In-Depth Analysis Report on Investment Opportunities in Domestic Substitution of Semiconductor Materials

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on comprehensive collected data, I now present a detailed analysis report on

Semiconductor materials are the cornerstone of chip manufacturing, known as the “grain of the chip industry”. According to TECHCET data cited by Everbright Securities, the global semiconductor materials market size is expected to reach approximately USD 70 billion in 2025, with a year-on-year growth of 6%, and is projected to exceed USD 87 billion by 2029. For the Chinese market, statistics and forecasts from Zhongshang Industrial Research Institute show that the market size of key semiconductor materials in China will reach RMB 174.1 billion in 2025, representing a significant year-on-year growth of 21.1%[1][2].

From the perspective of the global competitive landscape, the semiconductor materials industry exhibits obvious oligopolistic characteristics:

- Wafer Market: Japan’s Shin-Etsu Chemical and SUMCO together account for 56% of the market. Together with GlobalWafers and Siltronic, the top four manufacturers hold a market share of over 80%

- Photoresist Market: Japan’s JSR, Tokyo Ohka Kogyo (TOK), Shin-Etsu Chemical, and Sumitomo Chemical together hold 80% of the market share

- Electronic Specialty Gases Market: Japanese and American companies together account for 82% of the market share. Japan’s Taiyo Nippon Sanso holds a 40% market share in products such as high-purity fluorides and sulfur hexafluoride

Current geopolitical risks continue to intensify. Starting from January 15, 2026, the U.S. will impose an additional 25% ad valorem tariff on some imported semiconductors, semiconductor manufacturing equipment, and derivatives. NVIDIA’s H200 chip and AMD’s MI325X are both included in the tariff scope[3]. This external pressure has prompted the domestic industry chain to accelerate the process of domestic substitution.

Tu Hailing, Academician of the Chinese Academy of Engineering and Honorary President of the General Research Institute for Nonferrous Metals, pointed out that the localization process is accelerating. Domestic substitution in fields such as large-size silicon materials and gallium arsenide has entered a “golden window”. The localization rate of semiconductor-grade silicon materials has exceeded 50%, and the localization rate of materials such as polishing slurries has also exceeded 30%[2].

Wafers are the largest segmented field in semiconductor materials, and domestic enterprises are accelerating the breakthrough of technical barriers for 12-inch high-end wafers:

| Indicator | Current Status |

|---|---|

| Global Pattern | Oligopoly by top four players, market share over 80% |

| 12-inch Wafers | The two Japanese giants together hold over 90% market share |

| Localization Rate | 8-inch wafers have achieved large-scale supply; 12-inch wafers only about 10% |

| Leading Enterprises | Shanghai Silicon Industry Group (688126.SS): No.1 in domestic 12-inch wafers, 6th globally, with 12.3% market share |

Photoresist is the core material of the lithography process, with extremely low localization rate in high-end fields:

| Type | Global Pattern | Localization Rate | Remarks |

|---|---|---|---|

| G/I-line Photoresist | Mature process | Over 40% | Mass substitution achieved |

| KrF Photoresist | 28nm process | Approximately 10% | Accelerating breakthrough |

| ArF Photoresist | 14-28nm process | Less than 1% | Top four players hold 92% market share |

| EUV Photoresist | 7nm and below | Almost zero | Only three Japanese enterprises have achieved mass production |

Electronic specialty gases are core consumables for processes such as etching and doping, and the domestic industry shows the characteristic of “structural imbalance”:

| Indicator | Current Status |

|---|---|

| Overall Localization Rate | Approximately 25% |

| High-end Etching Gases, Doping Gases | Localization rate less than 20% |

| High-purity Gases of 7N Grade and Above | Import dependence reaches 70% |

| Proportion of Japanese Products | Accounts for 45% of total imports |

CMP (Chemical Mechanical Polishing) is a key process in integrated circuit manufacturing:

- Localization Rate of Polishing Slurries: Approximately 30%

- Localization Rate of Polishing Pads: Approximately 20%

- High-end Products: Still highly dependent on imports

Third-generation semiconductor materials represented by silicon carbide (SiC) and gallium nitride (GaN) are being rapidly applied in fields such as new energy vehicles and 5G communications:

- SiC Leader: Tianyue Advanced (688234.SS), which achieved a “20cm” limit-up (a 20% daily price increase cap, unique to China’s Sci-Tech Innovation Board) on January 16, 2026

- Application Fields: New energy vehicles, 5G communications, power devices

- Technological Breakthrough: The team led by Academician Hao Yue of Xi’an University of Electronic Science and Technology has made a major breakthrough in gallium nitride microwave power devices, with internationally leading output power density[6]

