In-Depth Analysis of the Strategic Value of Kweichow Moutai's Cash Reserves

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

I will now conduct a systematic and comprehensive analysis based on the collected data.

According to Kweichow Moutai’s 2024 annual report and the latest financial data[0][1], the company has demonstrated extremely strong financial resilience during the industry adjustment period:

Core Indicators |

2024 Data |

Industry Position |

|---|---|---|

| Monetary Funds | RMB 59.296 billion | Top among A-share baijiu enterprises |

| Trading Financial Assets | RMB 127.187 billion | Substantial growth |

Total Cash Reserves |

Approximately RMB 186.5 billion |

Accounting for 62.4% of total assets |

| Current Ratio | 4.45x | Far exceeding the safety margin |

| Asset-Liability Ratio | 21.4% | Lowest level in the industry |

| Cash Flow from Operating Activities | RMB 92.464 billion | YoY growth of 38.8% |

| ROE | 36.5% | Maintained at a high level |

| Inventory (Base Liquor) | RMB 54.343 billion | 4.21 years of base liquor reserve |

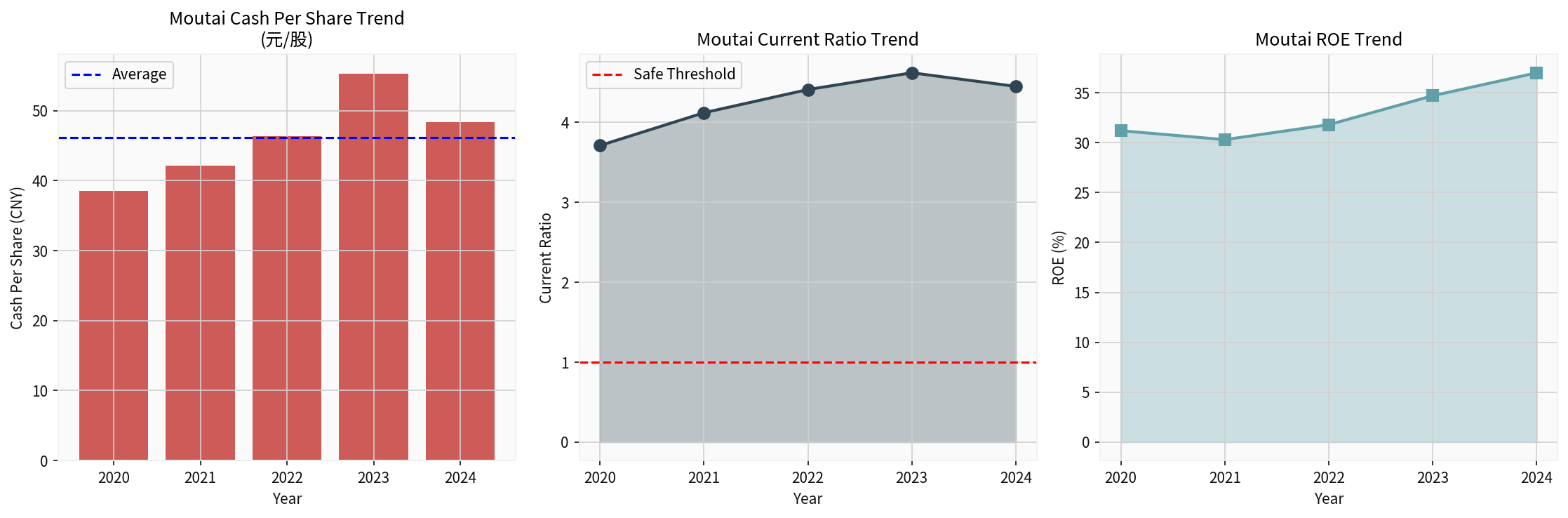

Chart Notes: The above chart shows the five-year trend changes of Moutai’s cash per share, current ratio, and ROE from 2020 to 2024. It can be seen that despite the industry being in an adjustment period, Moutai’s core liquidity indicators and profitability remain stable.

