In-depth Analysis of Jiamei Packaging's 8 Consecutive Limit-Up Hype Logic and Risk Avoidance Guide

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

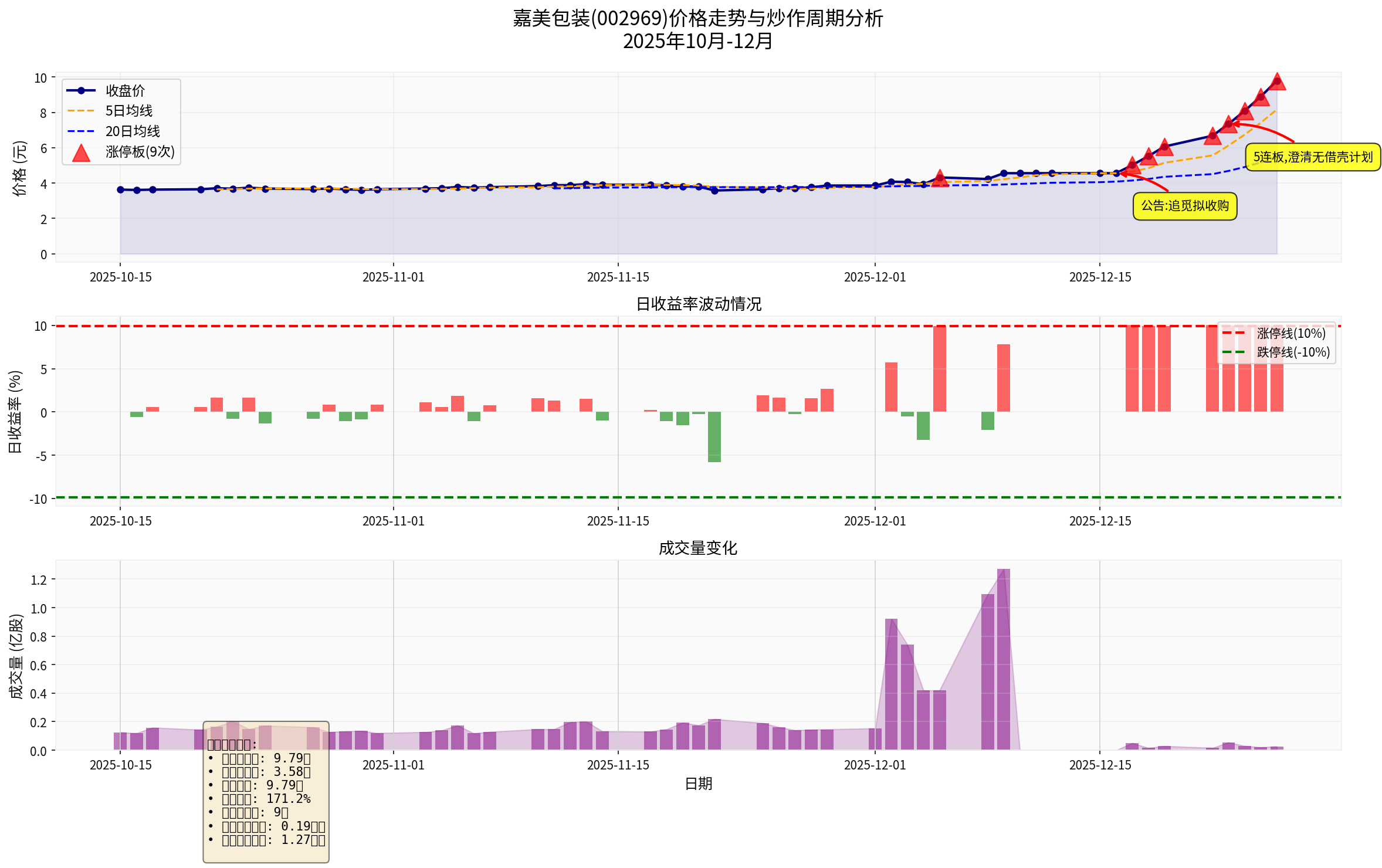

Jiamei Packaging (002969) has had 8 consecutive trading days of limit-ups since December 16, 2025. Its stock price soared from 3.90 yuan to 9.79 yuan,

