Comprehensive Impact Analysis of Large-Scale Institutional ETH Holdings on the Ethereum Ecosystem and Investment Value

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This is one of the largest single institutional holding announcements in cryptocurrency history. Bitmine’s total crypto assets + cash + “moonshots” amount to

- 4.11 million ETH (approximately $12 billion)

- 192 BTC

- $1 billion in cash

- Other crypto assets[1]

| Indicator | Value | Impact |

|---|---|---|

| Bitmine Holding Percentage | 3.41% | Significantly reduces tradable supply |

| Total Institutional Holdings (Estimated) | ~3.5% | Approximately 4.2 million ETH locked in institutions |

| Market Value | $35.174 billion | Circulating market value affected by institutional holdings |

- Reduced Tradable Supply:Large-scale institutional holdings lower the actual tradable supply in the market, potentially driving up prices if demand remains unchanged

- Enhanced Price Stability:Long-term holdings reduce market selling pressure, making price fluctuations relatively lower

- Liquidity Premium Risk:Supply concentration may lead to liquidity depletion at specific moments (e.g., institutional deleveraging)

According to brokerage data and market research, 2025 is a key turning point for institutional ETH adoption[2][3]:

- In August 2025, Ethereum spot ETF weekly trading volume reached $40 billion

- Weekly net inflows reached $3.37 billion, exceeding Bitcoin ETF inflows in the same period[2]

- Spot Bitcoin ETFs have held over $120 billionin assets, providing a framework for ETH capital inflows[5]

- In October 2025, Ethereum validator queue entry reached a record 1.3567 million ETH(approximately $5.5 billion)

- Grayscale injected $5.2 billionin ETH within three days

- Activation waiting time extended to 21-24 days, reflecting strong institutional demand for staking[3][4]

