Blackstone's Sale of Beacon Offshore Energy: Analysis of Shifts in Private Equity Upstream Oil and Gas Investment Strategies

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Based on collected data and information, the complete analysis report is presented below:

Blackstone is considering selling its energy investment firm Beacon Offshore Energy, an upstream company focused on deepwater oil and gas assets in the Gulf of Mexico, for over $5 billion. This move has sparked widespread market concern about whether a fundamental shift has occurred in the private equity industry’s upstream oil and gas investment strategies [0].

Beacon Offshore Energy is an upstream company focused on deepwater oil and gas exploration and production in the Gulf of Mexico. The Gulf of Mexico deepwater is a key U.S. oil and gas production base with the following characteristics:

- Strategically Superior Location: The Gulf of Mexico deepwater has mature oil and gas infrastructure and abundant resource reserves

- High Technological Maturity: Deepwater drilling and extraction technologies are quite mature, with relatively controllable operational risks

- Stable Regulatory Environment: The regulatory framework for U.S. domestic oil and gas development is relatively clear

As the world’s largest alternative asset manager, Blackstone’s energy investment portfolio covers multiple sectors:

| Indicator | Value |

|---|---|

| Total AUM | ~$1 trillion (2025) |

| Energy Sector Allocation | ~5-8% of total assets |

| Private Equity Business Share | ~40% |

Blackstone has reported solid recent financial performance, with a 2024 fiscal year ROE of 32.88%, net profit margin of 22.04%, and operating profit margin as high as 51.89% [0].

During the 2014-2016 oil price crash, many private equity funds sharply cut upstream oil and gas investments. The characteristics of this period include:

- Plummeting Investment Scale: Upstream oil and gas PE investment fell from approximately $30 billion in 2014 to less than $10 billion in 2016

- Asset Sell-off Wave: Many funds sold oil and gas assets at 30-50% below book value

- Strategic Adjustment: Shift from traditional oil and gas production to unconventional resources (shale oil, shale gas)

As oil prices rebounded from their 2020 lows, private equity refocused on energy investment:

- Rising Investment: Upstream oil and gas PE investment rebounded to approximately $20 billion in 2021

- Impact of ESG Factors: Investors began focusing on carbon emissions and ESG compliance

- Diversified Allocation: Shift from pure upstream production to an “exploration and development + infrastructure” portfolio

The current period presents a complex investment environment:

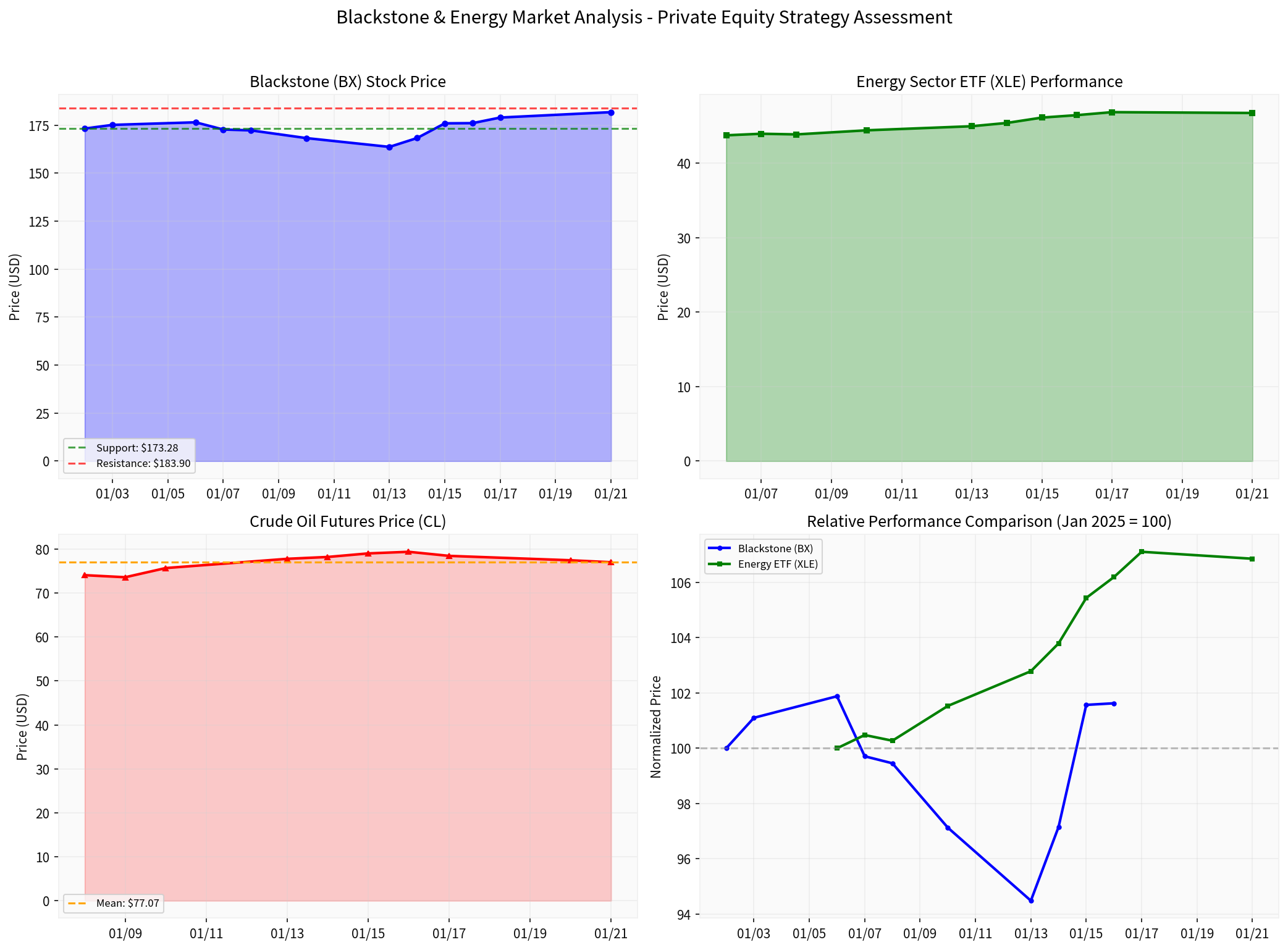

The chart above shows a comparison of the price trends of Blackstone’s stock, energy ETFs, and crude oil prices [0].

