Analysis of the Impact of Changes in Zealand Pharma's Outstanding Shares on Valuation and Investor Ownership Ratios

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

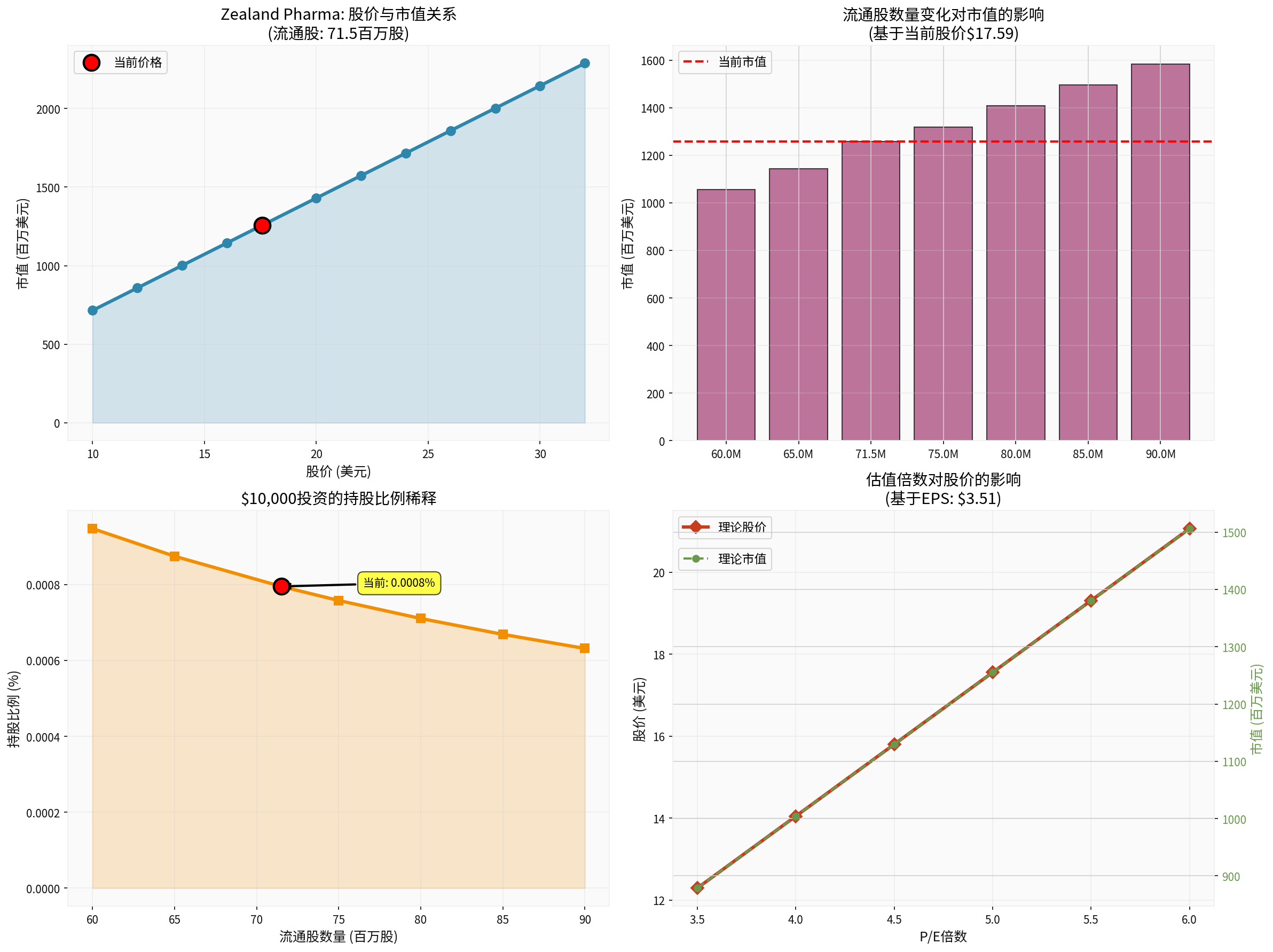

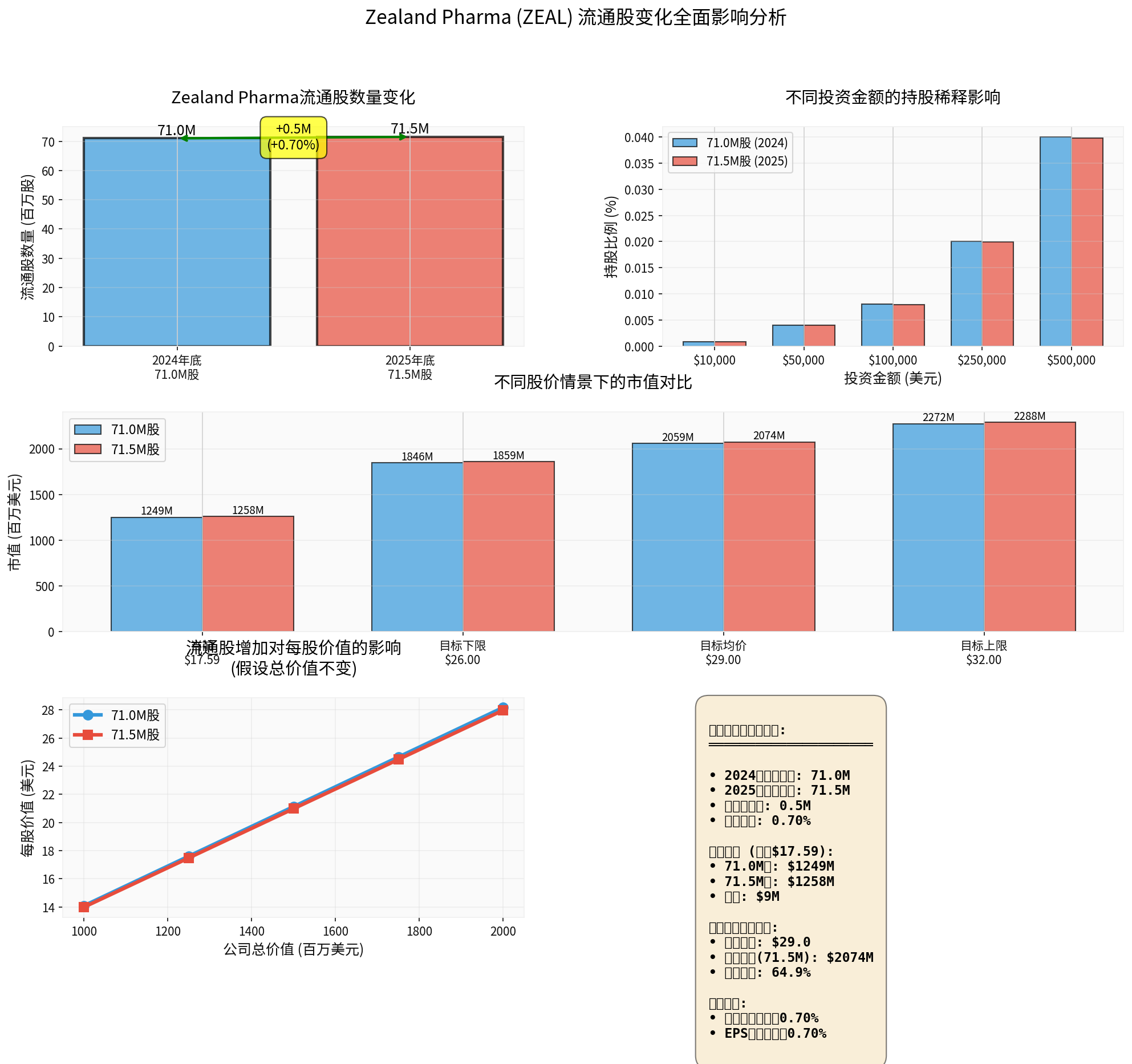

According to the latest data, Zealand Pharma (NASDAQ: ZEAL) has seen its outstanding shares increase from 71.0 million at the end of 2024 to 71.5 million at the end of 2025, and this change has had multi-dimensional impacts on the company’s valuation and investor ownership ratios [0][1].