- National Strategic Support: Independent and controllable semiconductor industry chain has been elevated to a national strategy

- Support from National Integrated Circuit Industry Investment Fund (Big Fund): The third phase of the Big Fund has increased capital in SMIC South, and ChangXin Memory Technologies has released its prospectus

- Trade Policy Adjustment: On January 7, 2026, the Ministry of Commerce officially initiated an anti-dumping investigation into imported dichlorosilane originating from Japan, which directly benefits domestic suppliers[1]

- AI Computing Power Demand: Global AI server shipments are expected to exceed 3 million units in 2026. New technologies such as HBM and Chiplet have doubled the material usage per wafer

- Wafer Fab Expansion Wave: From 2024 to 2027, the number of 300mm wafer fabs in mainland China will increase from 29 to 71, accounting for nearly 30% of the global total

- Memory Chip Recovery: TrendForce predicts that the contract price of general-purpose DRAM in Q1 2026 will increase by 55%-60% month-on-month[7]

Domestic enterprises have made substantial progress in multiple key links:

- Etching equipment and thin film deposition equipment have passed certification by mainstream customers

- Cleaning and metrology testing equipment have entered the large-scale mass production stage

- Advanced packaging materials have entered the critical stage of transformation from verification to mass production

| Company | Ticker | Segmented Field | Market Capitalization (USD 100 million) | YTD Growth | P/E |

|---|---|---|---|---|---|

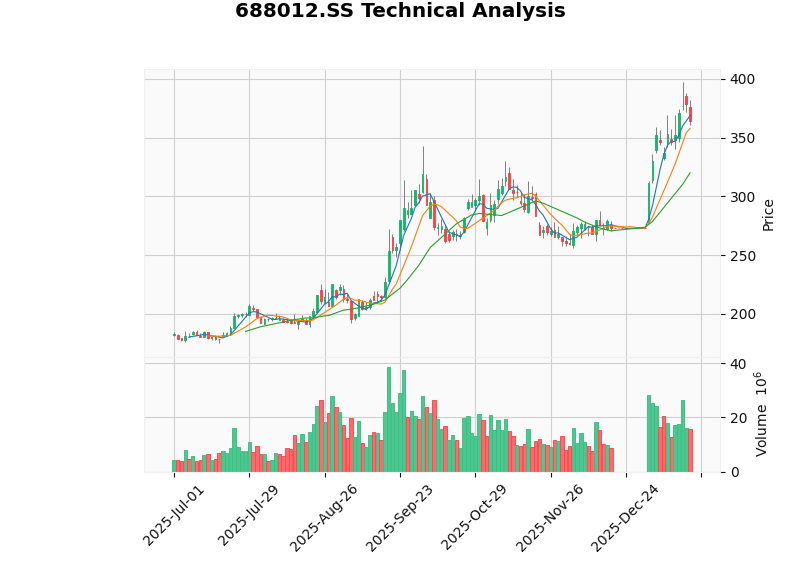

| AMEC (Advanced Micro-Fabrication Equipment Inc. China) | 688012.SS | Semiconductor Equipment/Materials | 227.35 | 17.02% | 118.79 |

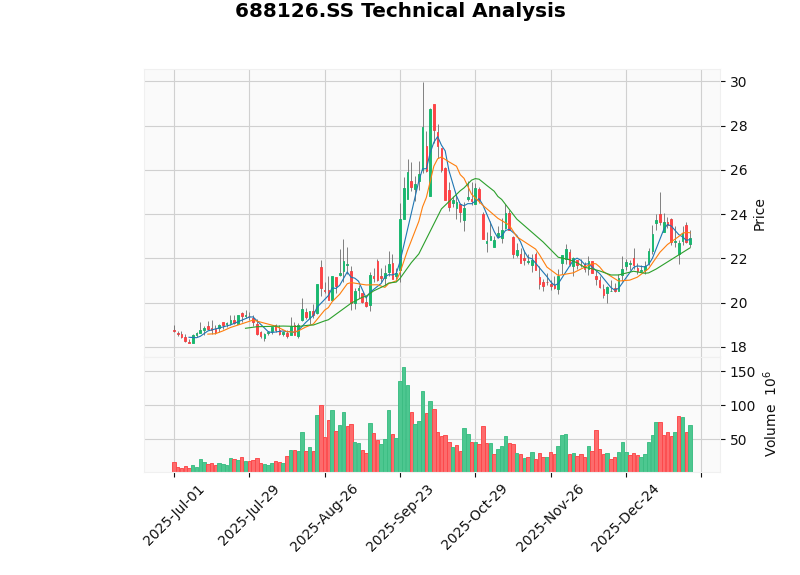

| Shanghai Silicon Industry Group | 688126.SS | Semiconductor Wafers | 63.03 | 2.64% | -59.15 |