- December 16: Announced that Yu Hao, founder of Dreame Technology, plans to acquire control via “agreement transfer + voluntary tender offer”

- December 18: First released an abnormal fluctuation announcement, emphasizing no plan to change the main business within 12 months

- December 23: Supplementary announcement after 5 consecutive limit-ups, clearly stating “no backdoor listing plan within the next 36 months”

- December 28: 8 consecutive limit-ups; the company released aserious abnormal fluctuation announcement, pointing out that “the stock price is seriously disconnected from the company’s fundamentals” and thatit may apply for suspension of trading for verificationif abnormal rises continue [2]

- Founded in 2017, started from the Xiaomi ecosystem, now ranks among the top three in the global robot vacuum market

- 2024 revenue was approximately 15 billion yuan; H1 2025 revenue exceeded the full year of last year

- Six-year compound annual growth rate (CAGR) exceeds 100%, valuation reaches 20.5 billion yuan[3]

- Business has expanded to smart home appliances, embodied robots, new energy vehicles, etc.

The core logic of market hype is:

Although the company has clearly stated twice:

- No change to main business within 12 months

- No backdoor listing through the listed company within 36 months

The market still hypes疯狂ly for the following reasons:

There have been multiple cases of “deny first, then backdoor list” in A-share history, so investors have a gambling mentality.

According to the Measures for the Administration of Major Asset Restructuring of Listed Companies, purchasing assets from the acquirer within 36 months after control change constitutes a major asset restructuring and requires strict review [1]. However, the market believes:

- It can still be operated after the 36-month commitment period

- Can avoid regulation by injecting assets step by step

- “No backdoor listing” does not mean “no capital operation”

Although Dreame focuses on smart home appliances and Jiamei on food packaging, the market hypes:

- Capacity synergy: Jiamei has the largest third-party beverage OEM filling capacity in the country

- Supply chain integration: Jiamei serves well-known brands like Yangyuan Beverage and Wanglaoji, with rich channel resources

- Imagination space for new energy vehicle packaging business

The company’s convertible bonds also experienced trading abnormalities, indicating that

| Financial Indicator | Value | Industry Comparison |

|---|---|---|

Price-to-Earnings Ratio (P/E) |

62.27x | Traditional packaging industry usually 10-20x |

Price-to-Book Ratio (P/B) |

3.84x | Reasonable level around 1.5-2x |

Market Cap |

About 65.8 billion yuan | Performance support should be in the range of 10-15 billion yuan |

| Profitability Indicator | Value | Comment |

|---|---|---|

Return on Equity (ROE) |

6.12% | Below the passing line of 10% |

Net Profit Margin |

4.70% | Traditional manufacturing level |

Operating Revenue (Q3) |

777.67 million yuan | No explosive growth |

Earnings Per Share (EPS, TTM) |

0.15 yuan | Cannot support 62x P/E |

Jiamei Packaging’s main business:

- Three-piece can and supporting printed iron business(traditional metal packaging)

- Beverage OEM filling service(limited by downstream prosperity)

Although it serves well-known brands like Yangyuan Beverage and Wanglaoji, these are

- Dreame’s 2024 revenue was 15 billion yuan; Jiamei’s market cap has reached 65.8 billion yuan after soaring

- Dreame fully meets the IPO conditions for the Science and Technology Innovation Board/GEM, so there is no need to spend 2.282 billion yuan to buy a “shell” (the actual cost is much higher than the 424 million yuan for an independent IPO) [3]

- Yu Hao announced in September 2025 that “it is expected that multiple businesses under the Dreame ecosystem will have batch IPOs by the end of 2026” [4]

- Highly coincident with the timeline of the “no change to main business within 12 months” commitment in this acquisition

- More likely: first take control as a platform for future capital operations, rather than backdoor listing immediately

- Current regulation has extremely strict review on “backdoor listing”

- Tech enterprises backdoor listing traditional manufacturing have low business synergy and great difficulty in passing

| Identification Dimension | Normal Company | Concept Hype Features |

|---|---|---|

Announcement Logic |

Clear business synergy, clear performance commitment | Vague commitment of “no plan within XX months” |

Stock Price Performance |

Slow rise, moderate volume increase | Consecutive one-word limit-ups, abnormal volume increase |

