Analysis of Kweichow Moutai's Risk Resistance Capacity During the Adjustment Cycle of the Baijiu Industry

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Now let me present the complete analysis report for you:

According to the latest industry data, the baijiu industry is undergoing its deepest adjustment cycle since 2012 in 2025 [1][2]. In the first three quarters of 2025, the combined revenue of 20 A-share listed baijiu companies reached RMB 317.779 billion, a year-on-year decrease of 5.90%; their combined net profit was RMB 122.571 billion, a year-on-year decrease of 6.93% [2]. In the third quarter, the industry’s overall revenue fell 18.47% year-on-year, and net profit dropped 22.22% year-on-year, indicating that the industry is still in a stage of accelerated bottoming [2].

From the production side, China’s baijiu output from January to October 2025 was 2.902 million kiloliters, a year-on-year decrease of 11.5% [2]. The industry is showing a systemic adjustment trend of “volume reduction, price decline, and profit contraction”. The wholesale price of Feitian Moutai has fallen from about RMB 1,800 per bottle at the beginning of the year to the range of about RMB 1,660-1,680 per bottle, and core products such as Wuliangye and Guojiao 1573 are also facing downward pressure on wholesale prices [1].

Despite the overall pressure on the industry, leading companies have performed relatively stably. In 2024, the revenue of listed baijiu companies accounted for 55.1% of the industry’s total, a year-on-year increase of 1 percentage point [1]. The industry shows an obvious “Matthew Effect” – the strong get stronger, and the weak are eliminated at an accelerated pace. The combined revenue of six leading baijiu enterprises including Kweichow Moutai, Wuliangye, Luzhou Laojiao, Shanxi Fenjiu, Yanghe Co., Ltd., and Gujing Gongjiu accounts for 88% of the total revenue of 20 listed baijiu companies, and their net profit accounts for as high as 95% [2].

Kweichow Moutai has demonstrated significant risk resilience during the industry adjustment period:

| Indicator | Kweichow Moutai | Industry Position |

|---|---|---|

| Revenue Market Share | 40.42% | Accounted for 40.42% of the revenue of 20 listed baijiu companies in the first three quarters |

| Net Profit Share | 52.73% | Accounts for more than half of the total net profit |

| Revenue Growth Rate | 10.5% (2025Q1-Q3) | One of the few enterprises maintaining positive growth in the first three quarters |

| Net Profit Attributable to Shareholders Growth Rate | 11.6% (2025Q1-Q3) | Leading growth rate among head-tier baijiu enterprises |

For the full year of 2024, Kweichow Moutai was one of the few baijiu enterprises that completed its annual business plan [1]. Against the backdrop of widespread pressure on the industry, Moutai still achieved positive growth of 15.7% in revenue and 15.4% in net profit attributable to shareholders [1].

According to the latest financial data [0], Kweichow Moutai’s financial health is in an absolutely leading position in the industry:

- Net Profit Margin: 51.51% (top-tier level in the industry)

- ROE (Return on Equity): 36.48% (far exceeding the industry average)

- Gross Profit Margin: ~91.5% (extreme profitability driven by high-end products)

- Operating Profit Margin: 71.37%

- Current Ratio: 6.62x (extremely strong short-term solvency)

- Quick Ratio: 5.18x

- P/E Valuation: 19.11x (currently in a historical low range)

- Beta Coefficient: 0.64 (lower volatility relative to the Shanghai Composite Index)

These indicators show that Moutai has extremely strong cash flow generation capability and financial buffer space, enabling it to calmly cope with industry cycle fluctuations.

Kweichow Moutai’s brand value is the core source of its risk resistance capacity:

- Pricing Power Advantage: Feitian Moutai, as the “hard currency” of the baijiu industry, has the strongest brand premium capability. Even during the industry adjustment period, its wholesale price remains higher than that of other competing products

- Social and Financial Attributes: The collection and investment attributes of Moutai give it value support beyond ordinary consumer goods

- Supply Scarcity: The fundamentals of limited production capacity and long-term supply shortage provide solid support for its price

- Consumer Loyalty: High-end consumer groups have extremely high recognition of the Moutai brand, with relatively rigid demand

According to the results of financial analysis tools [0], Kweichow Moutai is classified as having an “aggressive” accounting treatment model, mainly reflected in its low depreciation/capital expenditure ratio. This may mean:

- The company has retained more profit space through accounting policy choices

- Actual profitability may be stronger than the reported data

- It has the potential to release performance in the future

Its debt risk is assessed as “low risk” [0], indicating that the company’s financial structure is sound, with no concerns about long-term solvency.

