Analysis of Disclosure Violations History by Chairman of Rongbai Technology (688005) and Impact on Investor Confidence

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Rongbai Technology (Ningbo Rongbai New Energy Technology Co., Ltd.) is a STAR Market-listed company mainly engaged in the R&D, production and sales of new energy cathode materials. With a current market value of approximately RMB 23.3 billion and a current stock price of RMB 33.09, it is a leading enterprise in the new energy lithium battery materials sector[0].

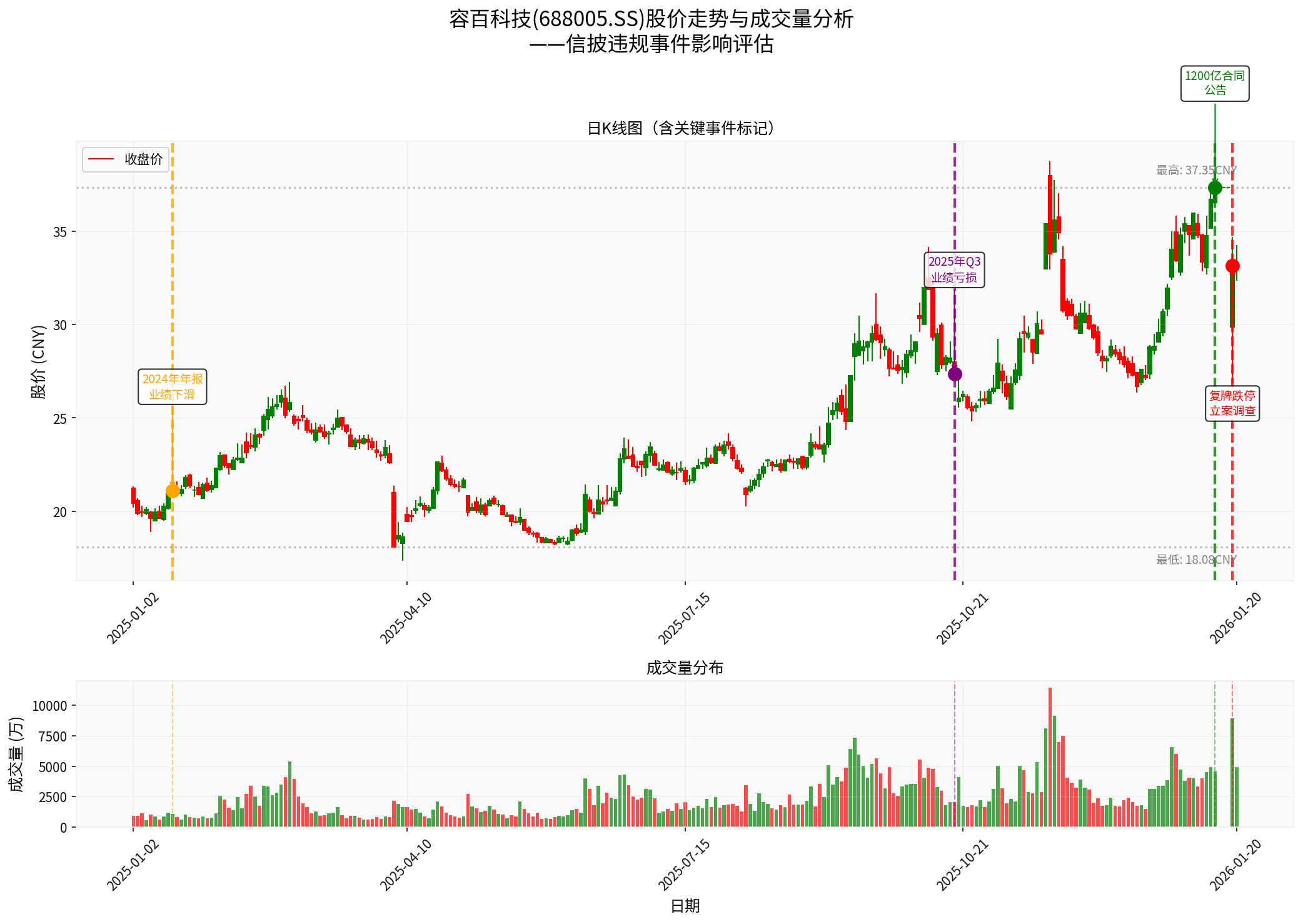

The chart above shows Rongbai Technology’s stock price trend and trading volume distribution from January 2025 to January 2026, clearly depicting the stock price volatility caused by the recent information disclosure violation incident.

In May 2021, a meeting minutes document involving Chairman of Rongbai Technology at an investor communication meeting went viral online, containing material information such as the company’s capacity construction, actual production commissioning and output, and making forecasts that the company’s core business would outperform performance expectations. The news caused Rongbai Technology’s stock price to surge over 40% in the following two trading days[1][2].

