In-depth Analysis of Profit Elasticity and Valuation of Lithium Mining Enterprises Amid Lithium Carbonate Prices Breaking 120,000 CNY/Ton

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

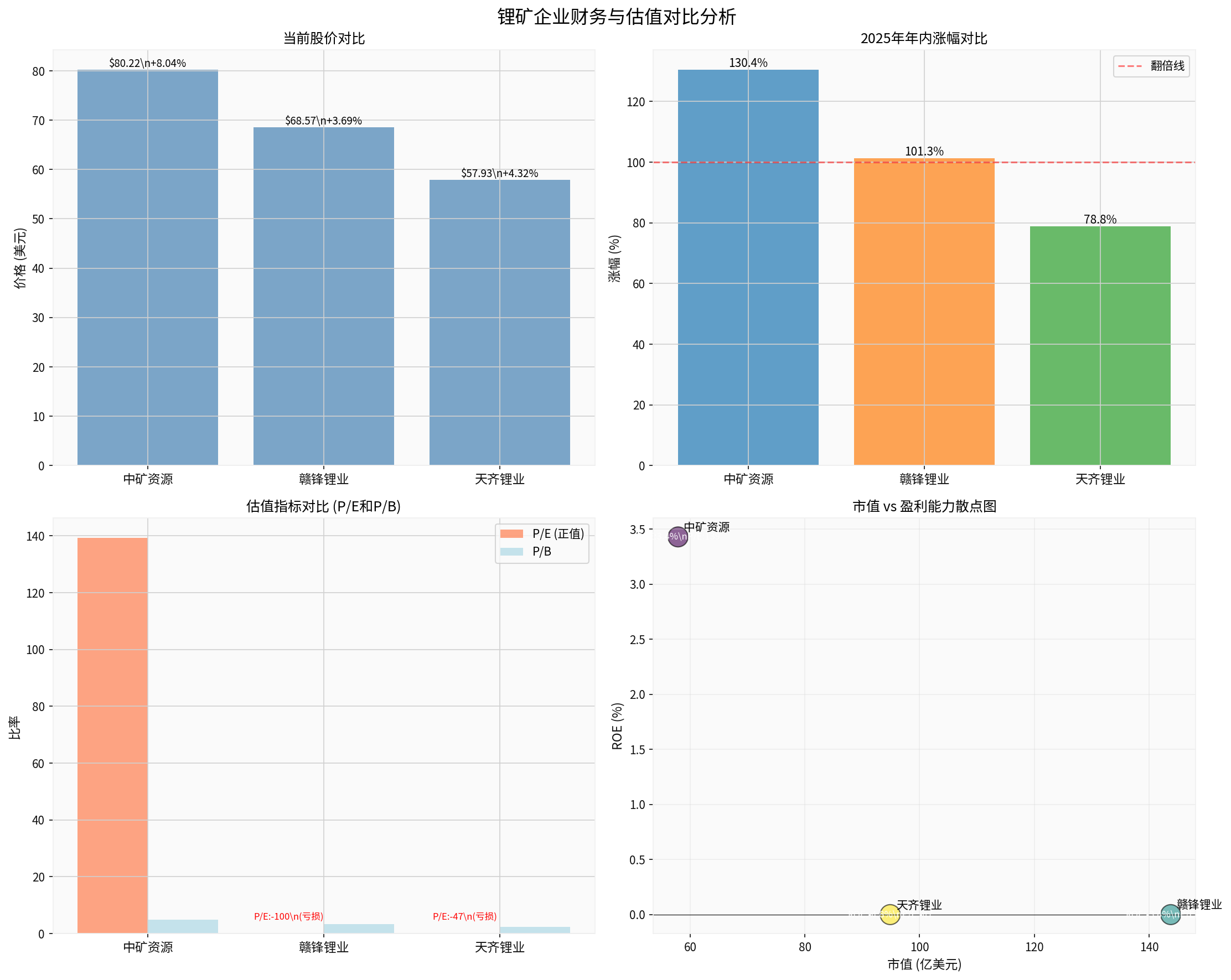

- Loss-making enterprises have the greatest elasticity:Ganfeng Lithium and Tianqi Lithium currently have negative P/E ratios (-99.6x and -47.1x) [0], and the shift from loss to profit will bringvaluation re-rating opportunities.

- Profitable enterprises have moderate elasticity:Zhong矿 Resources has achieved profitability (ROE: 3.43%), but its current P/E ratio is as high as 139x [0],valuation has already discounted part of the upside expectation.

