Strategic Analysis and Impact Assessment of Senior plc's Sale of Aerospace Structures Business

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

According to the latest information [1], Senior plc has sold its Aerospace Structures business to private equity firm KPS for a transaction valuation of

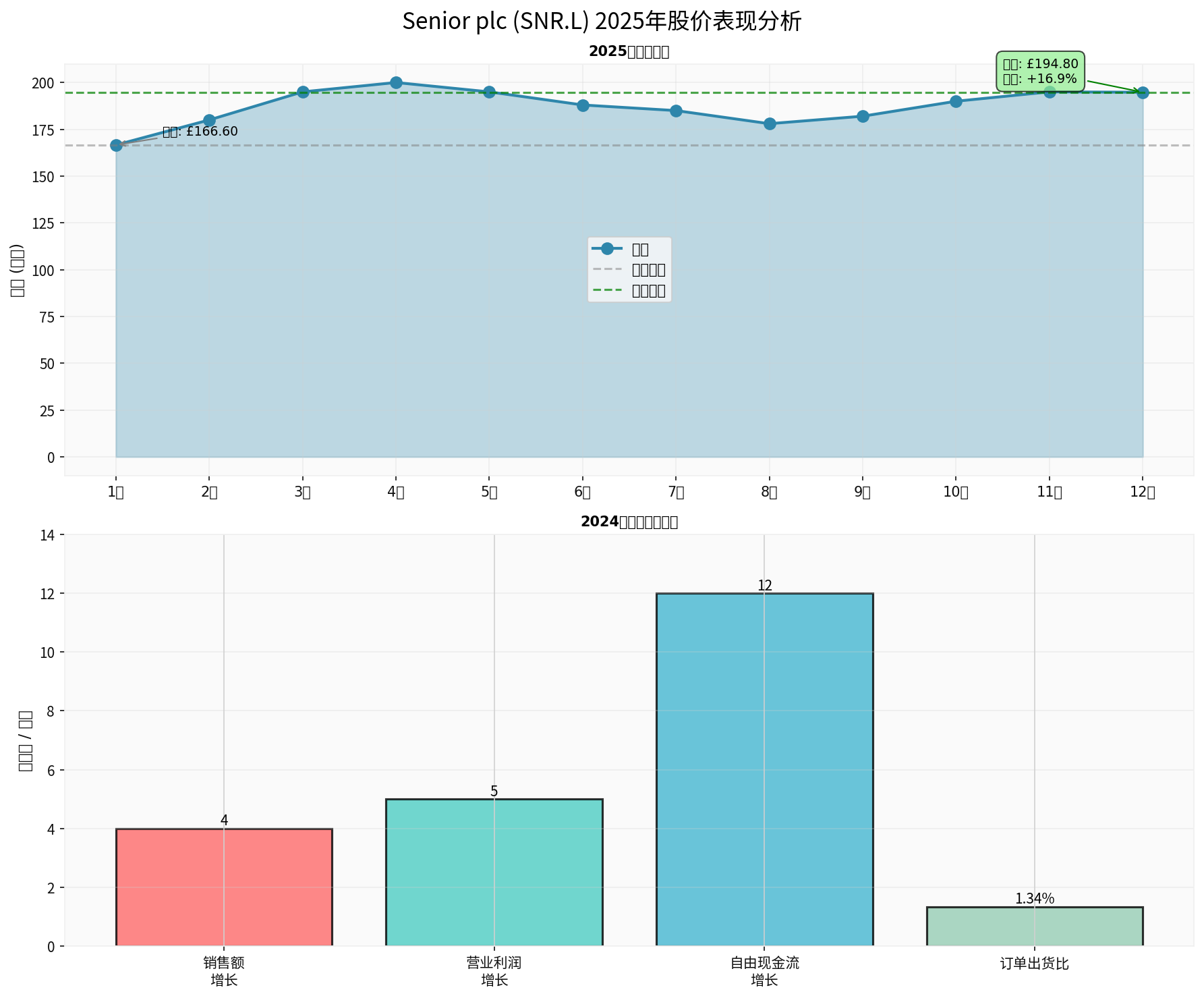

Figure: Senior plc 2025 Stock Price Trend and Key Financial Indicators [0]

- Divestment of underperforming assets: The Aerospace Structures business was in a loss-making state in 2024 [1], and although it is expected to achieve £9-11 million in operating profit in 2025, this business does not align with the company’s core strategic direction

- Focus on high-margin business: The Fluid Conveyance and Thermal Management (FCTM) business has higher profit margins and intellectual property value, with better market prospects

- Optimal resource allocation: Concentrate management attention, capital, and R&D resources on core advantage areas

- Debt reduction: Proceeds from the sale will be used to repay debt, significantly reducing financial leverage [1]

- Cash flow improvement: Free cash flow reached £17.3 million (12% growth) in 2024 [1], and cash generation capacity will be further enhanced after the transaction is completed