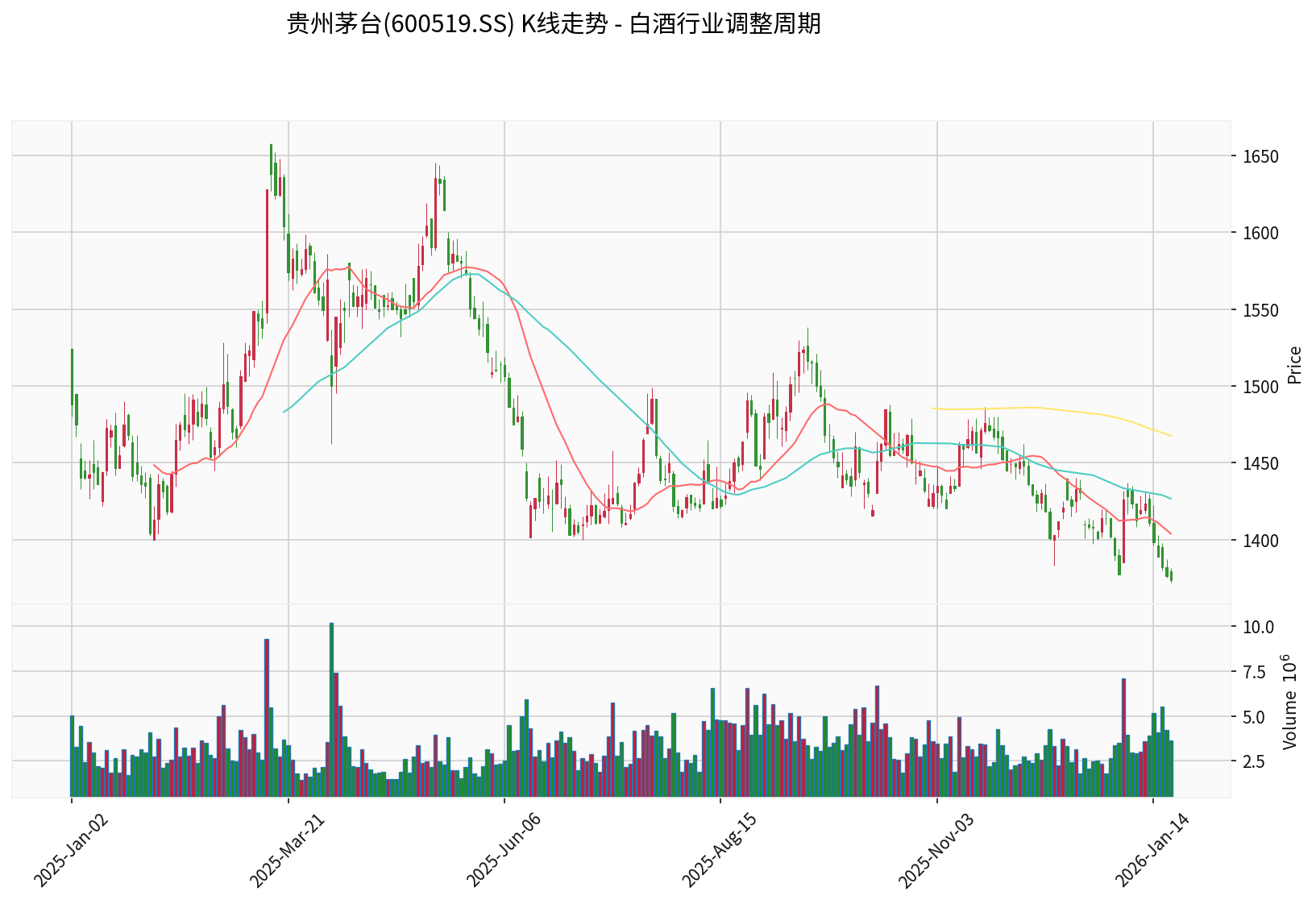

According to technical analysis results [0]:

- Current Price: USD 1,373.55 (approx. RMB 1,373.55 per share, converted at exchange rate)

- Current Trend: Downward trend (to be confirmed)

- Technical Signals:

- MACD: No crossover (bearish bias)

- KDJ: K value 13.3, D value 28.1, J value -16.4 → Oversold zone

- RSI (14-day): Oversold zone

- Key Price Levels:

- Support Level: RMB 1,372.05

- Resistance Level: RMB 1,436.97

- Next Target Level: RMB 1,354.93

| Valuation Indicator | Kweichow Moutai | Industry Average |

|---|---|---|

| P/E (TTM) | 19.11x | ~25-30x (historical central level) |

| P/B | 6.69x | - |

| P/S | 9.84x | - |

The current P/E valuation has fallen to around 19x, which is in a five-year low range [0]. Considering Moutai’s profit stability and leading industry position, the current valuation offers a good margin of safety.

| Period | Price Change |

|---|---|

| 1-Year | -6.87% |

| 3-Year | -26.15% |

| 5-Year | -32.69% |

The stock price performance reflects the market’s concerns about the adjustment of the baijiu industry, but from a medium- to long-term perspective, Moutai’s pullback magnitude is smaller than that of the overall industry, demonstrating strong anti-drop resilience.

| Enterprise | 2024 Revenue Growth Rate | 2025Q1-Q3 Revenue Growth Rate | 2025Q1-Q3 Net Profit Growth Rate | Business Target Achieved |

|---|---|---|---|---|

Kweichow Moutai |

15.7% | 10.5% | 11.6% | ✅ Achieved |

| Wuliangye | 7.1% | 6.1% | 5.8% | ❌ Not Achieved |

| Luzhou Laojiao | Under Pressure | Under Pressure | Under Pressure | ❌ Not Achieved |

| Shanxi Fenjiu | Double-digit Growth | Stable | Stable | ✅ Achieved |

| Yanghe Co., Ltd. | Declining | Declining | Declining | ❌ Not Achieved |

Moutai was one of the few high-end baijiu enterprises that achieved its business targets in 2024 [1].

Based on multi-dimensional analysis, Kweichow Moutai’s risk resistance capacity is at the top level in the industry:

| Dimension | Moutai’s Score | Industry Average | Advantage Analysis |

|---|---|---|---|

Brand Power |

98/100 | 60/100 | Millennium-old brand, status as the “National Liquor” |

Pricing Power |

95/100 | 55/100 | Possesses the strongest pricing power in the industry |

Financial Soundness |

92/100 | 65/100 | Extremely high profit margins, sufficient cash flow |

Channel Control |

88/100 | 50/100 | Increasing direct sales proportion, strong channel discourse power |

Market Share |

96/100 | 40/100 | Both revenue and profit shares exceed 40% |

Cash Flow |

94/100 | 55/100 | Abundant free cash flow |

- Industry Level: The baijiu industry is in an in-depth adjustment period, and it is expected that de-stocking and sales promotion will remain the main themes in 2025 [1]. With the release of channel pressure and the advancement of refined enterprise management, the industry is expected to gradually emerge from the cycle bottom after 2026.

- Company Level: Kweichow Moutai has demonstrated significant risk resistance capacity relying on its unique brand value, extremely strong financial soundness, and absolutely leading market position in the industry. During the industry adjustment period, Moutai is one of the few enterprises that can still maintain double-digit growth.

- Valuation Level: The current P/E valuation of 19x is in a historical low range, offering a good margin of safety and medium- to long-term allocation value.

- Technical Aspect: It is in a short-term downward trend, and technical indicators show oversold conditions; attention can be paid to the performance at the support level.

- Macroeconomic Fluctuations: Baijiu demand is highly correlated with macroeconomic conditions

- Price Fluctuations: A decline in Moutai’s wholesale price may affect market sentiment

- Channel Inventory: Industry inventory pressure still needs time to be digested

- Policy Risks: Changes in consumption policies and tax policies may affect the industry

- Investors with higher risk tolerance and optimistic about the long-term development of the industrymay consider accumulating positions on dips

- Key Time Windows to Monitor: Annual report disclosure period (April 28, 2026), Spring Festival sales data

- Valuation Range Reference: The current price has medium- to long-term allocation value; it is recommended to build positions in batches near the support level

[1] Dongfang Fortune Securities - Overview of 2024 Annual Report & 2025 Q1 Report of the Baijiu Industry (http://pdf.dfcfw.com/pdf/H3_AP202505211676443536_1.pdf)

[2] Xinhua News Network - 2025 Year-end Observation of the Baijiu Industry: Breaking Through in Deep Waters, Anchoring a New Growth Curve in Restructuring (http://www.news.cn/fortune/20251231/598b5722b80a4688922665fd844c0c4c/c.html)

[3] Securities Times - Third Quarterly Reports Show the Baijiu Industry Still Faces Overall Pressure (https://stcn.com/article/detail/3475058.html)

[0] Jinling AI Financial Database - Company Profile, Financial Analysis, and Technical Analysis Data of Kweichow Moutai

东鹏饮料(605499)投资价值深度分析报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.