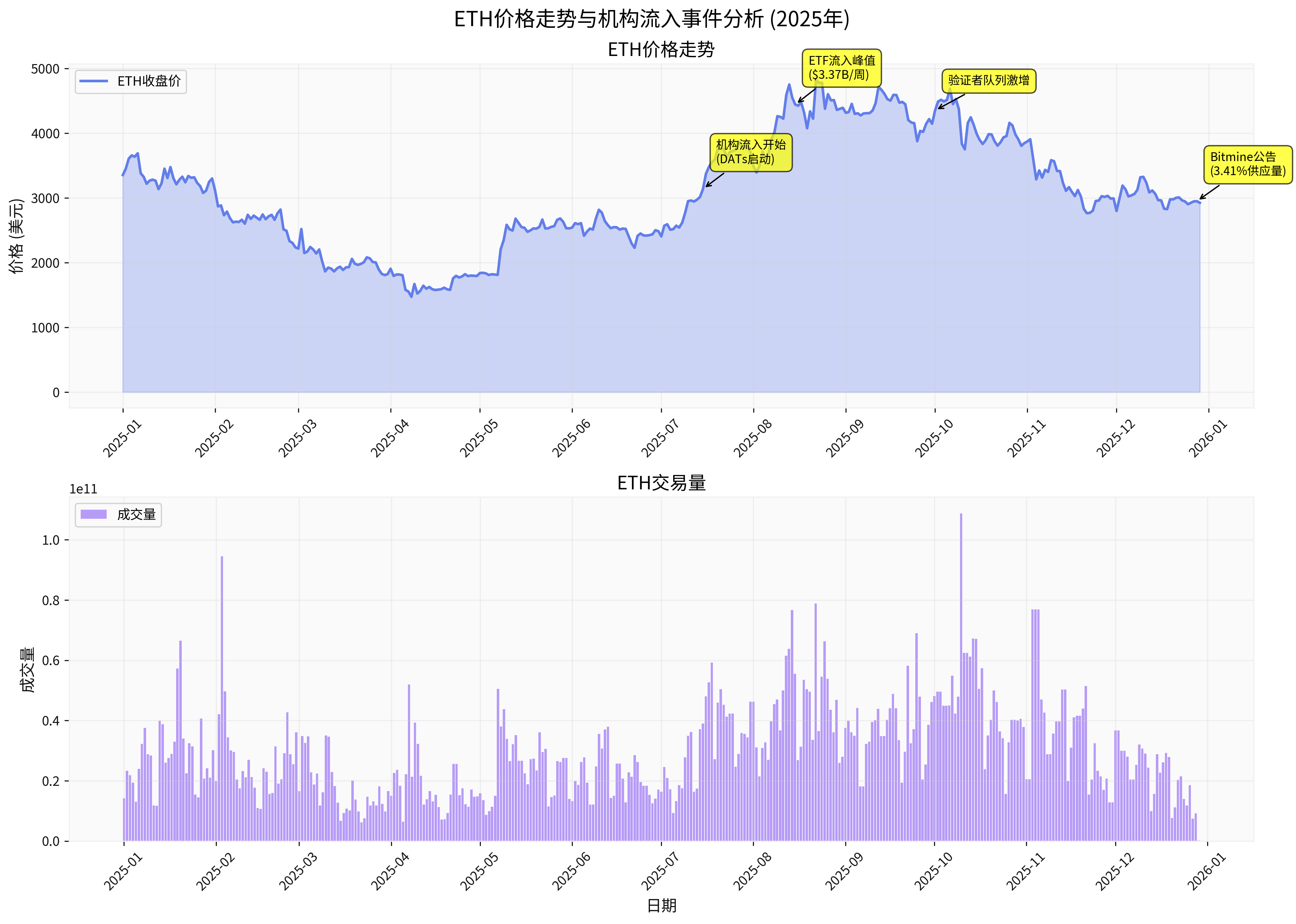

- Mid-July: Digital Asset Treasuries (DATs) launched, institutional inflows began

- Mid-August: ETF inflow peak, weekly net inflow of $3.37 billion

- October: Surge in validator queue

- December 28: Bitmine announced holding 3.41% of ETH supply[0]

- Year-start price: $3,353.32

- Current price: $2,923.89 (12.81% annual decline)

- Annual high: $4,831.24

- Annual low: $1,471.94

- Price volatility: 228.22%(extreme volatility)

- Average daily trading volume: $29.9 billion[0]

- Enhanced Network Security:Large-scale institutional staking increases the cost of network attacks and improves the security of Ethereum’s consensus layer

- Increased Staking Participation:The surge in the validator queue shows strong institutional interest in Ethereum staking

- Development of Restaking Protocols:Restaking protocols like EigenLayer have a TVL of$18-19 billion, giving staked ETH multiple utilities[3]

- Centralization Risk:Overly concentrated staking may threaten the principle of decentralization

- Concentration of Validator Power:Large institutions may gain disproportionate influence over network governance

- Institutional holdings enhance confidence in Ethereum as a settlement layer and smart contract platform

- Large-scale ETH locking may reduce the supply of collateral assets for DeFi protocols

- In the long run, institutional participation may bring more bridges between traditional financial products and DeFi

- Institutional adoption brings “compliance” recognition to the entire Ethereum ecosystem

- May accelerate the development of enterprise-level NFT and Web3 applications

-提升以太坊作为主流区块链平台的地位

Institutional adoption further expands Ethereum’s competitive advantages over other L1 blockchains:

- First-Mover Advantage:Has the most mature institutional and regulatory framework

- Network Effect:Institutional adoption attracts more institutions, forming a positive cycle

- Technical Moat:Continuous upgrades (e.g., Pectra, Fusaka) maintain technical leadership[3]

- Large-scale institutional holdings send a strong bullish signal to the market

- Reduces investors’ concerns about Ethereum’s long-term feasibility

- Attracts more institutional funds to follow (“institutional herding effect”)

- Long-term holdings reduce market selling pressure

- Provides potential support during market downturns (institutions buy the dip)

- May form a “price floor” effect

- Staking Returns:Current Ethereum staking APR is about 3-5%, providing stable cash flow for institutions

- Restaking Returns:Additional returns can be叠加 through protocols like EigenLayer

- Capital Appreciation:Although it declined overall in 2025, it rebounded nearly 100% from the low point ($1,471)

Based on current data:

- Total Market Value:$35.174 billion[0]

- Institutional Holding Value:Approximately $12.3 billion (about 35% of market value locked by institutions)

- Bitmine Holdings:$12 billion (34.1% of total market value)

- Adjusted Circulating Market Value:If considering 35% of institutional long-term holdings, the actual circulating market value is approximately $22.6 billion

- If institutions continue to inflow and maintain low turnover, the reduction in actual supply may support higher valuations

- Metrics like Price-to-Sales (P/S) and Market Value/Staking Value Ratio need to be re-evaluated, considering institutional locking factors

| Dimension | Bitcoin | Ethereum | Advantage Side |

|---|---|---|---|

| Institutional Inflow Scale | $120B (ETF) | Weekly peak $3.37B | BTC |

| Staking Returns | None | 3-5% APR | ETH |

| Application Scenarios | Value Storage | DeFi/NFT/Web3 | ETH |

| Supply Concentration | More decentralized | 3.41% held by a single institution | BTC |

| Regulatory Recognition | Higher | Rapidly improving | BTC |

- Large-Scale Sell-Off Risk:If institutions like Bitmine suddenly reduce holdings, it may lead to sharp price fluctuations

