Investment Value Analysis of Beidahuang (600598) — Combined with Heilongjiang's "22 Consecutive Bumper Harvests"

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The following is the analysis and conclusion based on the obtained tool data.

- Qualitative Impact of Heilongjiang’s “22 Consecutive Bumper Harvests” on Beidahuang (600598.SS) Investment Value (Based on Available Data)

1.1) Potential Support for Revenue and Profitability (Qualitative)

- Consecutive grain harvests reflect the stability and resilience of regional production and supply chains, which is conducive to the stability of land contracting, grain sources, and processing operations. In the absence of the company’s segmented business structure data (proportion of contracting/processing/trading, pricing mechanism), direct quantitative attribution from output to performance cannot be made; however, from the company’s fundamentals, its net profit margin reaches 21.55% and ROE is 13.63%, showing strong profitability [0].

- If the company’s main revenue sources are related to land contracting, grain processing and circulation, regional bumper harvests and stable grain supply help ensure business continuity and cost predictability, which forms a positive environment for the stability of profitability [3]. Further reliance on the company’s disclosed segmented business data is needed for quantification.

1.2) Possible Benefits from Policy and Valuation Environment (Qualitative)

- Heilongjiang continues to invest in directions such as “storing grain in land, storing grain in technology” and “integration of five good practices”, and high-standard farmland, smart agriculture and disaster prevention and mitigation systems help improve long-term yield and risk resistance [3]. If the company can participate in these projects, it may bring medium- and long-term operational improvements and incremental projects. Current evidence is insufficient to quantify its short-term performance contribution.

- Food security is a “national priority”, and macroscopically, it usually tends to support the sustainable operation and appropriate policy support of related fields [2], which is a positive environment for Beidahuang. However, the strength and rhythm of “policy support to stock price mapping” still depend on the company’s specific project implementation and market sentiment.

1.3) Supply and Demand and Price Dimensions (Need to Distinguish Business Types)

- For businesses mainly based on contracting and charged by area, the increase in regional grain production may bring stable or moderate growth in contracting demand, but the direct impact on unit price is limited, depending on contracts and pricing agreements.

- For processing and trading links, bumper harvests bring more abundant grain supply but also pressure on grain price decline; the comprehensive impact on the company’s gross profit depends on processing premium capacity, channel and inventory cycle adjustment capabilities. Due to the lack of segmented business structure data, no quantitative conclusion on the net impact can be given.

- Company Fundamentals and Market Performance Evidence (From Brokerage API)

- Financial Soundness: Net profit margin 21.55%, ROE 13.63%, current ratio 2.27, quick ratio 2.22, debt risk classified as low risk, accounting policies are conservative [0].

- Valuation Level: P/E around 24.1-24.2x, P/B around 3.2x, which matches its ROE and net profit margin levels well, and the valuation is not extreme [0].