- Outstanding shares at end of 2024: 71.0 million shares [2]

- Outstanding shares at end of 2025:71.5 million shares [0]

- Increase amount:0.5 million shares

- Dilution ratio: approximately0.70%

###1.2 Reasons for the Change

According to the company’s announcement, this increase is mainly due to the

##2. Analysis of Impact on Valuation

###2.1 Current Market Capitalization Changes

Calculated based on the current stock price of $17.59 [0]:

- Market cap at71.0M shares: approximately $1,249M

- Market cap at71.5M shares: approximately $1,258M

- Market cap increase: approximately $9M

###2.2 Impact on Valuation Multiples

According to API data, the current key valuation metrics are [0]:

- P/E ratio:5.01x

- P/B ratio:2.16x

- Enterprise Value/Operating Cash Flow:3.70x

- ROE (Return on Equity):54.87%

Impact of outstanding share increase on valuation multiples:

- EPS dilution: At the same profit level, EPS will be diluted by approximately0.70%

- Book value per share dilution: Net asset per share will decrease accordingly

- Valuation flexibility: The low dilution ratio (0.70%) has limited impact on overall valuation

###2.3 Analyst Target Price Perspective

Analysts have given a target price of $29.00, representing a 64.9% upside from the current price [0]. Under different target price scenarios:

- Target lower limit ($26.00): Market cap is approximately $1,859M (71.5M shares)

- Target average ($29.00): Market cap is approximately $2,074M (71.5M shares)

- Target upper limit ($32.00): Market cap is approximately $2,288M (71.5M shares)

##3. Analysis of Impact on Investor Ownership Ratios

###3.1 Ownership Dilution Analysis

Changes in ownership ratios for different investment amounts:

| Investment Amount | Ownership Ratio at71.0M Shares | Ownership Ratio at71.5M Shares | Dilution Magnitude |

|---|---|---|---|

| $10,000 | 0.00795% | 0.00790% | -0.00005% |

| $50,000 | 0.03975% | 0.03948% | -0.00027% |

| $100,000 | 0.07950% | 0.07896% | -0.00054% |

| $250,000 | 0.19875% | 0.19740% | -0.00135% |

| $500,000 | 0.39750% | 0.39480% | -0.00270% |

###3.2 Quantitative Assessment of Dilution Impact

- Dilution ratio: Mild (0.70%)

- Impact on EPS: Approximately -0.70%

- Impact on book value per share: Approximately -0.70%

- Impact on voting rights: Original shareholders’ voting rights are diluted by 0.70%

##4. Positive Significance of Outstanding Share Increase

Despite the dilution effect, this increase in outstanding shares also reflects the company’s positive development:

- Effective Employee Incentives: Employee warrant exercises indicate employees’ confidence in the company’s prospects

- Talent Retention Strategy: Helps retain core R&D teams, which is crucial for biopharmaceutical companies

- Financial Health: According to financial analysis, the company’s current ratio is14.10, with a sound financial position [0]

- Strategic Development: The company continues to advance in the metabolic disease and obesity treatment fields, recently entering into a $2.5 billion collaboration agreement with OTR Therapeutics [1]

##5. Comprehensive Assessment and Recommendations

###5.1 Dilution Impact Assessment

- Dilution degree: Minor (0.70%)

- Impact on overall valuation: Limited

- Impact on investor ownership ratios: Minimal but existing

###5.2 Key Investment Considerations

- Long-term Value: Analysts have a consensus rating of “Buy” with a target price of $29 [0]

- Business Progress: The company has deep professional accumulation in peptide pipelines such as GLP-1 and GLP-2 [1]

- Financial Soundness: Net profit margin of71.47%, operating profit margin of77.23%, strong profitability [0]

- Dilution Management: The 0.70% dilution ratio is within an acceptable range

###5.3 Key Risk Reminders

- Continuous Dilution Risk: Future equity issuances or warrant exercises may lead to further dilution

- Stock Price Volatility: The current stock price of $17.59 is still below the 52-week high of $32.12 [0]

- R&D Risk: Biopharmaceutical companies face the risk of clinical trial failure

##6. Conclusion

Zealand Pharma’s outstanding shares increased from71.0M to71.5M (+0.70%), and the impact on valuation and investor ownership ratios is

Investors should focus on the company’s business progress and pipeline advancement rather than overemphasizing this minor dilution effect. With the advancement of the company’s Metabolic Frontier 2030 strategy and the collaboration agreement with OTR Therapeutics, future stock price performance is expected to receive fundamental support [1].

[0] Gilin API Data - Zealand Pharma (ZEAL) Company Overview, Financial Analysis, Real-time Quotes

[1] GlobeNewswire - “Zealand Pharma increases its share capital as a result of the exercise of employee warrants” (https://www.globenewswire.com/en/news-release/2025/12/11/3204280/0/en/Zealand-Pharma-increases-its-share-capital-as-a-result-of-the-exercise-of-employee-warrants.html)

[2] Zealand Pharma Official Website Investor Relations - “71.0m shares outstanding as of December31,2024” (https://www.zealandpharma.com/investors/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.