| Indicator | 2024 Average | 2025 Forecast |

|---|---|---|

| Brent Crude | $82/bbl | $75-85/bbl |

| WTI Crude | $78/bbl | $72-82/bbl |

| Natural Gas | $2.5/MMBtu | $2.8-3.5/MMBtu |

Recent crude oil prices have shown increased volatility; in January 2025, oil prices fell from a high of $79.39 to $77.01, a decline of approximately 3% [0].

- Ongoing conflicts in the Middle East

- Sustained impact of the Russia-Ukraine conflict on energy markets

- Increased policy uncertainty following the U.S. presidential election

Private equity funds typically have a 7-10 year lifespan. Beacon Offshore Energy has been in operation for approximately 8 years since Blackstone’s investment, approaching the fund’s exit cycle.

Selling at a valuation of over $5 billion means Blackstone has achieved substantial returns on this project. Blackstone’s early positioning benefited from significant book value appreciation as Gulf of Mexico deepwater assets recovered in valuation after 2016.

Blackstone has recently shown a tendency to focus resources on core businesses:

- Private Equity Business: Accounts for 80.8% of revenue, the absolute core [0]

- Real Estate Sector: Accounts for 19.2%, maintains allocation but is not a strategic focus

- Energy Investment: Gradually shifting from proprietary investment to fund models

| Exit Method | 2023 | 2024 | Trend |

|---|---|---|---|

| Oil and Gas Asset Sales | 45 transactions | 62 transactions | +37.8% |

| Exit Value ($B) | 12.5 | 18.3 | +46.4% |

A growing number of private equity funds are choosing to exit rather than continue holding upstream oil and gas assets.

- Institutional investors are imposing more restrictions on fossil fuel asset allocations

- Pension funds and sovereign wealth funds are tightening ESG screening

- Rising carbon emission costs are impacting long-term return expectations

PE investment in clean energy infrastructure has increased from approximately $8 billion in 2020 to approximately $25 billion in 2024, with a compound annual growth rate of over 25%.

Private equity oil and gas investment is inherently cyclical. The current exits are more likely part of a normal business cycle rather than a permanent strategic shift.

Oil and gas assets still provide relatively stable cash flows and inflation-resistant characteristics. In a high-interest rate environment, the return characteristics of energy assets remain attractive.

Some private equity funds are shifting from comprehensive investment to specialized focus rather than exiting the energy sector entirely. Energy-focused funds are still actively raising capital.

Based on the above analysis, we believe Blackstone’s sale of Beacon is more likely to represent a

| Dimension | Assessment |

|---|---|

| Exit Motivation | Medium-high confidence: Mainly driven by cyclical and fund maturity factors |

| Strategic Shift | Medium-low confidence: More a tactical adjustment than a fundamental shift |

| Industry Impact | Medium confidence: May trigger a follow-up effect but will not form a sell-off wave |

Chinese private equity industry investments in the energy sector can reference the following trends:

- Diversified Allocation: Avoid over-concentration in a single energy sub-sector

- Exit Timing: Focus on matching industry cycles and fund lifespans

- ESG Integration: Proactively lay out carbon emission management and green transformation

- Upstream Asset Valuation: May face short-term pressure but long-term value remains

- Technological Upgrade: High-tech barrier fields such as deepwater and unconventional resources remain attractive

- International Cooperation: Cooperation models in mature regions such as the Gulf of Mexico can be referenced

| Indicator | Assessment | Explanation |

|---|---|---|

| Short-term Stock Price | Neutral to bearish | Volatility may occur before exit proceeds are recorded |

| Long-term Strategy | Positive | Helps optimize portfolio structure |

| Valuation Support | Stable | Current P/E of 44.47x, below historical average |

- Further Decline in Oil Prices: May impact subsequent exit valuations

- Transaction Execution Risk: Uncertainties such as regulatory approval and buyer financing

- Market Sentiment: Overall pressure on the energy sector may spill over to Blackstone

- Transaction Completion Time and Price: The final transaction price will validate market pricing of oil and gas assets

- Blackstone’s Subsequent Energy Investment Plans: Whether new allocation directions will emerge

- Industry Follow-up Effect: Whether other large PE firms will follow suit in exiting

Blackstone’s sale of Beacon Offshore Energy is more likely a

- Reasonable Timing: Exiting at a relatively high valuation for oil and gas assets aligns with private equity business logic

- Capital Allocation Optimization: Recovered capital can be allocated to higher-return opportunities

- Limited Industry Impact: Individual large transactions will not change the overall investment trend

- Unchanged Long-term Trend: Energy security needs and technological progress still support upstream oil and gas investment

Private equity investment in upstream oil and gas assets will continue, but investment methods may become more

[0] Gilin AI Financial Database - Blackstone (BX) Stock Price Data, Technical Analysis, and Company Profile (January 2025 Data)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.