- Zhong矿 Resourceshas the highest annual increase (130.45%), but also faces the greatest valuation pressure (P/E:139x).

- Ganfeng Lithiumhas the largest market capitalization (143.77 billion USD), but is in a loss state.

- Tianqi Lithiumhas a relatively moderate annual increase (78.85%), with a loss degree between the two.

| Indicator | Value | Market Implication |

|---|---|---|

| Current Stock Price | $80.22 | Rose 8.04% intraday, strong breakout [0] |

| Annual Increase | +130.45% | Led the lithium mining sector, strongest market expectation [0] |

| Market Capitalization | 57.88 billion USD | Medium scale, high elasticity [0] |

| P/E Ratio | 139.32x | High valuation risk , already priced in high growth expectations [0] |

| P/B Ratio | 4.82x | High price-to-book ratio, reflecting market optimism [0] |

| ROE | 3.43% | Just achieved profitability, large room for improvement [0] |

| Debt Risk | Low | Healthy financial structure [0] |

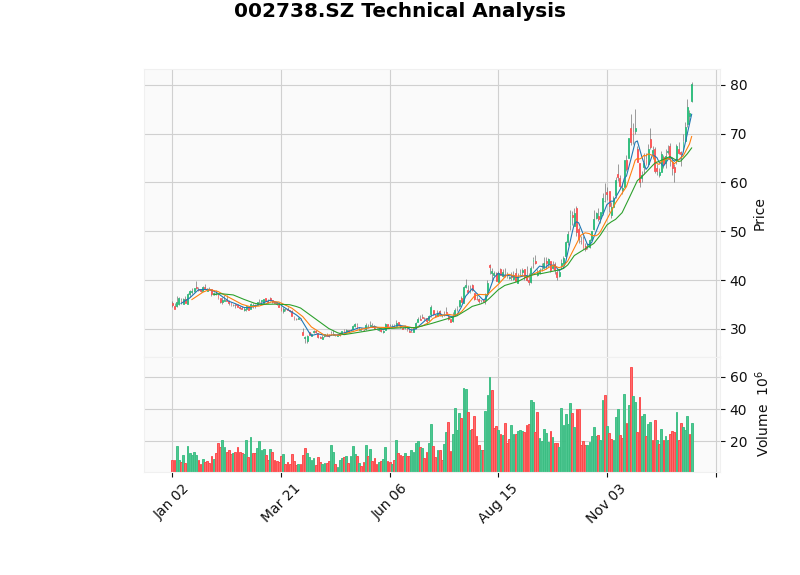

| Technical Analysis | Rising trend, KDJ overbought | Short-term correction risk [0] |

- Advantages:Already profitable; lithium price increases will directly boost profits.

- Disadvantages:Current valuation is at a high level (P/E:139x),limited further upside potential.

- Sensitivity Analysis:Assuming a 50% increase in lithium prices, net profit may double, but P/E will still be around 70x,valuation attractiveness decreases.

| Indicator | Value | Market Implication |

|---|---|---|

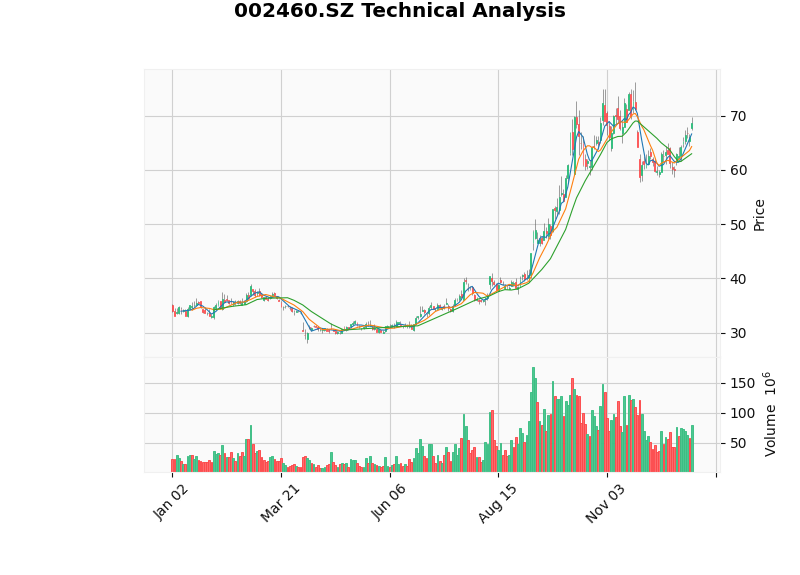

| Current Stock Price | $68.57 | Rose 3.69% intraday, moderate follow-up [0] |

| Annual Increase | +101.26% | Significant increase but lower than Zhong矿 [0] |

| Market Capitalization | 143.77 billion USD | Industry leader , obvious scale effect [0] |

