In-Depth Investment Value Analysis Report of Dongpeng Beverage (605499.SS)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now let me provide you with a systematic and comprehensive investment analysis report on Dongpeng Beverage:

Dongpeng Beverage Group Co., Ltd. is a leading enterprise in China’s functional beverage industry, and its core product "Dongpeng Special Drink" holds an important position in consumers’ minds. After the company went public in 2021, its stock price experienced a significant increase, with a cumulative gain of over 400%[0]. As of January 20, 2026, the company’s market value is approximately RMB 135 billion, ranking among the top in the A-share food and beverage sector.

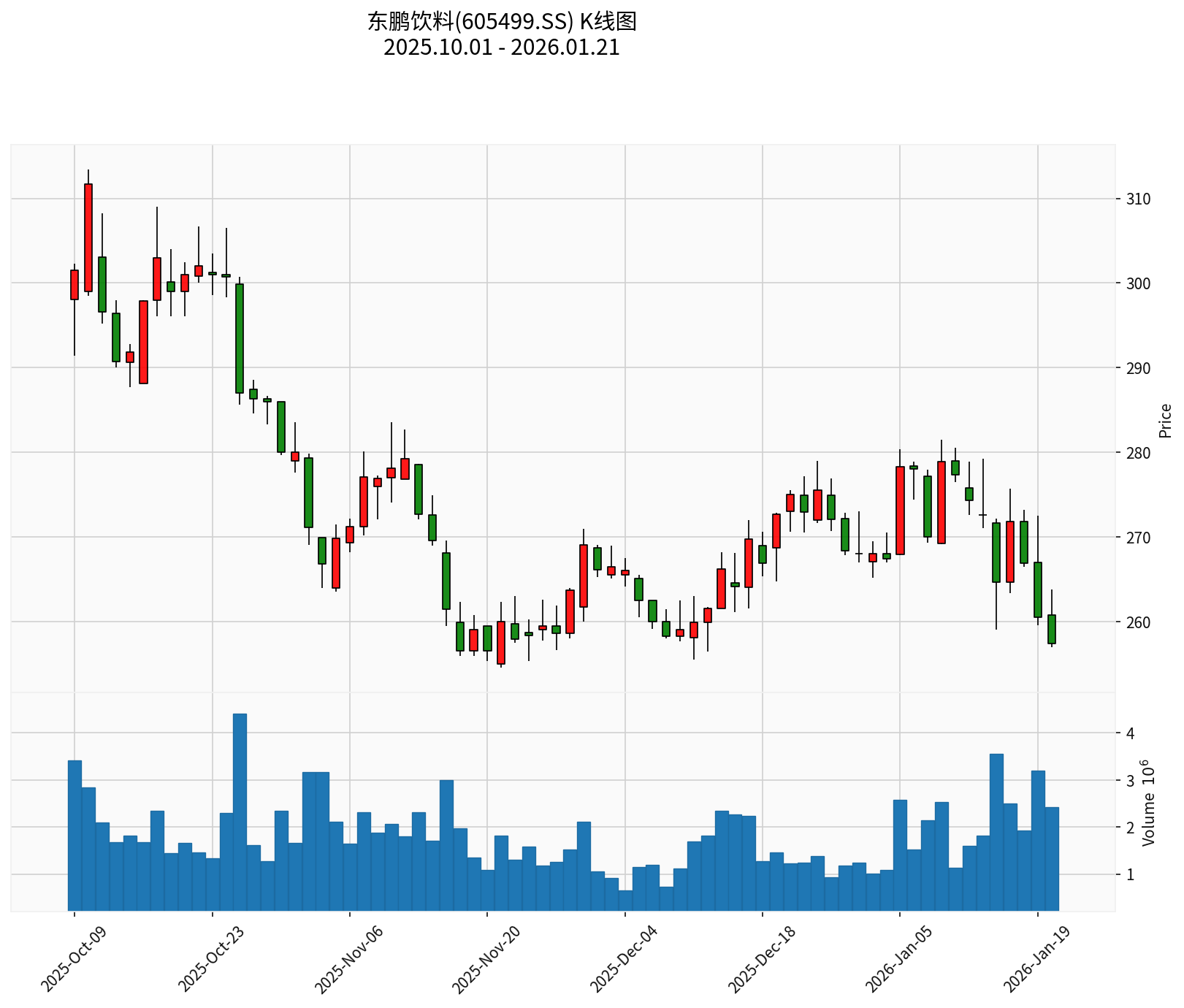

K-line Chart shows: From October 2025 to January 2026, the stock price fell from RMB 298 to RMB 257, a decline of approximately 13.66%, and is currently in a sideways consolidation phase[0]