- Market Manipulation Concerns:A 3.41% holding can theoretically have a significant impact on prices

- Liquidity Depletion:During market pressure periods, institutional holdings may exacerbate liquidity shortages

- Concentration Review:Regulators may focus on a single institution holding such a large share of cryptocurrency

- Market Impact:Large-scale institutional holdings may trigger securities law and antitrust reviews

- Cross-Border Regulation:Regulations on institutional crypto holdings may conflict across jurisdictions

- Smart Contract Risk:Large-scale staking faces contract vulnerability risks

- Private Key Security:Institutional-level security measures are crucial

- Staking Unlock Delay:Exit queue time (up to 41 days) limits asset liquidity

- High Expectation Risk:The market may be overly optimistic about institutional participation, and the actual impact may be exaggerated

- Volatility Continuation:Despite institutional participation, ETH still experienced extreme volatility of 228% in 2025[0]

- Correlation Risk:Correlation with traditional financial markets may increase

- Bitmine’s Movements:Whether it will continue to increase holdings or start partial deleveraging

- ETF Capital Flows:Actual capital inflows after regulatory approval

- Market Sentiment:Whether institutional holdings drive retail FOMO (fear of missing out)

- Continuous Institutional Inflow:CoinDesk predicts institutions will hold about 4% of ETH supply[3]

- Technical Upgrades:Pectra and Fusaka upgrades improve scalability and staking efficiency[3]

- Application Growth:DeFi recovery and accelerated Web3 application development

- Macroeconomic Headwinds:Interest rate environment may be unfavorable to risk assets

- Regulatory Uncertainty:Crypto regulations in various countries are still evolving

- Increased Competition:Challenges from competitors like Solana and Cardano

- Allocation Strategy:Consider ETH as a core holding in the digital asset portfolio (recommended weight: 5-15%)

- Risk Management:Diversify entry timing, avoid large positions at a single price point

- Staking Strategy:Participate in staking to get returns, but pay attention to liquidity management

- Long-Term Perspective:Institutional adoption supports long-term value, but short-term volatility is inevitable

- Risk Control:Allocate small positions, avoid over-concentration

- Continuous Tracking:Follow institutional capital flows and technical developments

- ✅ Enhanced network security and credibility

- ✅ Improved market liquidity and price discovery

- ✅ Laid the foundation for long-term value investment

- ✅ Accelerated mainstream adoption and regulatory compliance

- ⚠️ Liquidity risks from supply concentration

- ⚠️ Centralization threatens the principle of decentralization

- ⚠️ Increased regulatory uncertainty

- ⚠️ Large-scale sell-offs may trigger market panic

Although ETH price fell by 12.81% in 2025, the significant increase in institutional participation provides strong support for long-term investment value[0]. The current price of $2,923.89 is significantly lower than the annual high of $4,831, providing potential entry opportunities for long-term investors.

[0] Jinling API Data - ETH Real-Time Price, Historical Data, and Market Statistics

[1] Bitmine Official Announcement (PR Newswire) - “Bitmine Immersion Technologies Announces ETH Holdings Reach 4.11 Million Tokens and Total Crypto and Total Cash Holdings of $13.2 Billion” (Dec 29, 2025) - https://www.webdisclosure.com/press-release/bitmine-immersion-bmnr-announces-eth-holdings-411-million-tokens-132-billion-wVA6lOe90Ae

[2] MEXC Crypto Pulse - “Ethereum’s Market Dynamics in 2025” - https://www.mexc.co/en-GB/crypto-pulse/article/ethereum-s-market-dynamics-in-2025-50794

[3] CoinDesk Research - “State of the Blockchain 2025: Market Review & Outlook” - https://www.coindesk.com/research/state-of-the-blockchain-2025

[4] AInvest News - “The Ethereum Validator Queue Surge: A Signal of Institutional Confidence and Restaking Momentum” (Dec 28, 2025) - https://www.ainvest.com/news/ethereum-validator-queue-surge-signal-institutional-confidence-restaking-momentum-2512/

[5] Bitget News - “Ethereum staking inflows outpace exits for first time since June 2025” (Dec 29, 2025) - https://www.bitget.com/news/detail/12560605125281

[6] 3CQS Crypto Screener - “BitMine Goes Shopping As Ethereum Dips: $140M Buy Spotted On-Chain” - https://www.3cqs.com/crypto-screener/

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.