Humanoid Robot Industry Trends and Wanxiang Qianchao (000559.SZ) Strategic Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

- Industry Heat and Differentiation:In 2025, humanoid robots moved from “science fiction” to “industrialization”, and capital and supply chains are going through a “selective voting” phase. Leading enterprises have gradually transformed humanoid robots from high-end scientific research props to industrial/service applications through mass production expansion, supply chain collaboration, and the implementation of domestic core components. According to reports, investment in embodied intelligence (including humanoid robots) reached 23 billion yuan in the first five months of 2025, and the market size is expected to approach 1.55 trillion yuan by 2030, with a compound annual growth rate (CAGR) of about 10% [4]; meanwhile, as of December 16, the humanoid robot concept sector has risen by nearly 55% cumulatively, reflecting the high concentration of market expectations [2].

- Core Drivers:Involves three paths: localization of components (such as torque motors, roller screws, harmonic reducers), AI large model capabilities (embodied intelligence “VLA” architecture), and cost reduction; specifically including embodied intelligence platforms, full-link localization, and the implementation and expansion of industrial/service scenarios. Currently, domestic leading enterprises are gradually shifting from “demonstration actions” to specific applications such as “factory loading and unloading”, “smart logistics”, and “data center operation and maintenance”, and the commercialization path is gradually becoming clear [1][3].

- Challenges and Rhythm:Despite high capital enthusiasm, technical reliability, mass supply, and real scenario adaptation are still being calibrated; the industry still needs to stabilize market expectations through multi-batch verification, customer feedback validation, and continuous cost reduction [2][3].

- Transformation Positioning:As a leading traditional auto parts enterprise, Wanxiang Qianchao has established the robot industry as its third strategic sector after bearings and chassis, covering core components such as roller screws, precision reducers, robot-specific bearings, and joint universal joints. It plans to achieve a production capacity of 1.2 million sets of robot-specific bearings in 2026, and promote overseas production capacity (Thailand) and overseas mergers and acquisitions (WAC) to support global layout [3].

- Finance and Valuation:The latest data shows that the company’s market value is about 45 billion yuan, with a TTM P/E ratio of 44.8x, ROE of 10.86%, operating profit margin of about 8.6%, and debt/liquidity still in a controllable range; cash flow remains positive (free cash flow of about 935 million yuan). Therefore, against the background that expectations during the transformation period have not been fully realized, the valuation is in a state of market heat premium, and attention needs to be paid to whether subsequent performance can match the high valuation [0].

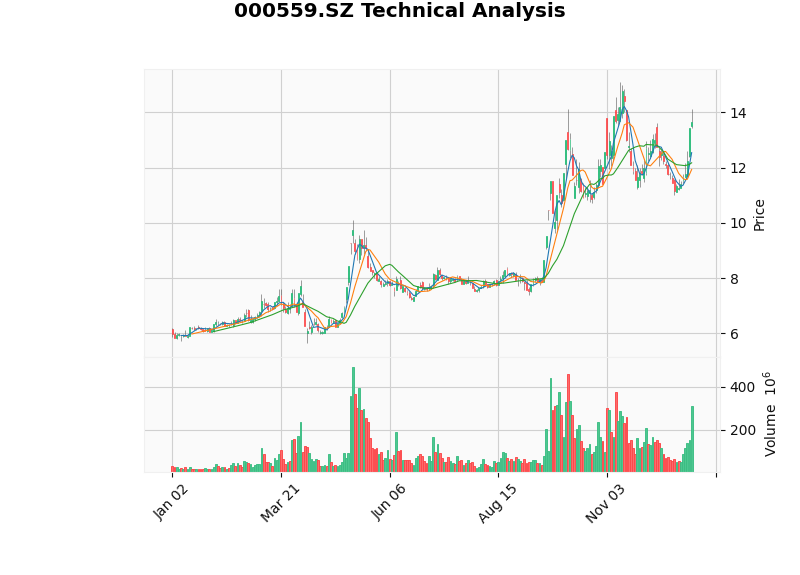

- Technical Aspect:From October to December 2025, the stock price fluctuated between 10.7 yuan and 15.1 yuan, and remained above the 20/50-day moving averages. The MACD has no death cross yet, the KDJ is at a high level, and there is a short-term “overbought” risk but the trend is still upward; the key resistance level is 14.11 yuan, and the support level is 12.17 yuan. Relevant technical charts have covered the above trends and daily return distribution for investors’ reference [0].