- Enhanced financial flexibility: Reducing debt levels will provide more room for future investments and mergers & acquisitions

- Market opportunity: The global fluid conveyance products market size is approximately $10 billion, and it is expected to reach $16 billion by 2032 (CAGR of 6.9%) [2]

- Technical barriers: The company has deep expertise and technical accumulation in high-value, customized fluid conveyance and thermal management systems

- Customer relationships: Retain long-term customer relationships with key industries such as aerospace, defense, and energy

| Financial Indicator | Before Sale | After Sale (Expected) | Change |

|---|---|---|---|

| Group Sales | £977.1M (2024)[1] | Decrease by approx. £100-150M | ↓10-15% |

| Operating Profit | £46.5M (2024)[1] | May slightly decrease | To be adjusted |

| Free Cash Flow | £17.3M (2024)[1] | Significantly improved | ↑↑ |

| Net Profit Margin | 4.25%[0] | Expected improvement | ↑ |

- Revenue scale reduction: Divesting the aerospace business will lead to a decline in total sales, but retains the higher-margin FCTM business

- Margin improvement: Increased proportion of high-margin core business enhances overall profitability

- Lower financial expenses: Debt reduction will lower interest expenses and increase net profit

-

Market growth potential: Demand for fluid conveyance systems in aerospace and defense continues to grow, benefiting from the recovery in commercial aircraft production and increased defense spending

-

Low-carbon transition opportunities: The company is positioned to support the low-carbon transition of “hard-to-abate industries” [2], aligning with global sustainable development trends

-

Technology innovation-driven: Focusing on core FCTM business allows increased R&D investment, driving product innovation and value-added enhancement

-

Strong order backlog: The order-to-shipment ratio reached 1.34 in Q1 2025 [1], indicating high visibility of future revenue

- A smaller revenue base may increase the risk of dependence on a single business area

- Cyclical fluctuations in the aerospace market may affect core business performance

- Year-to-date gain: +19.95%

- 1-year gain: +22.06%

- 3-year gain: +57.86%

- Current market capitalization: approx. $805 million

- Current stock price: 194.80 pence

- P/E ratio: 23.10x

- P/B ratio:1.96x

- EV/OCF:16.83x

- ROE: 8.05%

Pure-play companies usually enjoy higher valuation multiples because:

- Investors can more easily understand and evaluate the business model

- Management has higher focus

- Better capital allocation efficiency

- Reduced financial leverage risk

- Enhanced free cash flow stability

- Strengthened balance sheet

- FCTM business market demand is stable and predictable

- Technical barriers provide pricing power

- Long-term contracts provide revenue certainty

| Valuation Multiple | Pure-play FCTM Adjustment | Debt Reduction Effect | Combined |

|---|---|---|---|

| P/E Multiple | +15-20% | +5-10% | +20-30% |

| EV/EBITDA Multiple | +10-15% | +5-8% | +15-23% |

- Pure-play business premium

- Reduced financial risk

- Improved profit quality

According to the company’s disclosure [2], future focus will be on:

-

Core Business Enhancement

- Expand technological leadership in fluid conveyance and thermal management

- Deepen cooperative relationships with customers in aerospace, defense, and energy industries

-

Market Expansion

- Seize the opportunity of commercial aviation recovery

- Participate in the early design phase of next-generation aircraft projects

- Expand industrial energy and clean energy applications

-

Operational Optimization

- Continuously improve manufacturing efficiency

- Optimize global supply chain layout

- Digital transformation and smart manufacturing

| Risk Type | Specific Performance | Impact Level |

|---|---|---|

| Market Risk | Fluctuations in aerospace demand | Medium |

| Competitive Risk | Reduced technical thresholds | Medium-Low |

| Execution Risk | Transformation process management | Medium |

| Exchange Rate Risk | USD/GBP fluctuations | Medium-Low |

✓ Correct strategic transformation direction, focusing on high-growth, high-margin core business

✓ Significantly improved financial structure, reduced debt levels

✓ Clear market positioning, high technical barriers

✓ Sufficient order backlog, good visibility of future revenue

✓ Reasonable valuation, pure-play premium expected

⚠ Short-term revenue scale reduction

⚠ Risk from increased business concentration

⚠ Cyclical fluctuations in the aerospace market

Selling the aerospace structures business is a major

[0] Gilin API Data - Senior plc (SNR.L) Company Overview, Financial Data, Stock Performance and Valuation Indicators

[1] Matrix BCG Analysis - “Senior Company Growth Strategy and Future Prospects” - Regarding the progress of the aerospace business sale, transaction valuation (up to £200 million), 2024 financial performance (4% sales growth,5% operating profit growth, free cash flow growth of12% to £17.3 million), and strategic transformation goals

[2] Market Research Report - Fluid Conveyance Products Market Size Forecast (CAGR of6.9% from2025 to2032, growing from$10 billion to$16 billion) and Senior plc’s strategic positioning in low-carbon transition

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.