| P/E Ratio | -99.60x | Loss state , maximum reversal potential [0] |

| P/B Ratio | 3.37x | Lower than Zhong矿, relatively reasonable valuation [0] |

| ROE | -3.41% | Still in loss [0] |

| Debt Risk | High | Large financial pressure [0] |

| Technical Analysis | Rising trend, KDJ overbought | Need to be alert to short-term corrections [0] |

- Core Logic:As a lithium mining leader, once lithium prices continue to rise above the break-even point,it will jump from -99.6x P/E to positive P/E, and valuation will experiencejump-like re-rating.

- Sensitivity Analysis:If lithium prices rise from 120,000 to 200,000 CNY/ton, the company may turn from annual loss to annual profit of billions of yuan,stock price elasticity may exceed 200%.

- Risk Points:High debt risk will amplify financial pressure during loss periods; need to pay attention to cash flow status [0].

###3.1 Price Scenario Analysis

| Scenario | Lithium Carbonate Price | Increase vs Current | Impact on Zhong矿 Resources | Impact on Ganfeng Lithium |

|---|---|---|---|---|

| Conservative | 150,000 CNY/ton | +25% | Net profit +30-40% | Loss narrowed by 50% |

| Neutral | 175,000 CNY/ton | +46% | Net profit +60-80% | Near break-even |

| Optimistic | 200,000 CNY/ton | +67% | Net profit +100-120% | Turn to profit, valuation re-rating |

###3.2 Core Conclusion on Profit Elasticity

- Profit Elasticity: Moderate(Net profit is sensitive to lithium prices, but the base is already high).

- Valuation Upside Potential: Limited(Current P/E:139x is already at a high level).

- Investment Logic: Performance Verification Type, need to pay attention to whether actual performance can keep up with valuation expectations.

- Profit Elasticity: Extremely High(The inflection point from loss to profit has the greatest elasticity).

- Valuation Upside Potential: Huge(Jump-like re-rating from negative to positive P/E).

- Investment Logic: Distress Reversal Type, the market will gradually price in profit improvement expectations.

###4.1 Zhong矿 Resources (002738.SZ)

- Support Level:$69.40 (Important correction support) [0].

- Resistance Level:$80.55 (Current position, need volume to break through) [0].

- Next Target:$84.53 (After breakout) [0].

- Technical Indicator:KDJ (87.9,79.3,105.2) issued an overbought warning; short-term correction pressure exists [0].

###4.2 Ganfeng Lithium (002460.SZ)

- Support Level:$64.30 (Strong support area) [0].

- Resistance Level:$69.78 (Close to current position) [0].

- Next Target:$72.70 (After breakout) [0].

- Technical Indicator:KDJ (83.9,77.6,96.4) is also overbought, but the intensity is lower than Zhong矿 [0].

###5.1 Current Market Sentiment Characteristics

- Stock Prices React in Advance:Lithium mining stocks have increased by 78-130% annually [0], far exceeding the actual increase in lithium carbonate prices.

- Technical Overbought:Both companies’ KDJ indicators show overbought status [0], with short-term profit-taking pressure.

- Sentiment Drivers:

- Supply tightness expectation from extremely low inventory (105,400 tons vs reasonable inventory of 169,000 tons).

- Supply-side contraction expectation from mid-stream production suspension to support prices.

- Expectation of better-than-expected new energy vehicle subsidy policies.

###5.2 Industry Fundamental Support Strength

- Inventory Data:The 105,400 tons of inventory you mentioned is indeed at a historical low, with asupply-demand gap of 63,600 tonscompared to the reasonable demand of 169,000 tons.

- Capacity Contraction:Collective production suspension by mid-stream enterprises to support prices, and upstream follow-up maintenance will further tighten supply.

- International Market:Online searches show that overseas lithium mining enterprises such as Sigma Lithium have seen their stock prices rise by 30.7% due to tight supply in China [1], verifying the global supply tightness logic.

- New Energy Vehicles:The 2025 expected 3000GWh power battery output (data provided by you) implies lithium carbonate demand will reach approximately 2.25 million tons (calculated at 0.75 tons/GWh).

- Energy Storage Demand:Explosive growth of the global energy storage market will provide additional support for lithium demand.