The current baijiu industry is in a period of in-depth adjustment; in the first three quarters of 2025, the net profit of 15 major baijiu enterprises decreased by 5.5% YoY [2][3]. Against this background, Moutai’s cash reserves demonstrate three strategic values:

- The current ratio of 4.45x far exceeds the industry average of 1.8x, meaning that even if revenue drops by 50%, debt repayment can still be guaranteed

- The quick ratio is 3.66x, resulting in minimal pressure to liquidate inventory

- Net cash is negative (net debt/EBITDA is -0.29), maintaining a net cash position [0]

In 2024, Moutai’s operating cash flow reached RMB 92.464 billion, with a YoY growth of 38.8% [1]. It performed strongly against the trend amid widespread industry pressure, indicating:

- Although dealer advances decreased by 32%, the core profitability has not been fundamentally impacted

- The direct sales ratio has increased to over 45%, enhancing channel discourse power

- The “iMoutai” platform enables direct sales of Feitian Moutai at RMB 1,499, improving capital recovery efficiency

- Contract liabilities are RMB 9.592 billion; although down 32% YoY, they remain at a reasonable level

- Compared to the extreme situation of over 70% drop in advance receipts during the previous cycle (2013-2014), Moutai’s channel stability has significantly improved in this cycle

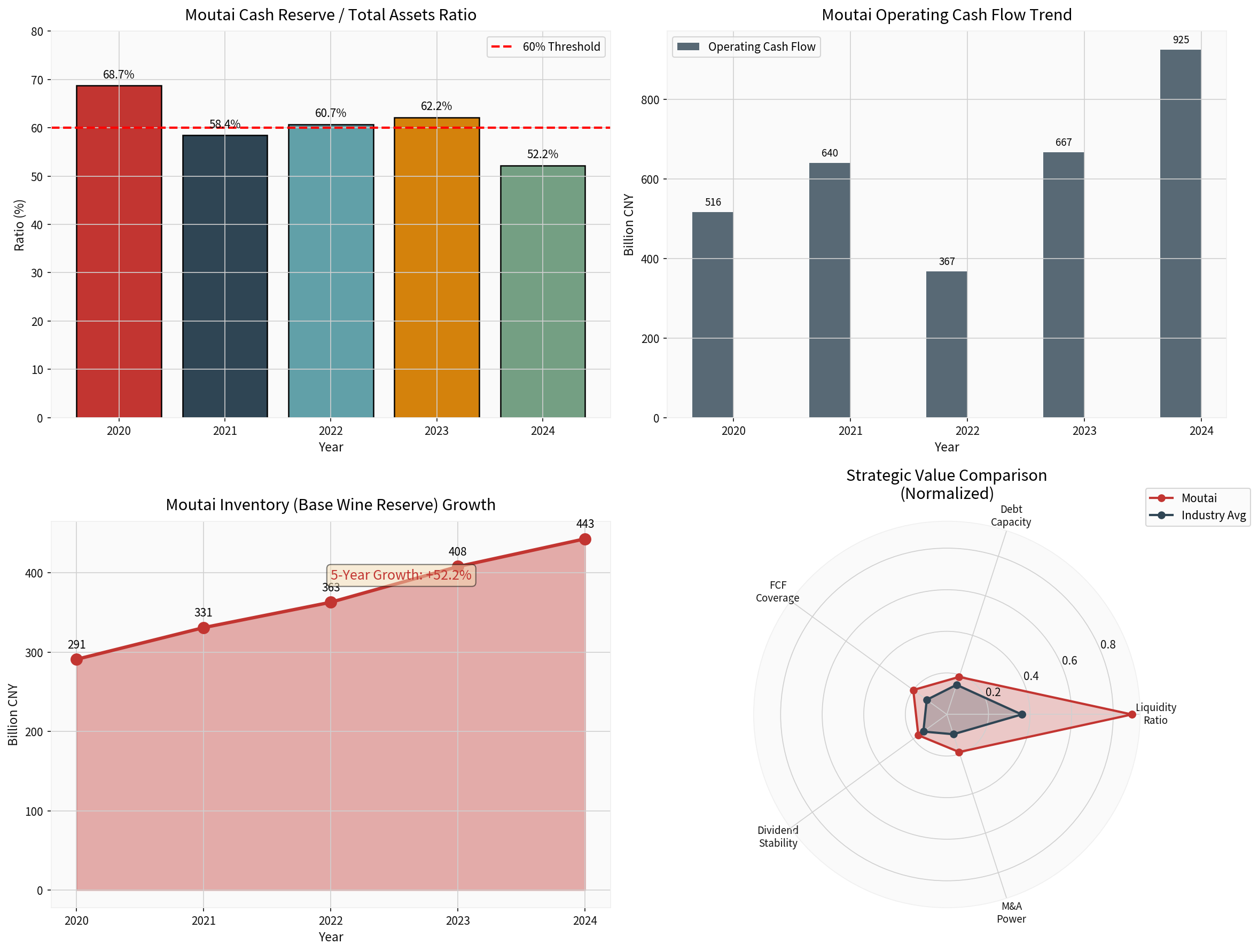

Chart Notes: The above chart comprehensively displays changes in Moutai’s cash reserves and asset proportion, operating cash flow trends, base liquor reserve growth, and a radar chart comparing strategic value with the industry average.

