-

Scenario Analysis:Assign probabilities to bull/base/bear cases; expected value calculation at current price suggests modest downside risk (-10% to -20% if using reasonable probability weights)

-

Peer Group Comparison:Compare to:

- Traditional Auto:GM, Ford (5-8x P/E)

- EV Pure Plays:Rivian, Lucid (pre-profit, growth multiples)

- AI/Platforms:Alphabet, Nvidia (25-35x P/E on high growth)

- Ride-Hailing:Uber, Lyft (2-3x revenue, negative earnings)

Conclusion:Tesla trades at premium to all comparables

Tesla faces a fundamental

- If valued as automaker:Worth $150-200B (85-90% downside)

- If valued as AI/platform company:Needs to prove hypergrowth from new segments

- Current reality:Market pricing it as AI company before new businesses have generated material revenue

Timeline |

Milestone |

Current Status |

Confidence |

|---|---|---|---|

| Q1 2026 | Robotaxi expansion to 30 cities announced | Planning stage | Medium |

| Q2 2026 | Fleet grows to 1,000+ vehicles | ~500 currently | Medium |

| Q3 2026 | First positive unit economics data | Unproven | Low |

| Q4 2026 | $1B+ robotaxi revenue run rate | ~$0 currently | Low |

| 2027 | Optimus enters limited production | Testing phase | Very Low |

| 2028 | Robotaxi revenue >$10B | Speculative | Very Low |

[0]

[1]

https://finance.yahoo.com/news/800-tesla-stock-could-reality-143002634.html

[2]

https://finance.yahoo.com/news/golden-goose-could-tesla-3-023056178.html

[3]

https://finance.yahoo.com/news/tesla-sky-high-valuation-prompts-160032022.html

[4]

https://www.forbes.com/sites/greatspeculations/2025

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.