- AI and Energy Transition:Online searches show that the AI revolution and energy transition are driving general increases in industrial metal prices [2].

###5.3 Deviation Assessment Conclusion

- Technical overbought [0], short-term may face 5-10% correction pressure.

- But correction range is limited due to strong fundamental support (low inventory + supply contraction).

- If lithium carbonate prices indeed rise to 150,000-200,000 CNY/ton, current valuation will be digested.

- Loss-making enterprises (Ganfeng, Tianqi) will迎来 performance inflection points, driving the second wave of increases.

- If lithium carbonate prices remain above 150,000 CNY/ton, current valuation is still reasonable.

- If prices fall back below 100,000 CNY/ton, high-valuation stocks (such as Zhong矿) face large correction risks.

###6.1 Short-term Strategy (1-3 Months): Be Cautious of Chasing Highs, Wait for Corrections

- Technical indicators are overbought [0].

- Huge annual increases (130% for Zhong矿, 101% for Ganfeng) [0], large profit-taking pressure.

- After short-term catalysts (subsidy policies) are implemented, “good news is priced in” may occur.

- Holders: Can continue to hold, but set stop-loss levels (Zhong矿: $69, Ganfeng: $64).

- Non-holders: Wait for technical corrections to support levels before entering.

###6.2 Mid-term Strategy (3-12 Months): Focus on Reversal Opportunities of Loss-making Enterprises

- Greatest Valuation Elasticity:Jump-like re-rating from -99.6x P/E to positive P/E.

- Stable Leader Position:Market capitalization of 143.8 billion USD, absolute industry leader [0].

- Capacity Scale Advantage:Greatest profit elasticity from lithium price increases.

- Relatively Healthy Technical Aspect:Although also overbought, intensity is lower than Zhong矿.

- High debt risk amplifies financial pressure during loss periods [0].

- If lithium price increases are less than expected, losses will continue to expand.

###6.3 Long-term Strategy (Over 1 Year): Allocate High-quality Capacity

- Irreversible New Energy Revolution:Continuous increase in electric vehicle penetration.

- Energy Storage Market Explosion:Global energy transition brings a second growth curve for lithium demand.

- Supply Rigidity:High-quality lithium mining resources are scarce, and expansion cycles are long (3-5 years).

- Core Position:Ganfeng Lithium (Leader + Reversal Elasticity).

- Satellite Position:Zhong矿 Resources (Fast performance verification, but need to control position).

- Avoid:Small lithium mining enterprises with high debt + low capacity utilization.

###7.1 Price Risk

- If lithium carbonate prices cannot maintain above 120,000 CNY/ton, loss-making enterprises (Ganfeng, Tianqi) will continue to be under pressure.

- A sharp price correction (below 80,000 CNY/ton) will lead to overall industry losses.

###7.2 Technical Risk

- Short-term technical overbought [0], 5-15% correction risk exists.

- Breaking support levels may trigger technical selling.

###7.3 Policy Risk

- If new energy vehicle subsidy policies are below expectations, it will hit demand-side confidence.

- Tightening environmental protection policies may increase lithium mining costs.

-

Profit Elasticity Ranking:Ganfeng Lithium > Tianqi Lithium > Zhong矿 Resources

- Loss-making enterprises are far more sensitive to price reversals than profitable ones.

-

Valuation Upside Potential Ranking:Ganfeng Lithium > Tianqi Lithium > Zhong矿 Resources

- Greatest opportunity for valuation re-rating from negative to positive P/E.

-

Relationship Between Market Sentiment and Fundamentals:

- Short-term deviation exists (technical overbought + excessive increases).

- Mid-term will converge with performance improvement.

- Strong fundamental support from low inventory + supply contraction.

-

Investment Recommendations:

- Short-term: Be cautious of chasing highs, wait for technical corrections.

- Mid-term: Focus on reversal opportunities of loss-making enterprises.

- Long-term: Allocate high-quality lithium mining resources.

[0] Jinling API Data (Company Overview, Real-time Quotes, Historical Prices, Technical Analysis, Financial Analysis)

[1] Yahoo Finance - “Why Sigma Lithium Stock Zoomed to 52-Week Highs Today” (https://finance.yahoo.com/news/why-sigma-lithium-stock-zoomed-171744984.html)

[2] Yahoo Finance - “Gold and silver hit records in 2025. They aren’t the only metals having a massive year” (https://finance.yahoo.com/news/gold-and-silver-hit-records-in-2025-they-arent-the-only-metals-having-a-massive-year-160006577.html)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.