Moutai’s base liquor reserve strategy embodies the long-termism mindset of “trading time for space” [4][5]:

Indicator |

Data Interpretation |

|---|---|

| Semi-finished goods inventory growth rate of 10.33% | Proactive increase in base liquor reserves amid zero output growth |

| Base liquor reserve period of 4.21 years | Finished product/sales volume ratio is only 0.21, resulting in extremely light channel pressure |

| Inventory turnover days of 1438 days | Approximately 4-year turnover cycle, with significant time value |

| Inventory of RMB 54.3 billion in 2024 | 86.7% growth compared to 2020 |

This strategy of “producing more while storing more” enables Moutai to, during the industry downturn:

- Maintain product quality consistency and scarcity

- Reserve sufficient “ammunition” for future recovery cycles

- Seize the initiative in industry consolidation

During the industry’s in-depth adjustment period, small and medium-sized baijiu enterprises face difficulties such as idle production capacity, channel loss, and capital chain crises [3][6], which provides a rare M&A window for Moutai:

- High-quality production capacity and brand assets of regional baijiu enterprises

- Small baijiu enterprises with characteristic flavor types or geographical indications

- Regional distributors with existing channel networks

- Approximately RMB 186.5 billion in cash reserves on the books, enabling one-time completion of large-scale acquisitions

- Ultra-low asset-liability ratio (21.4%) provides sufficient leverage space

- Strong brand endorsement enables rapid integration of acquired enterprises

According to KPMG’s 2025 Mid-Term Research Report on the Chinese Baijiu Market [7], the current high-quality production capacity planning is being gradually released, and the problem of overcapacity will gradually become prominent. Moutai can use its cash reserves to:

- Accelerate the advancement of the “14th Five-Year Plan” capacity projects

- Integrate the upstream supply chain to reduce raw material cost fluctuations

- Deploy intelligent production facilities to improve production efficiency

In the first three quarters of 2025, the number of Moutai’s international distributors increased to 121, and overseas revenue grew by 31.29% YoY [8]. The internationalization strategy requires continuous investment:

- Overseas market channel construction

- Brand culture promotion (such as sponsoring the Singapore Open, hosting “Moutai Night”)

- Differentiated strategies for 66 target markets

Indicator |

2024 Data |

|---|---|

| Cash Dividend Payout Ratio | Approximately 80% |

| Dividend Yield | 3.6% |

| Cash Per Share | RMB 48.36 |

Even during the industry downturn, Moutai maintains a high dividend policy:

- Cumulative dividends exceeded RMB 60 billion in 2024

- Maintained a dividend payout ratio of over 75% for consecutive years

- Provides stable cash returns to shareholders, enhancing confidence in holding shares

Amid pressure on stock performance (stock price dropped by over 6% in 2025) [0], Moutai can:

- Large-scale share buybacks (subject to shareholder meeting authorization)

- Employee stock ownership plans

- Equity incentive plans

Maintain stock price stability and protect investor interests.

Comparison Dimension |

2013-2014 Cycle |

2024-2025 Cycle |

|---|---|---|

| Industry Profit Decline | 22.5% | 5.5% (as of 2025Q3) |

| Moutai’s Advance Receipts Decline | From RMB 5.1 billion to RMB 1.5 billion (-70%) | RMB 9.592 billion (-32%) |

| Moutai’s Liquidity Ratio | Approximately 2.5x | 4.45x |

| Moutai’s Cash Reserves | Approximately RMB 40 billion | RMB 186.5 billion |

| Risk Resistance Capability | Weak, experienced difficult bottoming | Strong, growing against the trend |

Data shows [2][3] that Moutai’s resilience in this cycle has significantly improved; its “family assets” have grown from approximately RMB 28 billion in 2013 to nearly RMB 470 billion (total undistributed profits of 15 baijiu enterprises), with Moutai accounting for over 50%.