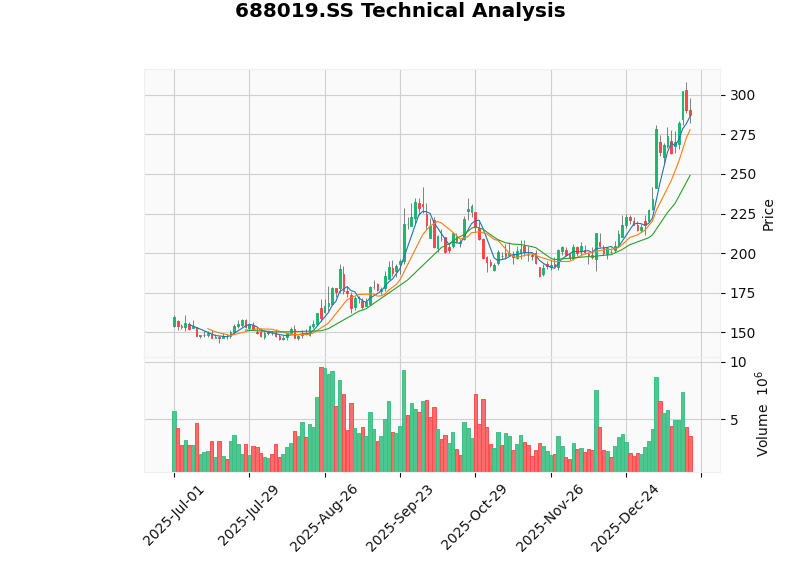

| Anji Microelectronics | 688019.SS | CMP Polishing Slurries | 48.36 | 26.39% | 64.55 |

| Nanda Optoelectronics | 300346.SZ | Photoresist | 43.34 | 40.39% | 141.57 |

| Tianyue Advanced | 688234.SS | Silicon Carbide | 47.10 | 24.28% | 1425.23 |

- ROE (TTM): 25.06%, outstanding performance among semiconductor material enterprises

- Net Profit Margin: 32.10%, leading profitability in the industry

- Current Ratio: 7.31, sound financial condition

- EPS in the latest quarter exceeded expectations by 14.05%

- Market capitalization of USD 22.735 billion, one of the largest market cap companies on the Sci-Tech Innovation Board

- 93.60% growth in the past year, 236.24% growth in the past three years

- Customers cover major global wafer fabs such as TSMC and SMIC

- In a stage of strategic losses with high R&D investment

- 12-inch wafers have passed certification by TSMC and SMIC

- Is a core raw material supplier for HBM, benefiting from AI memory chip demand

- YTD growth of 99.52%, 99.52% growth in the past year

- Market capitalization of USD 4.334 billion, P/E ratio of 141.57x

- Technological breakthrough in ArF photoresist has been achieved

According to consensus forecasts from 5 or more institutions, there are 12 semiconductor material concept stocks expected to achieve net profit growth of over 20% in both 2026 and 2027. Among them, Debang Technology and Haohua Technology have upside potential of 39.21% and 10.86% respectively[2].

Since 2026, semiconductor material concept stocks have performed strongly[2]:

- January 16: The semiconductor materials index surged 4.22% in a single day. SiC leader Tianyue Advanced achieved a “20cm” limit-up (20% daily price increase cap on the Sci-Tech Innovation Board), and Kangqiang Electronics achieved a 10% daily limit

- YTD: Semiconductor material concept stocks have risen by an average of 21.15%, significantly outperforming the Shanghai Composite Index, ChiNext Index, and STAR 50 Index

- All-Time Highs: On January 16 alone, 12 semiconductor material concept stocks hit intraday all-time highs

| ETF Name | Ticker | Tracked Index | YTD Growth |

|---|---|---|---|

| Penghua STAR Market Semiconductor ETF | 589020 | SSE STAR Market Semiconductor Materials & Equipment Thematic Index | +31.83% |

| Tianhong CSI Semiconductor Materials & Equipment Index ETF | 021532/021533 | CSI Semiconductor Materials & Equipment Index | - |

The top ten weight stocks of the index include Tuojing Technology, Huahai Qingke, Shanghai Silicon Industry Group, AMEC, Zhongke Feice, Anji Microelectronics, Xinyuan Micro, Tianyue Advanced, etc., accounting for a total of 74.05%[8].

