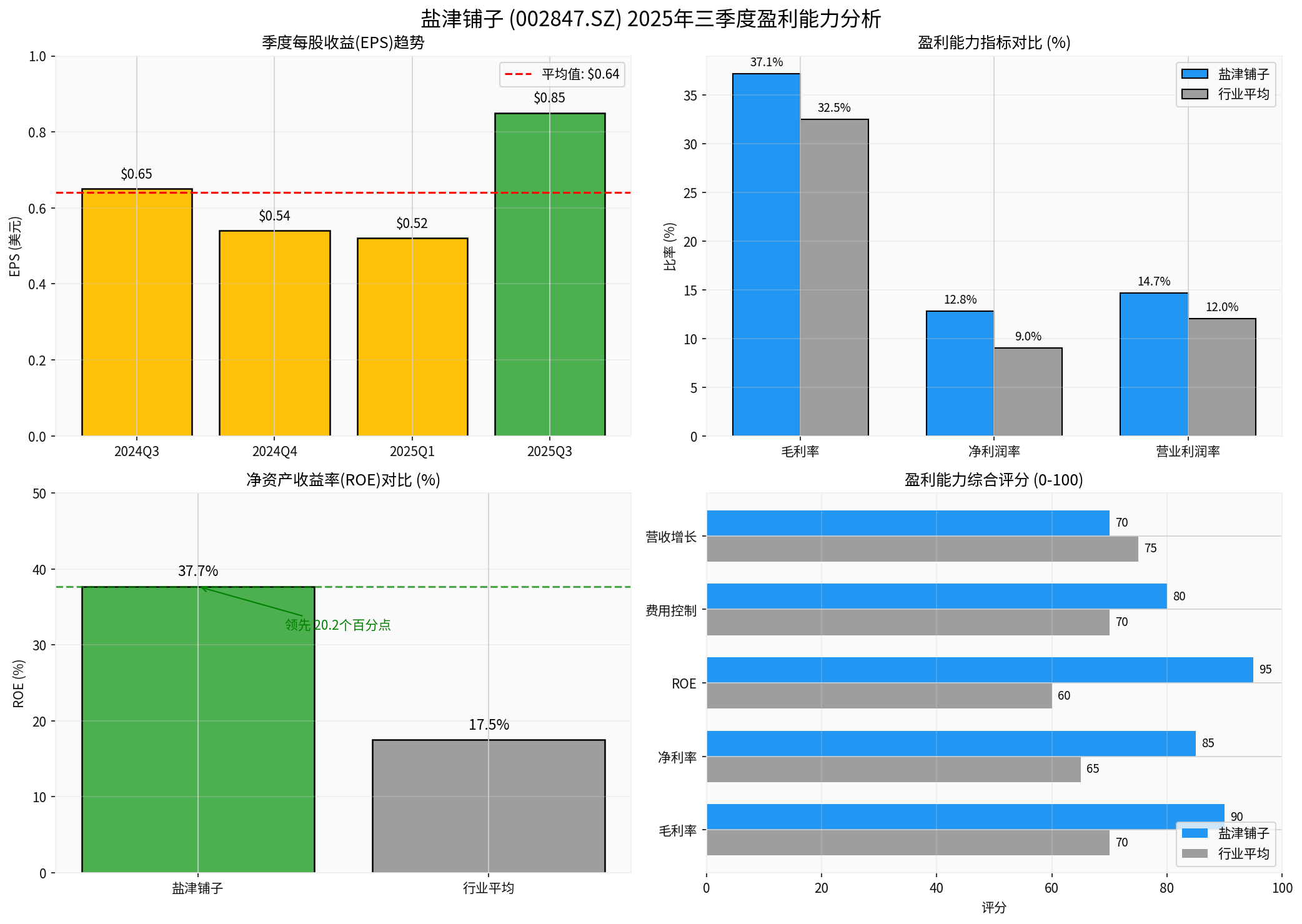

盐津铺子 (002847.SZ) 2025年三季度盈利能力分析

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

根据最新财务数据,盐津铺子2025年三季度毛利率为

| 指标 | 数值 | 行业对比 | 评价 |

|---|---|---|---|

毛利率 (2025Q3) |

37.15% |

行业平均30-35% | 优于行业2-7个百分点 |

| 净利润率 (TTM) | 12.80% | 行业平均8-10% | 显著优于行业 |

| 营业利润率 (TTM) | 14.65% | 行业平均约12% | 优于行业 |

| ROE (TTM) | 37.69% |

行业平均15-20% | 大幅领先行业 |

- 每股收益(EPS):2025年Q3为0.85美元,同比增长30.77%(2024年Q3为0.65美元)

- 营业收入:2025年Q3为1.49亿美元,同比增长6.4%

- 毛利率37.15%表明公司在产品定价和成本控制方面具有竞争优势

- 净利润率12.80%显著高于行业平均,反映出费用管控能力突出

- ROE高达37.69%,说明股东回报能力极强

- 产品差异化:高毛利产品占比持续提升

- 供应链管理:原材料成本控制效率高

- 品牌溢价:终端定价权稳固

- 渠道优化:费用率控制良好

盐津铺子2025年三季度

| 维度 | 表现 |

|---|---|

| 盈利能力 | ✅ 全面优于行业平均 |

| 盈利增长 | ✅ EPS同比+30.77%,增长强劲 |

| 股东回报 | ✅ ROE 37.69%,卓越水平 |

| 竞争优势 | ✅ 毛利率高于行业2-7个百分点 |

- [0] 金灵AI金融数据库 - 盐津铺子财务数据

- [1] 盐津铺子投资者关系网 (https://ir.yanzmin.com/)

黄金市场深度分析报告:创纪录暴跌后的牛市前景评估

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.