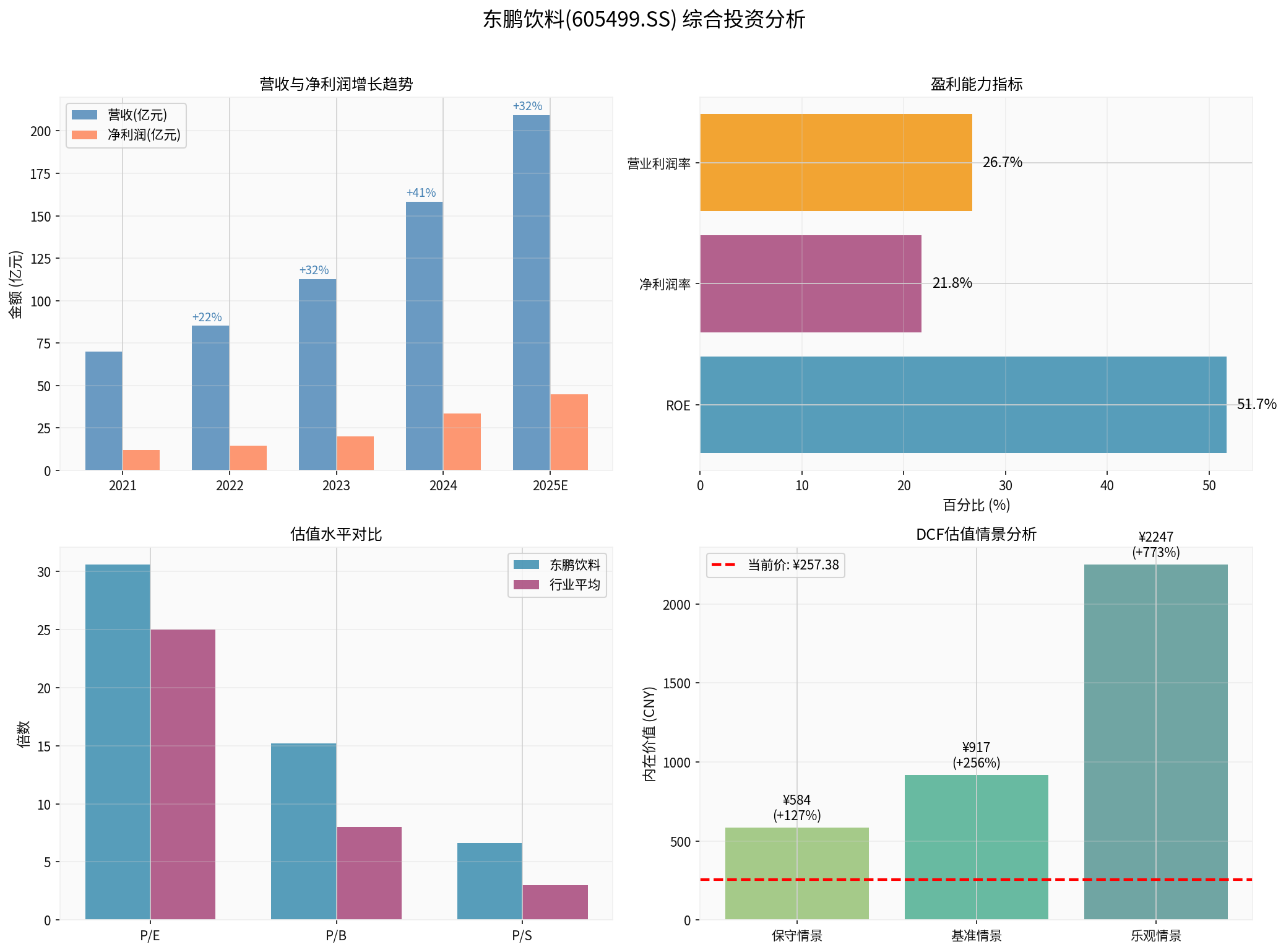

According to the performance forecast released by the company on January 13, 2026[1][2]:

| Indicator | 2025 Figure | Year-on-Year Change |

|---|---|---|

| Operating Revenue | RMB 20.76-21.12 billion | +31.07% to +33.34% |

| Net Profit | RMB 4.34-4.59 billion | +30.46% to +37.97% |

| Annual Revenue | Exceeded RMB 20 billion for the first time | Historic Milestone |