Figure: The left chart shows the closing price of Wanxiang Qianchao and the trends of MA5/MA10/MA20 with major resistance/support levels; the right chart shows the daily return distribution from October to December 2025. Source: Technical data and visualization tools covered by Jinling AI Securities API [0].

-

Value Judgment:

- Strategic synergy: The company can reuse high-precision manufacturing capabilities accumulated in automotive transmission systems, precision bearings, etc., to connect robot joint modules and low-altitude economy products, forming “hardware + system” synergy;

- Orders and customers: Has delivered samples to multiple leading robot enterprises; if it enters the large-scale delivery stage in the future, it will form a new revenue source. Coupled with the successful verification of low-altitude economy bearings, it can achieve performance growth through two channels;

- Valuation patch: If the robot business achieves mass volume in the second half of 2026, it is expected to support the current valuation premium.

-

Main Risks:

- Commercialization rhythm is not fully confirmed: Currently, the robot business is still dominated by samples and verification; it still needs to wait to truly form a large-scale supply chain and profit contribution;

- High valuation: If the robot business does not deliver in the short term, it will put pressure on the current high valuation;

- Fierce industry competition: UBTech, Inovance Technology, Ziyuan, etc., are accelerating expansion in scenarios and components; price wars and customer stickiness tests continue;

- Decline in demand for hybrid vehicle components weakens the pull on traditional businesses; if the transformation is not as expected, it will amplify profit fluctuations.

-

Focus Points:

- Follow up on the production capacity release progress of robot-specific bearings in 2026 and core customer orders (especially industry customers with demonstration effects);

- Observe whether the contribution of the robot business to revenue/profit can be reflected quarter by quarter, and the progress of group mergers and acquisitions (WAC and overseas);

- From the technical perspective, pay attention to whether it can stand above 14.11 yuan and maintain volume; if it falls back, observe the effectiveness of the 12.17 yuan support level.

-

Strategy Recommendations:

- Conservative investorscan wait for further confirmation of fundamentals before gradually entering, especially focusing on the capacity and order fulfillment node in the second half of 2026;

- Active investorscan focus on the pullback opportunities after breakthroughs, with dynamic stop-profit, under the premise that the trend continues and growth expectations are clear despite high valuations;

- In the overall humanoid robot sector, pay attention to complete machine leaders with fast embodied intelligence implementation and mass delivery (such as UBTech), and high-margin components (such as Inovance Technology, Haozhi Electromechanical) for portfolio hedging.

If you need more in-depth industry comparison, valuation models, or parallel tracking of multiple companies, you can enable the

[0] Jinling AI Securities API Data (real-time stock prices, company profiles, technical analysis, financial analysis, visualization charts)

[1] “Humanoid Robots in 2025: How Far Are They From ‘Entering Homes’?” Tencent Cloud Developer Community (https://cloud.tencent.com/developer/article/2608558)

[2] “Humanoid Robots in 2025: Half Misty Forest, Half Starry Sea” Phoenix Network (https://h5.ifeng.com/c/vivoArticle/v002PEqrooFVSxNw-_GFYVvtUGlbURQmlL--bJgiiOVbAxgzw__?isNews=1&showComments=0)

[3] “Taking Advantage of Both Virtual and Real: Lu Weiding’s Layout of Robots and Low-Altitude Economy” Sina Finance (https://finance.sina.com.cn/stock/zqgd/2025-12-24/doc-inhcwxmm4486572.shtml)

[4] “2026 Economic and Industry Outlook | Deloitte China Research ‘Monthly Economic Overview’ Issue 101” (https://www.deloitte.com/cn/zh/our-thinking/research//issue101.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.