Valuation Level |

In line with industry historical range | Far exceeding industry average, P/E often 50-100x |

Fundamental Changes |

Substantial growth in orders and revenue | Supported only by “future expectations” |

Participating Funds |

Mainly institutional allocation | Led by hot money, retail investors, leveraged funds |

✗

- When the listed company itself can’t stand the stock price, the bubble is usually at its limit

✗

- Indicates that leveraged funds have deep participation; once reversed, it will trigger chain stampede

✗

- Real value investment will not deny off-market funds the opportunity to get on board

✗

- Indicates that the market has lost rationality and is in a stage of fool’s game

✗

- Regulators have paid attention; once suspended and resumed trading, there are often large adjustments

###3.

- Don’t fantasize that there will be a 9th or 10th limit-up

- Convertible bond holders should sell immediately; leveraged risk is huge

Historical data shows that similar concept hype stocks after opening the limit-up:

- Average first-day drop after opening limit-up: -5% to -10%

- Average drop in1 week after opening: -20% to -30%

- Average drop in1 month after opening: -40% to -60%

If you firmly believe that Dreame and Jiamei will have substantial cooperation, wait for:

- After consecutive limit-ups open and full turnover (turnover rate>50%)

- Stock price returns to reasonable valuation range (about4-5 yuan)

- Clear asset injection or business integration announcement

- Substantial improvement in financial data

- If the company applies for suspension for verification, it will most likely make up for the drop after resuming trading

- If regulators issue inquiry letters or take regulatory measures, hype sentiment will quickly ebb

###4.

The essence of investment is to share the dividends of enterprise growth, not to seek short-term price differences. Investors are advised to:

✅

- ROE>15%

- Revenue growth rate>20%

- Net profit growth rate>25%

- P/E below industry historical median

✅

- Companies with consecutive losses supported by “stories”

- Small market cap “shell companies” easy to manipulate

- Companies with frequent cross-border operations and no core main business

✅

- Real growth enterprises will survive bull and bear markets

- Short-term concept hype will eventually return to the value center

| Risk Dimension | Rating | Explanation |

|---|---|---|

Valuation Risk |

⭐⭐⭐⭐⭐ | P/E of62x, far exceeding reasonable level |

Liquidity Risk |

⭐⭐⭐⭐ | Consecutive one-word limit-ups, hard to sell |

Regulatory Risk |

⭐⭐⭐⭐⭐ | Has prompted “may apply for suspension for verification” |

Fundamental Risk |

⭐⭐⭐⭐⭐ | ROE only6.12%, weak profitability |

Leveraged Risk |

⭐⭐⭐⭐⭐ | Convertible bonds also abnormal, fragile capital chain |

- Existing holders: Immediately take profits and secure gains

- Off-market investors: Resolutely do not chase, wait for full correction before re-evaluating

- View rationally: Dreame’s acquisition of Jiamei is a long-term capital operation, not a short-term performance explosion point

- Be alert to risks: Current stock price is completely disconnected from fundamentals; bubble burst is only a matter of time

[0] Gilin API Data - Jiamei Packaging Company Overview, Real-time Quotes, Historical Price Data

[1] Cailian She - “Dreame Technology Founder’s Takeover Hypes Jiamei Packaging to 5 Consecutive Limit-ups, Responds to Backdoor Listing Rumors” (https://finance.eastmoney.com/a/202512233599732158.html)

[2] Yicai.com - “8 Consecutive Limit-ups for Jiamei Packaging: If Stock Price Further Abnormally Rises, Company May Apply for Suspension for Verification” (https://www.yicai.com/brief/102978019.html)

[3] Wild Leopard Financial View - “Dreame Spends 2.282 Billion Yuan to Acquire Jiamei Packaging: What’s Yu Hao’s Big Plan?” (https://www.163.com/dy/article/KHL34KMG0556C9BF.html)

[4] Sina Finance - “Dreame Technology’s Yu Hao Acquires Jiamei Packaging for 2.28 Billion Yuan: Prelude to Backdoor Listing or Financing Platform?” (https://finance.sina.com.cn/stock/observe/2025-12-23/doc-inhcucqs0885935.shtml)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.