In June 2021,

Earlier, on April 10, 2020, the company was subject to administrative regulatory measures by the CSRC due to the following issues in its prospectus disclosure during the application process for its STAR Market IPO[1]:

- Failure to fully disclose the significant increase in credit risk of BAK Battery

- Disclosing that the ‘payment collection’ of BAK Battery was essentially the repayment of overdue accounts receivable by issuing its own commercial acceptance bills

At that time, the CSRC imposed a tough regulatory measure on the company of ‘

On the evening of January 13, 2026, Rongbai Technology announced the signing of the “Lithium Iron Phosphate Cathode Material Procurement Cooperation Agreement” with CATL (300750.SZ). The announcement stated:

- The contract has a term of 6 years (from Q1 2026 to 2031)

- Agreed supply of 3.05 million metric tons of products

- Total amount exceeds RMB 120 billion[1][2]

Five hours after the announcement was released,

- Specific annual capacity agreements in the contract

- Planned, under-construction capacity, acquisition plans, capital reserves and strategic planning

- Whether supplementary agreements have been signed regarding capacity construction, delivery volume, price adjustment mechanisms, etc.

- Whether the current technical, quality, and standard prerequisites for delivery are met

On January 18, in its response, the company

On January 18, Rongbai Technology disclosed that it was ‘

- The announcement content ‘was reviewed by the Secretary of the Board of Directors, who organized the temporary announcement disclosure work, but was not submitted to the Chairman for signature’[2]

- The company claimed that ‘there was no motive to hype the stock price through large-value contracts’

However, combined with the record that Bai Houshan had been publicly criticized for similar violations before,

| Time Node | Stock Price Change | Interpretation |

|---|---|---|

| January 13 (announcement release) | Trading halt | Market expects positive news |

| January 19 (resumption of trading) | Closed down 11.16% |

Significantly below expectations |

| Market Value Change | Evaporated approximately 3 billion yuan |

Dropped from 26.7 billion yuan to 23.7 billion yuan |

From a technical analysis perspective, the company’s stock price has recently shown a

This is not the first time Rongbai Technology has received regulatory sanctions due to disclosure issues. From the 2020 IPO stage to the 2021 performance leak, and now the 2026 “120 billion yuan order” incident,

Tian Lihui, a professor of finance at Nankai University, pointed out: ‘

The reason for this investigation - ‘suspicion of misleading statements in major contract announcements’ - is

The harms of misleading statements include:

- Distorting the market price discovery function: Causing the stock price to deviate from the company’s true value[1]

- Undermining market fairness: Market failure caused by information asymmetry[1]

- Accumulating investment risks: Misleading investors into making wrong decisions[1]

As the company’s founder and primary person responsible for information disclosure, Bai Houshan

Wang Jiyue, a senior investment banking professional, stated: ‘

The company’s current financial situation is not optimistic[0]:

- 2025 Q3 performance fell far short of expectations: EPS of -$0.19 (expected $0.06), revenue 18.86% below expectations

- TTM PE ratio of -966.47x (in a loss-making state)

- ROE of -0.29%, net profit margin of -0.19%

Amid already pressured fundamentals,

The CSRC and SSE have adopted an increasingly tough stance on such incidents:

- Issued an inquiry letter overnight (on the evening of January 13)[1]

- Launched the investigation process promptly[1][2]

- Multiple companies that released “major positive news” received regulatory attention during the same period[2]

Professor Tian Lihui recommended standardizing information disclosure from three aspects[1]:

- Refine order disclosure standards: Mandate that announcements clearly state the basis for the amount, execution period, breach clauses, and uncertainties

- Strengthen pre-review and rapid accountability: Launch immediate inquiries for large-value order announcements, and implement dual penalties of “property penalties + qualification penalties”

- Establish a regular information disclosure review mechanism: Focus supervision on enterprises with low order execution rates and frequent revisions to disclosure content

| Dimension | Key Focus Areas | Red Flag Signals |

|---|---|---|

| Disclosure Details | Basis for amount, risk warnings | Vague statements, estimated amounts |

| Performance Capacity | Matching degree of capacity and revenue | Sky-high orders, exceeding carrying capacity |

| Trading Timing | Avoid chasing rallies | Immediate limit-up after positive news release |

- Short-term avoidance: The information disclosure violation may lead to further penalties, resulting in high stock price volatility risks

- Follow up on subsequent developments: Track the progress of regulatory investigations and the company’s rectification measures

- Anchor on fundamentals: The company is in the new energy track, but needs to wait for signals of a performance inflection point

The history of information disclosure violations by Bai Houshan, Chairman of Rongbai Technology,

- Market trust crisis: Repeated violation records have caused investors to fundamentally question the quality of the company’s information disclosure

- Valuation discount risk: Compliance risk premiums may lead to long-term pressure on the company’s valuation

- Legal risk exposure: Potential investor claims and further regulatory penalties

- Restricted financing capacity: Damaged credit records may affect subsequent financing channels and costs

From the market reaction, investors have voted with their feet through the stock price drop (plummeting 11.16% on the resumption day) and increased trading volume (abnormal volume)[1][2]. In the long run, against the backdrop of the deepening reform of the registration-based IPO system and stricter information disclosure supervision,

[0] Jinling API - Real-time Market and Financial Data of Rongbai Technology (688005.SS)

[1] Securities Times - “Rongbai Technology Placed Under Investigation: The Whole Story of the ‘120 Billion Yuan Order’ Touching the Compliance Red Line” (https://www.stcn.com/article/detail/3601217.html)

[2] Tonghuashun/Caiwen - “Rongbai Technology ‘Launches a Satellite’ with a 100 Billion Yuan Order, Self-directed and Self-acted by the Secretary of the Board?” (https://m.10jqka.com.cn/20260119/c674127211.shtml)

容百科技(688005)复牌暴跌技术面信号分析

贵州茅台现金储备战略价值深度分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.