- "Operation Guided by Offtake" Strategy: The company continues to advance its nationalization strategy and strengthens operational capabilities through refined channel management

- Chilled Display Expansion: Increases exposure of all product categories and drives terminal offtake

- Multi-Category Development: While consolidating Dongpeng Special Drink, actively cultivates new growth drivers[1][2]

- Terminal Coverage: Over 4.3 million terminal outlets

- Channel Depth: Covers nearly 100% of prefecture-level cities nationwide

- Digital Capabilities: Upgraded from "One Item One Code" to "Five Codes in One" technical system, connecting end-to-end data[3]

| Product Category | Revenue Share in the First Three Quarters of 2025 | Strategic Positioning |

|---|---|---|

| Dongpeng Special Drink | Core Product | Core Pillar |

| Dongpeng Hydrate Up | 16.91% | Second Growth Curve |

| Dongpeng Daka | Continuous Volume Growth | Daily Consumption Market |

| Other New Products | Gradually Cultivated | Potential Growth Driver |

The success of "Dongpeng Hydrate Up" validates the company’s mature capabilities in cross-category operation and platform-based development[2][3].

As of the first half of 2025, the company has planned and constructed

- Products have been exported to over 30 countries worldwide

- Established overseas subsidiaries in Indonesia and Vietnam

- The under-preparation Indonesia factorywill be a key step in replicating supply chain capabilities overseas[3]

| Indicator | Figure | Industry Comparison | Evaluation |

|---|---|---|---|

| Return on Equity (ROE) | 51.71% |

Consumer industry average is about 15% | Extremely Excellent |

| Net Profit Margin | 21.77% |

FMCG industry average is about 10-15% | High Level |

| Operating Profit Margin | 26.72% |

Industry Excellent Level | Strong Operational Efficiency |

| Price-to-Earnings Ratio (P/E) | 30.56x |

Moderately high in the consumer industry | Valuation Has Reflected High Growth |

- ROE has remained above 50% for consecutive periods, reflecting extremely strong shareholder return capability[0]

- Net profit margin has stably stayed above 20%, demonstrating brand premium and cost control capabilities

- Financial analysis rating is "Conservative", with prudent accounting treatment[0]

Based on a professional DCF valuation model[0]:

| Scenario | Intrinsic Value | Upside Relative to Current Stock Price |

|---|---|---|

| Conservative Scenario | ¥584.21 | +127.0% |

| Base Case Scenario | ¥917.09 | +256.3% |

| Optimistic Scenario | ¥2,247.43 | +773.2% |

| Probability-Weighted Value | ¥1,249.58 | +385.5% |

| Parameter | Figure |

|---|---|

| Revenue CAGR (5-Year Average) | 33.7% |

| EBITDA Margin | 23.5% |

| WACC | 6.1% |

| Beta | 0.26 |

- The base case scenario is based on 5-year historical average data, with an intrinsic value of approximately ¥917

- The current stock price of ¥257 corresponds to a P/E ratio of about 30x, which has partially reflected high growth expectations

- DCF indicates significant upside potential in the medium to long term, but requires continuous performance delivery[0]

| Indicator | Figure |

|---|---|

| Current Price | ¥257.38 |

| 20-Day Moving Average | ¥270.90 (Resistance Level) |

| 50-Day Moving Average | ¥267.09 |

| Support Level | ¥253.45 |

| Beta | 0.26 (Low Correlation with Broad Market) |

| Indicator | Status | Signal Interpretation |

|---|---|---|

| MACD | No Crossover | Weak |

| KDJ | K:22, D:37 | Death Cross, Weak |

| RSI(14) | Oversold Zone | Potential Rebound Opportunity |

| Trend Judgment | Sideways Consolidation | No Clear Direction |

- Health-Conscious Trend: Niche categories like electrolyte water and sugar-free tea are growing rapidly

