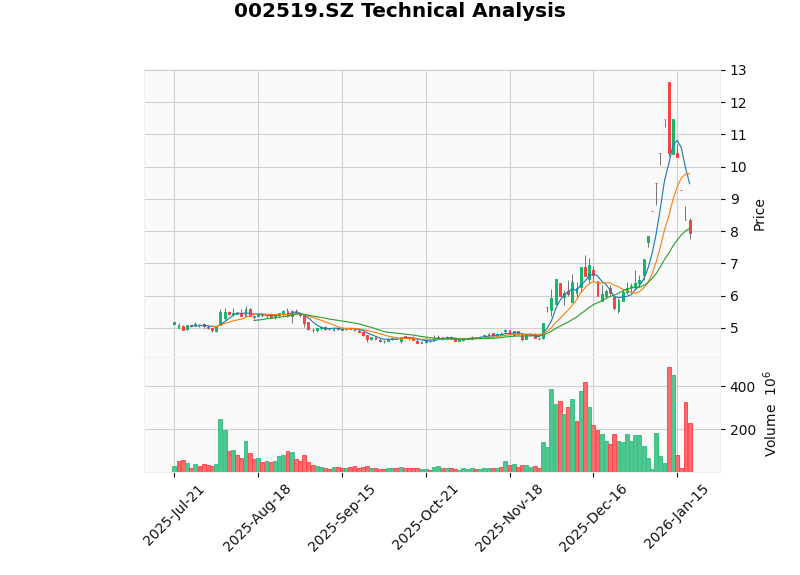

In-depth Investment Research Report on Commercial Aerospace: Yinhe Electronics (002519) vs Juli Sling (002342)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I will now provide you with a detailed comparative analysis report.

- Sustained revenue contraction: Only RMB 332 million in the first three quarters of 2025, a year-on-year decrease of 59.12%[4]

- Net loss of RMB 50 million after deducting non-recurring gains and losses, with ROE of -37.43% after deduction[0]

- Its subsidiary Tongzhi Electromechanics has been disqualified from military equipment procurement for all military branches for 36 months due to contract pricing issues in specific fields, with zero new orders

- A qualified opinion was issued for its 2024 annual report, and the accounting firm questioned the authenticity and recoverability of some of its assets[4]

- Operating cash flow remains tight, with a net outflow of RMB 113 million in the first three quarters

- Revenue of RMB 1.743 billion in the first three quarters of 2025, a year-on-year increase of over 13%[4]

- Achieved a net profit of RMB 6 million after deducting non-recurring gains and losses, successfully turning losses into profits

- ROE of -1.28% after deduction, which is healthier compared to Yinhe Electronics

- P/E ratio of -314.32 (due to negative net profit), price-to-sales ratio of 4.05x

| Dimension | Yinhe Electronics | Juli Sling |

|---|---|---|

Aerospace Business Positioning |

Strategic bet, active entry with in-depth binding | Taking orders as a natural extension, stable supporting supplier |

Core Products |

Satellite user terminals, satellite ODM manufacturing | Rocket transfer hoisting, satellite assembly fixing, recovery capture arms |

Customer Structure |

Undertakes manufacturing for the “Qianfan Constellation” through Gespace | Core supplier to national teams such as CASC |

Business Proportion |

Not yet converted into actual orders or revenue | Limited but stable scale, serves as an incremental boost |

Technology Migration |

Military-grade power supply and distribution, radiation-resistant technology migrated to satellite energy systems | Industrial hoisting technology extended to aerospace launch site supporting facilities |

| Evaluation Dimension | Yinhe Electronics | Juli Sling |

|---|---|---|

Commercial Aerospace Substantiveness |

★★☆☆☆ (Concept-focused) | ★★★★☆ (Officially confirmed supplier) |

Fundamental Health |

★★☆☆☆ (High risk) | ★★★☆☆ (Relatively robust) |

Valuation Rationality |

★★☆☆☆ (Overvalued) | ★★★☆☆ (Reasonable) |

Investment Risk Level |

High-risk, high-elasticity | Low-volatility defensive |

- Short-term speculative investors with high risk appetite

- Investors who are optimistic about the commercial aerospace industry’s boom and are willing to bear high uncertainty in exchange for potential high returns

- Investors who will pay attention to the follow-up order implementation and the progress of resolving audit issues

- Medium- to long-term investors pursuing certainty

- A stable allocation choice for investors who are optimistic about the recoverable rocket technology route and the development of China’s commercial aerospace

- Investors who will pay attention to incremental orders brought by the promotion of net-based recovery technology

- Valuation bubbles emerge in the commercial aerospace sector, with the average P/E ratio reaching as high as 96x before the decline, and some individual stocks exceeding 1,000x[6]

- Tighter regulation: the Shanghai Stock Exchange has issued regulatory warnings to multiple companies, and information disclosure issues have triggered market concerns[6]

- Satellite launch progress may be lower than expected; as of December 2025, 136 satellites of the GW Constellation and 108 satellites of the Qianfan Constellation are in orbit[1]

- Yinhe Electronics: Sustained contraction of main business, qualified audit opinion, restricted subsidiary business, tight operating cash flow

- Juli Sling: Limited proportion of aerospace business, little impact on overall performance, and also has the attribute of concept speculation

From the perspective of commercial aerospace investment,

-

Substantive Business:As a core supplier of rocket net-based recovery technology, its products have been applied in actual launch missions, with verifiability and irreplaceability

-

More Robust Fundamentals:Revenue growth, turning losses into profits, and operating conditions are significantly better than Yinhe Electronics

-

More Controllable Risks:Although it also benefits from concept speculation, the company has its traditional sling business as a safety cushion and will not fall into trouble due to the failure of its aerospace business

-

More Reasonable Valuation:A price-to-sales ratio of 4.05x, which is more attractive compared to Yinhe Electronics’ 185.91x

On the other hand,

[1] ESM China - “203,000 Satellites! China’s Single LEO Satellite Application Sets a Global Record” (https://www.esmchina.com/news/13831.html)

[2] Securities Times - “Over 200,000 Satellites! China Submits Multiple New Constellation Plan Applications, Commercial Aerospace Triggers Another Limit-Up Wave” (https://www.stcn.com/article/detail/3588728.html)

[3] Xinhua News Agency - “China Submits Applications for Over 200,000 Additional Satellites” (https://www.news.cn/tech/20260112/fcfaf74691dc49d9b1d7d99cac61b3bb/c.html)

[4] Eastmoney Wealth Account - “Commercial Aerospace Booms! Yinhe Electronics VS Juli Sling, Who Is Down-to-Earth?” (https://caifuhao.eastmoney.com/news/20260120174435789614050)

[5] Eastmoney Wealth Account - “China’s Pioneering Rocket Recovery Black Technology Surpasses SpaceX, Juli Sling Is the Core Company of ‘Net-Based Recovery Technology’” (https://caifuhao.eastmoney.com/news/20251227133514186527300)

[6] Economic Daily - “Don’t Let Concept Speculation Mislead Commercial Aerospace” (http://paper.ce.cn/pc/content/202601/20/content_327063.html)

[0] Jinling AI Financial Database (Real-time Market Data and Financial Analysis)

中国社区生鲜行业竞争格局深度分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.