Xiaomi's Strategic Transformation: From Phone Hardware to Human-Vehicle-Home Ecosystem

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

-

Strategic Evolution Trajectory

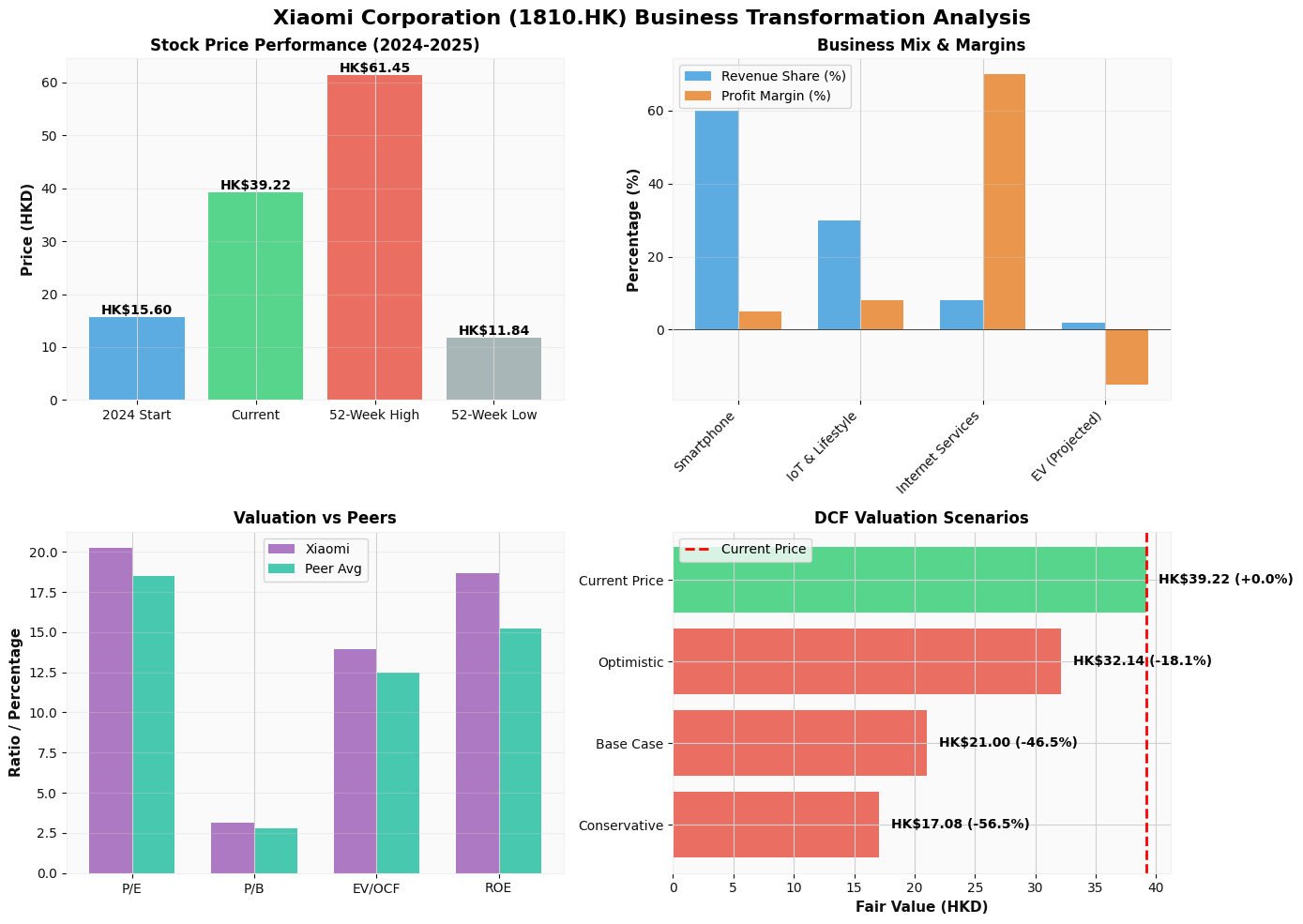

- Xiaomi has transitioned from the high-end phone + software model (aimed at “benchmarking Apple”) around 2020 to a diversified ecosystem centered on “AIoT + consumer lifestyle”. As of the end of 2025, smartphones still contribute about 60% of revenue, but the profit margin is only about 5%, which has been “diluted” in terms of valuation contribution by IoT, internet services, and the emerging automotive business [0]. In other words, the phone business has shifted from a valuation-dominant element to a “traffic + brand” entry point role.