- Scenario-Based Demand: Evolves from a single "energy-boosting and fatigue-relieving" focus to a "Function+" ecosystem

- Emerging Track Rise: The market size of Chinese-style health-preserving water surged 182% year-on-year[2]

- Dongpeng Special Drink ranks among the top in the functional beverage market

- Competition in the electrolyte water track is intensifying, requiring continuous investment in marketing resources

- Traditional giants (such as Red Bull) still dominate the high-end market[2]

| Dimension | Supporting Factors | Sustainability Assessment |

|---|---|---|

Channels |

4.3 million terminals + Digital Five Codes in One | Strong - Deep Moat |

Products |

Multi-Category Portfolio (Special Drink + Hydrate Up + Coffee, etc.) | Relatively Strong - Proven Successful Model |

Brand |

Top-Tier Mind Share in Functional Beverages | Strong - High Brand Barrier |

Production Capacity |

National Layout of 13 Major Bases | Strong - Supply Chain Guarantee |

Strategy |

Nationalization + Internationalization + Digitalization | Relatively Strong - Proven Execution Capability |

- Valuation Risk: The current P/E of 30.56x has reflected high growth expectations, with risk of valuation correction

- Liquidity Risk: Current ratio of 0.84 < 1, inventory turnover is critical

- Intensified Competition: Competition in the functional beverage and electrolyte water tracks is fierce

- Raw Material Cost Fluctuations: Price volatility of packaging materials such as PET and white sugar impacts gross profit margin

- Single Product Dependency: Dongpeng Special Drink still contributes the majority of revenue[0]

| Dimension | Rating | Explanation |

|---|---|---|

| Growth | ★★★★☆ | High growth for 5 consecutive years, 2025 growth rate of 31%+ |

| Profitability | ★★★★★ | ROE of 51.71%, extremely excellent |

| Valuation Rationality | ★★★☆☆ | P/E of 30.56x is moderately high, requiring performance delivery |

| Strategic Execution | ★★★★★ | Clear path of nationalization + multi-category + internationalization |

| Technicals | ★★★☆☆ | Short-term momentum is weak, in sideways consolidation |

- May accumulate positions in batches below ¥250

- Benefit from the company’s growth dividends, target price refers to the DCF base case of ¥917

- Requires 3-5 years of investment patience, track performance delivery

- Wait for technical signals of stabilization and rebound

- Monitor the effectiveness of the ¥253.45 support level

- Consider reducing positions near the ¥270.90 resistance level

- Valuation correction risk (current P/E is higher than historical average)

- Risk of falling short of performance expectations

- Risk of changes in the consumption environment

Dongpeng Beverage’s "Gold-Making Formula" ——

- Excellent Fundamentals: Indicators such as ROE of 51.71% and net profit margin of 21.77% lead the industry

- High Growth Visibility: Channel network, product portfolio, and production capacity layout have formed a positive cycle

- Valuation Requires Performance Support: The current price has partially reflected high growth expectations, need to continuously track performance delivery

- Promising Long-Term Value: DCF valuation indicates significant upside potential, but it takes 3-5 years to realize

[0] Jinling AI Brokerage API Data - Dongpeng Beverage (605499.SS) Market Data, Financial Analysis, Technical Analysis, DCF Valuation

[1] CLS - "Dongpeng Beverage: 2025 Net Profit Expected to Grow 30.46%-37.97% Year-on-Year" (https://www.cls.cn/detail/2256290)

[2] Sina Finance - "Dongpeng Beverage’s 2025 Annual Performance Exceeds Expectations, Nationalization and Multi-Category Strategy Drive Revenue to Exceed RMB 20 Billion" (https://finance.sina.com.cn/stock/relnews/cn/2026-01-14/doc-inhhhnwt4046902.shtml)

[3] China.com - "Dongpeng Beverage’s 2025 Performance Expected to Grow Over 30%, the ‘Oriental Roc’ is Taking Off at the Right Time!" (https://hea.china.com/articles/20260115/202601151797605.html)

四方精创中国银行业务收入变动分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.