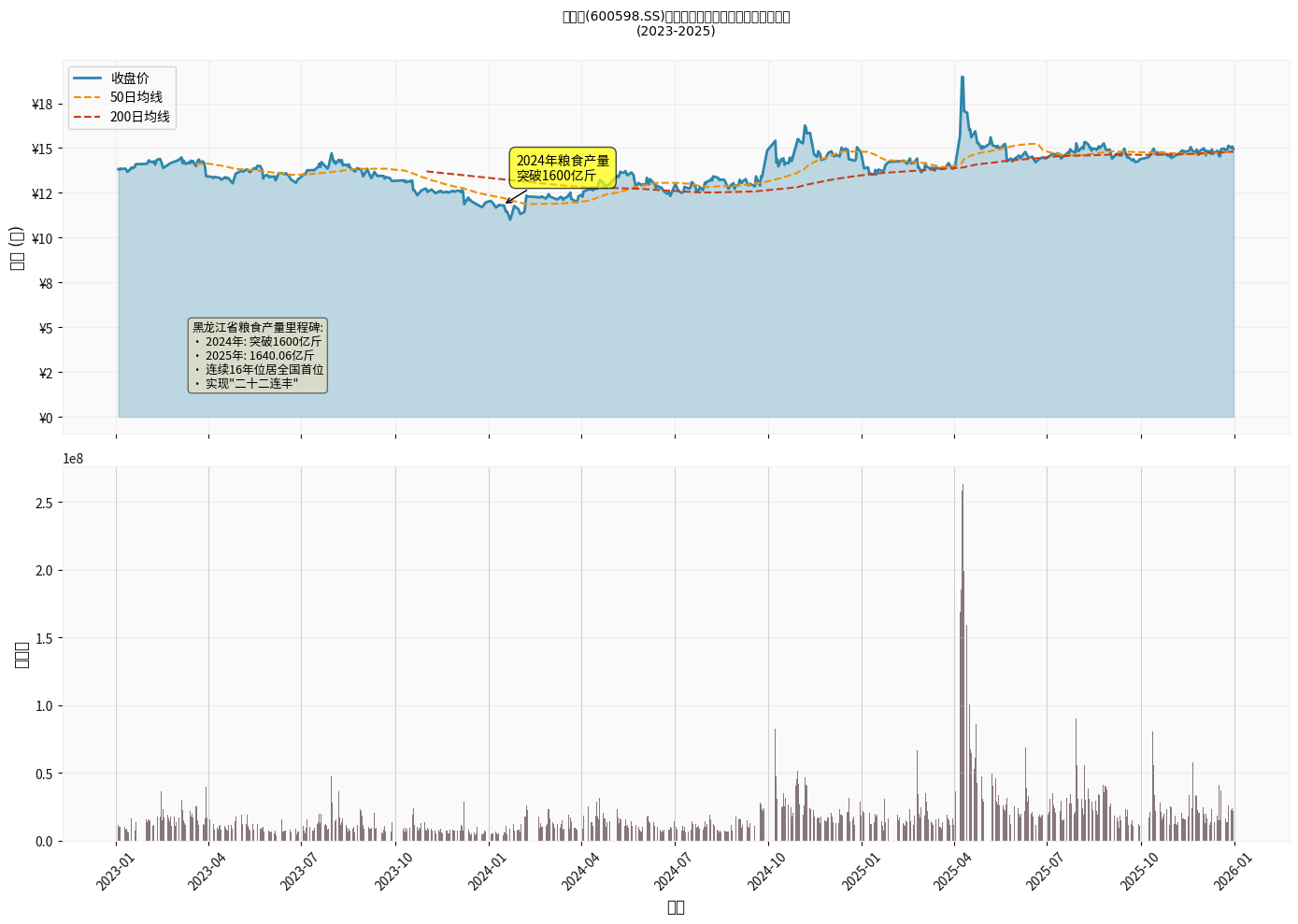

- Recent Price Trend: From the beginning of 2024 to the end of 2025, the closing price is about 14.95 yuan, with a high of about 19.60 yuan and a low of about 10.84 yuan during the period; the 20/50/200-day moving averages are about 14.84/14.79/14.81 yuan respectively, and the price is near the center [0]. The technical pattern shows a consolidation range (reference level about 14.82-15.08), lacking clear strong direction signals [0].

- Beta is 0.45, showing relatively low volatility compared to the market [0].

- Macro Background Supplement (Based on Public Web Search)

- In 2025, national grain output was 1.42975 trillion jin, an increase of 16.75 billion jin over the previous year, with a growth rate of 1.2%, achieving high-level增产 nationwide [2].

- Heilongjiang Province’s total grain output in 2025 was 164.006 billion jin, standing at the 160 billion jin level again after first exceeding it in 2024, achieving “22 consecutive bumper harvests” and ranking first in the country for 16 consecutive years [1]. Note: Web search shows that national data comes from Xinhuanet, which does not conflict with the brokerage API caliber; the conclusions in this article are mainly based on company data, supplemented by macro information.

- Risks and Uncertainties (Data Gap Reminder)

- Segmented Business Structure and Pricing: Current public data does not provide Beidahuang’s revenue proportion, pricing mechanism of different business lines (land contracting, processing, trading), so it is impossible to accurately quantify the transmission amplitude and direction of “regional grain增产 → company profit”.

- Cyclicality: Grain prices and policy orientation are cyclical; under the background of bumper harvests, if grain prices are under pressure, it may form phased pressure on the gross profit of trade and processing ends.

- Market Style and Capital Flow: The consumer staples sector has performed weakly overall in the current period, which may suppress the sector’s valuation to a certain extent [0].

- Conclusion (Neutral to Positive, Prudent Recommendations Consistent with Existing Data)

- Comprehensive visible data: The company has sound financials, strong profitability, and high matching degree between valuation and performance; combined with the long-term positive environment of regional “22 consecutive bumper harvests” and agricultural technology investment, it supports the company’s medium- and long-term value (qualitative).

- Given that the current technical pattern shows sideways震荡, lacks clear breakthrough signals, and lacks segmented business structure data for quantitative performance attribution, the direct pull of output → stock price in the short term should not be overestimated.

- Investment Recommendations: Current valuation matches stable profitability and low-risk characteristics, suitable for allocation or bargain hunting by stable-style, long-term funds; pay attention to the follow-up company’s disclosure of “high-standard farmland and smart agriculture project implementation progress, changes in segmented business revenue structure, single-quarter performance and order/project announcements” to verify whether the transmission chain is actually strengthened.

Supplementary Notes (For In-depth Investment Research): For a more precise quantitative impact of “grain output → company performance → stock price”, it is recommended to enter the in-depth investment research mode to obtain Beidahuang’s segmented business revenue, gross profit margin, order projects and capital expenditure structure over the past 5-10 years for regression and scenario calculation, and compare with peers (such as other regional planting and processing enterprises). At the same time, variables like regional weather, inventory cycle and price seasonality can be included to improve scenario analysis.

References

- [1] Xinhuanet: Be a “Ballast Stone” for National Food Security — “Beidacang” Continues the Harvest Chapter with “22 Consecutive Bumper Harvests”

http://www.hlj.xinhuanet.com/20251230/92a34ac849854f21a4617dd07ac31a30/c.html - [2] Xinhuanet: Data Overview of China’s Pulse | Stable Grain Ensures World Security! “Great Power Granary” Increases Production at a High Level

http://www.news.cn/20251229/bb532b57a2614ac690263162918bf121/c.html - [3] Science and Technology Daily: Be a “Ballast Stone” for National Food Security — The Harvest Code of “Beidacang”

https://www.stdaily.com/web/gdxw/2024-12/28/content_279878.html - [0] Jinling AI System Data (600598.SS) — Includes company overview, financial indicators, price quotes, technical analysis, sector performance, etc.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.