- Photoresist: Focus on large-scale mass production of ArF photoresist and technological breakthroughs in EUV photoresist

- High-End Target Materials: Special target materials for advanced processes such as tantalum targets and tungsten targets

- High-End Electronic Specialty Gases: Products with high import dependence such as hexafluorobutadiene and zirconium alkane

- Anti-dumping investigation on dichlorosilane directly benefits domestic suppliers

- Clear short-term substitution space with strong certainty

- HBM material suppliers (Shanghai Silicon Industry Group)

- High-end CMP materials (Anji Microelectronics)

- Third-generation semiconductor materials (Tianyue Advanced)

| Target | Ticker | Recommendation Logic | Risk Warning |

|---|---|---|---|

Anji Microelectronics |

688019.SS | Leader in CMP polishing slurries with strong profitability, benefiting from increased localization rate | High valuation |

Shanghai Silicon Industry Group |

688126.SS | Leader in 12-inch wafers, core HBM material supplier | Still in loss |

Nanda Optoelectronics |

300346.SZ | Achieved photoresist technological breakthrough, benefiting from advanced process demand | High valuation |

Tianyue Advanced |

688234.SS | SiC leader, pioneer in third-generation semiconductor materials | High performance volatility |

AMEC |

688012.SS | Leader in semiconductor equipment, benefiting from wafer fab expansion | High valuation |

- Focus on targets with annual report performance forecasts exceeding expectations

- Focus on the implementation of wafer fab expansion orders

- Focus on the impact of changes in Japan-U.S. trade policies on the supply chain

- Focus on the verification progress of advanced process materials

- Focus on the progress of localization rate improvement

- Focus on material demand growth driven by memory chip recovery

- Focus on valuation reconstruction opportunities brought by technological breakthroughs

- Focus on industry integration and increased concentration of leading enterprises

- Focus on application expansion of third-generation semiconductor materials

- Technological breakthroughs falling short of expectations: High technical barriers for high-end photoresist, EUV photoresist, etc.

- Downstream demand falling short of expectations: AI computing power demand growth may have cyclical fluctuations

- Intensified industry competition: International giants may suppress domestic manufacturers through price wars and other means

- R&D investment failure: Semiconductor material R&D has a long cycle and high investment

- Customer certification progress: Entering the supply chain of mainstream wafer fabs requires long-term verification

- Financial risks: Some companies are still in a stage of strategic losses

- Changes in international trade policies: Uncertainties such as tariff policies and export controls

- Exchange rate fluctuations: Imported raw material costs may be affected by exchange rates

- Changes in subsidy policies: Government subsidy intensity may be adjusted

![]()

![]()

Domestic substitution of semiconductor materials is in a historic “golden window”. Driven by three factors: policy support, demand explosion, and technological breakthroughs, the industry is facing strategic investment opportunities. The current overall localization rate is about 15-20%, and the localization rate of advanced process materials is even lower, leaving broad room for substitution.

- Continuous expansion of market size: The market size of key semiconductor materials in China will reach RMB 174.1 billion in 2025, with a year-on-year growth of 21.1%

- Accelerated localization process: The localization rate of semiconductor-grade silicon materials has exceeded 50%, and that of polishing slurries has exceeded 30%

- Dual-drive of AI + memory: New technologies such as HBM and Chiplet have doubled material usage

- Release of policy dividends: Adjustments to Sino-Japanese trade policies and anti-dumping investigations directly benefit domestic suppliers

[1] Gelonghui - “Anti-dumping + AI dual drive, will this track take off?” (https://finance.sina.com.cn/stock/bxjj/2026-01-10/doc-inhfvhet8945705.shtml)

[2] Securities Times - “Semiconductor Materials, Major Breakthrough! SiC Leader Has Taken the Lead” (https://www.stcn.com/article/detail/3598441.html)

[3] Sina Finance - “TSMC’s performance exceeds expectations, semiconductor industry chain may face growth opportunities” (http://www.aastocks.com/sc/stocks/analysis/china-hot-topic-content.aspx?catg=4&type=16&id=YLC6105097N&source=YOULIAN)

[4] Xueqiu - “Seven Core Track Targets for Semiconductor Materials” (https://xueqiu.com/S/SH688126)

[5] Jinling AI - Listed Companies’ Financial and Market Data (API Data)

[6] Science and Technology Daily - “Team led by Academician Hao Yue of Xi’an University of Electronic Science and Technology makes breakthrough in gallium nitride materials” (http://www.stdaily.com/)

[7] Jiemian News - “Concepts such as fourth-generation semiconductors and memory chips lead gains in morning trading” (https://www.jiemian.com/article/13906640.html)

[8] AAStocks - “Penghua STAR Market Semiconductor ETF (589020) rises nearly 2%” (http://www.aastocks.com/sc/stocks/analysis/china-hot-topic-content.aspx?id=YLC6105001N&source=YOULIAN&catg=4)

东鹏饮料(605499.SS)投资价值深度分析报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.