In-Depth Investment Value Analysis Report on Dongpeng Beverage (605499)

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I have collected sufficient data, let me prepare a comprehensive investment analysis report for you.

Dongpeng Beverage Group was founded in 1997 and is a leading enterprise in China’s functional beverage industry. Its core product “Dongpeng Special Drink” has become a household name. As of January 20, 2026, the company’s market capitalization reached

| Product Series | Positioning | 2025 Revenue Share | Development Stage |

|---|---|---|---|

| Dongpeng Special Drink | Energy Drink | Approx. 65% | Mature Stage |

| Dongpeng Bu Shui La | Electrolyte Water | 16.91% | Rapid Growth Stage |

| Dongpeng Da Ka | Ready-to-Drink Coffee | Approx. 5% | Nurturing Stage |

| Shang Cha Series | Sugar-Free Tea | Approx. 3% | Nurturing Stage |

The company has successfully transformed from a single functional beverage brand to a healthy beverage group covering full scenarios of “refreshment, hydration, thirst quenching, and leisure” [1][2].

| Indicator | 2025 Data | YoY Change | Evaluation |

|---|---|---|---|

| Operating Revenue | RMB 20.76-21.12 billion | +31.07%~+33.34% | Exceeded RMB 20 billion for the first time |

| Net Profit Attributable to Parent Companies | RMB 4.34-4.59 billion | +30.46%~+37.97% | Better-than-expected growth |

| Net Profit Margin | Approx. 21.8% | Remained stable | Excellent profitability |

| Continuous Growth | Maintained double-digit growth for 6 consecutive years | — | Growth sustainability verified |

Notably, in the first three quarters of 2025, the company achieved operating revenue of RMB 16.844 billion and net profit of RMB 3.761 billion, with year-on-year growth of 34.13% and 38.91% respectively [3], and its full-year performance exceeded market expectations.

The company has established a sales network covering

| Operational Indicator | Dongpeng Beverage | Industry Average | Margin of Advantage |

|---|---|---|---|

| ROE | 51.71% |

12.5% | +39.21pp |

| Net Profit Margin | 21.77% |

15.0% | +6.77pp |

| Gross Profit Margin | 46.5% |

40.0% | +6.5pp |

| Asset Turnover Ratio | 1.85x | 1.2x | +54% |

The company’s ROE is as high as 51.71%, far leading the beverage industry, reflecting excellent capital efficiency and profitability [0].

The success of “Dongpeng Bu Shui La” has verified the company’s cross-category operation capability. The product’s revenue share rose to 16.91% in the first three quarters of 2025, successfully seizing a position in the sports health track and becoming the company’s second growth curve [1][2]. New products can share existing terminal channels and freezer resources, forming significant channel reuse and synergy advantages.

Revenue growth in regions with low initial penetration such as North China and Southwest China is significantly higher than that in mature markets, leaving broad space for national layout. At the same time, the company is actively expanding into the Southeast Asian market, and its products have entered countries and regions such as Vietnam and Malaysia [2].

| Scenario | Intrinsic Value | Upside vs Current Price | Assumptions |

|---|---|---|---|

| Conservative Scenario | CNY 584.21 | +127.0% | Zero growth, 22.3% EBITDA margin |

| Base Scenario | CNY 917.09 | +256.3% | 33.7% historical growth rate, 23.5% EBITDA margin |

| Optimistic Scenario | CNY 2,247.43 | +773.2% | 36.7% growth rate, 24.6% EBITDA margin |

Weighted Valuation |

CNY 1,249.58 |

+385.5% |

Probability-weighted average |

| Indicator | Current Value | Historical Range | Evaluation |

|---|---|---|---|

| P/E (TTM) | 30.56x | 25-50x | Moderately high |

| P/B | 15.21x | 10-20x | Within reasonable range |

| P/S | 6.65x | 5-10x | Reasonable growth premium |

The DCF model shows that the company’s intrinsic value is significantly higher than the current stock price, but it should be noted that:

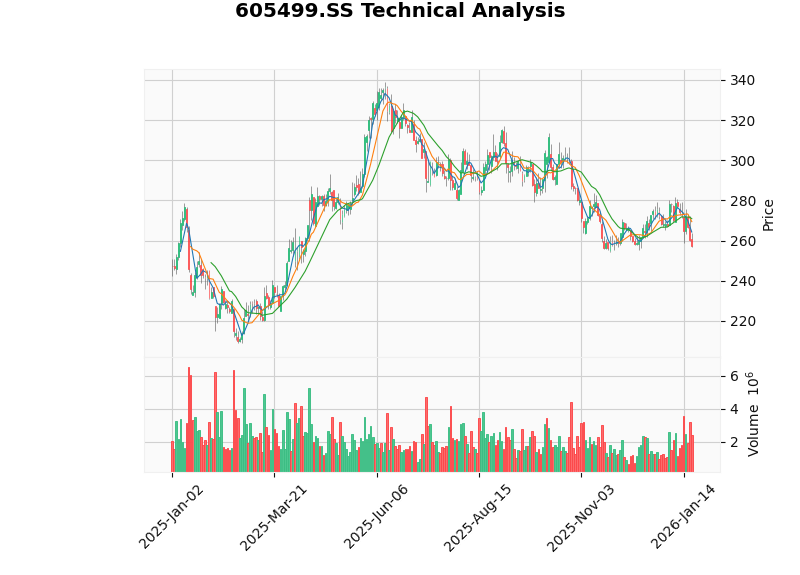

| Indicator | Value | Signal Interpretation |

|---|---|---|

| Current Price | 257.38 CNY | — |

| MA20 | 270.90 CNY | Below short-term moving average |

| MA50 | 267.09 CNY | Below medium-term moving average |

| MA200 | 286.90 CNY | Below long-term moving average |

| RSI(14) | 41.74 | Neutral to weak, oversold opportunity possible |

| MACD | -1.31 | Death cross, weak momentum |

| KDJ (K/D/J) | 1.51/14.33/-24.12 | Death cross, oversold zone |

- The stock price is currently below all moving averages, under short-term pressure

- RSI is at 41.74, close to the oversold zone, a technical rebound may occur

- MACD is below the zero axis and shows a death cross, short-term momentum is weak

- Trading volume maintains an average of 2.24 million shares per day, with active trading

- Support level: CNY 253.45; Resistance level: CNY 270.90 [0]

The current P/E ratio of 30.56x is at a historical medium-to-high level; if growth falls short of expectations, it may face valuation correction pressure.

Competition in the functional beverage market is becoming increasingly fierce, with brands such as Red Bull and Anfei continuing to expand, and the electrolyte water track has also attracted giants such as Nongfu Spring and C’estbon to deploy [2].

Fluctuations in the prices of raw materials such as sugar, PET bottles, and taurine may affect gross profit margin.

Changes in the preferences of young consumers may lead to slowdown in the growth of traditional functional beverages.

| Dimension | Score (1-10) | Weight | Weighted Score |

|---|---|---|---|

| Growth | 9.0 | 25% | 2.25 |

| Profitability | 9.5 | 20% | 1.90 |

| Valuation Rationality | 6.5 | 20% | 1.30 |

| Competitive Advantage | 8.5 | 20% | 1.70 |

| Industry Outlook | 8.0 | 15% | 1.20 |

Comprehensive Score |

— | 100% | 8.35 |

- Solid Channel Barrier: The 4.3 million terminal network and digital system have built a strong moat

- Mature Multi-Category Matrix: Dongpeng Special Drink + Bu Shui La + Da Ka + Shang Cha form a product echelon

- Still Room for National Layout: Regions such as North China and Southwest China have great growth potential

- Strong Brand Momentum: 6 consecutive years of double-digit growth verify execution capability

- High Base Effect: 2025 revenue has exceeded RMB 20 billion, making it more difficult to maintain a growth rate of over 30%

- Narrowing Valuation Premium: The current price has partially priced in growth expectations

- Intensified Industry Competition: Giants are entering the functional beverage and electrolyte water tracks

| Investor Type | Recommendation | Reason |

|---|---|---|

| Long-term Investor | Accumulate positions on dips |

High growth certainty, hold patiently |

| Short-term Trader | Range trading |

Buy low and sell high in the range of CNY 253-270 |

| Value Investor | Wait for a pullback |

Wait for valuation to return to a reasonable range |

[0] Jinling API Market Data - Real-time Quotation, Financial Analysis, Technical Analysis of Dongpeng Beverage (605499.SS) (2026-01-20)

[1] Ifeng Finance - “Oriental Roc, Leaping Across the Globe: Strategic Conviction and Global Ambition Behind Dongpeng Beverage’s Sustained High Growth” (2026-01-15) https://finance.ifeng.com/c/8pvoGUSFyli

[2] Sina Finance - “Dongpeng Beverage’s 2025 Annual Performance Exceeds Expectations, Nationalization and Multi-Category Strategy Drive Revenue to Surpass RMB 20 Billion” (2026-01-14) https://finance.sina.com.cn/stock/relnews/cn/2026-01-14/doc-inhhhnwt4046902.shtml

[3] Xinhua News - “Enterprise Sample | How a ‘Small Beverage’ Unleashes Great Energy - The Transformation Story of Dongpeng Beverage” (2025-12-29) http://www.news.cn/fortune/20251229/73a73e64f2e2491e809e209102dac876/c.html

半导体材料国产替代投资机会深度分析报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.