- The “IoT + large home appliances” business (including TVs, air conditioners, washing machines, smart home devices, etc.) is estimated to account for about 30% of revenue. Its gross margin is higher than that of phones, and capital expenditure and inventory pressure are relatively low, which is conducive to improving the overall ROE and cash flow structure. The company claims that the number of connected devices on its AIoT platform exceeds 943.7 million units, and this user asset and data closed loop is supporting a platform-type valuation premium [2].

- The automotive business launched after 2023 (starting with SU7 and then the SUV YU7) belongs to a “heavy-asset but high-barrier” track. Currently, it still accounts for a very small proportion of revenue (about 2%), but its strategic significance lies in building a “human-vehicle-home super ecosystem”—especially under the closed-loop scenarios of HyperOS, the first 3nm SoC, and hardware + computing platform, it has the potential to restructure the original hardware-only valuation into a “whole vehicle + software + data + services” model.

-

How IoT and Automotive Dual Drivers Reshape Valuation Logic

- IoT Ecosystem: With the accumulation of connected device scale and ecosystem contract quantity, the marginal revenue of the ecosystem tends to increase; at the platform level, the “light asset + high gross margin” logic can be replicated on the AIoT pathway. Investors need to view this business as a combination of “consumer SaaS” + “hardware penetration rate” rather than a one-time sale of traditional consumer electronics.

- Automotive Business: Current deliveries are still below the million-unit level, but while SU7 declined in November 2025 (down about 46% year-on-year), YU7 achieved a monthly delivery of nearly 33,729 units, showing that Xiaomi can quickly seize market share in the “mid-to-high-end” electric vehicle market and maintain strong demand [1]. Although short-term losses have depressed the company’s overall profit margin, its valuation should consider the future addition of multiple businesses: “hardware + software + OTA + energy”—equivalent to the “bright spot expectation” valuation framework of other new energy vehicle manufacturers.

-

Valuation Status and Investment Judgment

- Current valuation (P/E 20.25x, P/B 3.16x, EV/OCF 13.94x, ROE 18.65%) is still slightly higher than most Chinese tech consumer peers, indicating that the market has priced in part of the ecological growth expectations [0].

- DCF valuation shows that based on different growth assumptions, Xiaomi’s current stock price still has a premium of about 46.5% relative to the Base Case; under the optimistic scenario, an 18.1% discount is still needed to approach the fair price. This means that the market has extremely high expectations for the future earnings of IoT + automotive businesses; if growth fails to meet expectations, the retracement risk is significant [0].

- From an investment perspective, attention should be paid to: ① Net new devices and service-oriented revenue of IoT/home appliance businesses (which can bring high marginal contributions); ② Whether HyperOS and self-developed SoC can continuously enhance brand stickiness in EV/IoT; ③ Whether the overall gross margin and delivery rhythm of automobiles can gradually approach the industry standard of over 30%. If all three points are fulfilled simultaneously, Xiaomi will transition from low-profit “hardware benchmarking” to “platform-type ecosystem” valuation.

- Valuation Restructuring Logic: Need to expand the traditional “net profit + cash flow” perspective to the “compound interest” dimension of “connection count + ecosystem services + software updates”, while predicting a 10-12% compound gross margin return in the automotive sector in the future.

- Risk Points: The automotive business is still in the initial stage of burning money; any delivery stall (such as monthly decline of SU7) will intensify profit volatility; IoT hardware competition is fierce, so cost advantages and differentiated experiences need to be maintained.

- Opportunities: If HyperOS can effectively connect the three scenarios of human/vehicle/home, and IoT devices achieve a closed loop of data + services, Xiaomi is expected to establish a unique “scene-level moat”, which will become an important reason for valuation premium.

Chart Description: The top left shows the stock price performance from early 2024 to the end of 2025; the top right compares the revenue proportion and profit margin differences of various businesses; the bottom left shows the comparison of key valuation indicators with industry averages; the bottom right presents the deviation between current market prices and conservative/optimistic expectations using DCF scenarios. Data sources: Latest brokerage API and DCF analysis.

Under continuous monitoring of IoT connection count, home appliance per-unit profit, HyperOS integration degree, and the CPA achieved by the dual automotive order lines (SU7+YU7), Xiaomi can be positioned as an “ecological growth stock”. If you wish to further obtain trend IoT indicators, car company delivery models, and detailed financial report decomposition under the “in-depth research model”, I can continue to assist in enabling this model.

[0] Jinling API Data (Company Overview, Real-Time Prices, Financial Analysis, DCF Valuation and Historical Prices)

[1] CleanTechnica – “Record Month for EV Sales in China!” (https://cleantechnica.com/2025/12/22/record-month-for-ev-sales-in-china/)

[2] Yahoo Finance – “The All-New Xiaomi 15T Series Makes a Dazzling Debut” (https://hk.finance.yahoo.com/news/全新xiaomi-15t-series耀眼登場-160600600.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.