- Adhere to the Bottom Line of Liquidity Management: Maintain a current ratio of over 3x, and cash reserves not less than 50% of total assets

- Seize the M&A Window: During the accelerated industry consolidation phase, prioritize acquiring high-quality regional assets

- Accelerate Direct Sales Channel Construction: Continue to increase the direct sales ratio, enhancing channel control and profit margins

- Strengthen International Layout: Use cash reserves to support overseas market expansion and diversify market risks

- Cash Reserves are the Core Moat for Counter-Cyclical Investment: Moutai’s case shows that during industry downturns, sufficient cash reserves not only ensure enterprise survival but also create opportunities for excess returns

- Liquidity Indicators are More Important than Profit Margins: During industry downturns, indicators such as current ratio and quick ratio better reflect an enterprise’s safety margin than gross profit margin

- Base Liquor Reserves are Hidden Assets of Baijiu Enterprises: Moutai’s 4.21-year base liquor reserve is an important source of its long-term competitiveness

- Increased Concentration of Leading Enterprises is a Definite Trend: The CR6 profit share increased from 55% in 2014 to 86% in 2024 [7], and Moutai, as the industry leader, will continue to benefit

Kweichow Moutai’s approximately RMB 186.5 billion cash reserves demonstrate multiple strategic values during the current industry downturn:

- Defensive Value: A current ratio of over 4x and nearly RMB 190 billion in cash provide a sufficient safety margin to ensure the enterprise can weather extreme fluctuations in the industry cycle

- Offensive Value: Provides sufficient financial support for counter-cyclical M&As, capacity expansion, and international layout, seizing the initiative in industry reshuffling

- Shareholder Return Value: Supports high dividend policies and potential share buybacks, providing stable returns to shareholders during the industry adjustment period

- Brand Value: Abundant cash reserves themselves are a manifestation of brand strength, enhancing market confidence and channel loyalty

During the critical period when the baijiu industry is transforming from “scale expansion” to “value deep cultivation” [6][8], Moutai’s cash reserves will become its core competitive advantage in consolidating its leading position and achieving high-quality development. As industry insiders analyze, “Never underestimate the ability of any industry leading company to cope with difficulties, especially those with huge cash reserves and strong business models” [4]. Moutai is expected to stabilize and rebound first in the industry recovery cycle, continuing its leading position in the high-end baijiu market.

[0] Jilin API - Kweichow Moutai Company Profile and Financial Indicator Data

[1] Kweichow Moutai 2024 Annual Report - Monetary Funds and Balance Sheet Data (https://www.moutaichina.com/mtgf/articleFileDir/2025-04/08/8055b7bed7db41bdbc617f4c9b9ec591.pdf)

[2] 21st Century Business Herald - Full Scan of Two Baijiu Cycles: Industry Has Thicker “Family Assets” and Leading Enterprises Have Stronger Resilience (https://www.21jingji.com/article/20251107/herald/ab8c8e022ab14b1e6947bcfc2ccb94d2.html)

[3] Xinhua News Agency - 2025 Year-End Observation of the Baijiu Industry: Breaking Through in Deep Waters, Anchoring a New Growth Curve in Restructuring (http://www.news.cn/fortune/20251231/598b5722b80a4688922665fd844c0c4c/c.html)

[4] Sina Finance - Proactive Moutai: Will It Be the First to End the Baijiu Adjustment Cycle? (https://cj.sina.cn/articles/view/2637695114/9d38088a00101k2au)

[5] Sohu - 2025 In-Depth Research Series on Listed Baijiu Companies: Supply Chain Chapter (https://q.stock.sohu.com/cn/news.html?textId=964825527)

[6] 21 Finance - Decoding the 2025 Baijiu Industry: Restructuring New Growth Drivers in Adjustment (https://www.21jingji.com/article/20251228/herald/082f87cd00bf525f0f6871caad05133a.html)

[7] KPMG - 2025 Mid-Term Research Report on the Chinese Baijiu Market (https://assets.kpmg.com/content/dam/kpmg/cn/pdf/zh/2025/06/mid-term-research-report-on-the-chinese-baijiu-market-2025.pdf)

[8] Sina Finance - Kweichow Moutai 2024 Annual Report (http://money.finance.sina.com.cn/corp/view/vCB_AllBulletinDetail.php?stockid=600519&id=10845840)

容百科技(688005)董事长信披违规历史及投资者信心影响分析

社区生鲜行业估值方法深度研究报告

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.