AI Sector Rotation: Anthropic's New Tool Triggers Software Selloff Amid Market Reallocation

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

The February 4, 2026 Reuters “Morning Bid” column reports a significant market rotation triggered by Anthropic’s launch of a new AI automation tool on January 30, 2026 [1]. This development has fundamentally altered investor sentiment toward software and data analytics companies, creating a stark divergence between AI beneficiaries and potential losers. The technology sector experienced its worst daily performance on February 3, 2026, with a decline of 2.60%, while the NASDAQ Composite fell 1.74% (377 points) and the Consumer Cyclical sector dropped 3.69% [0][1].

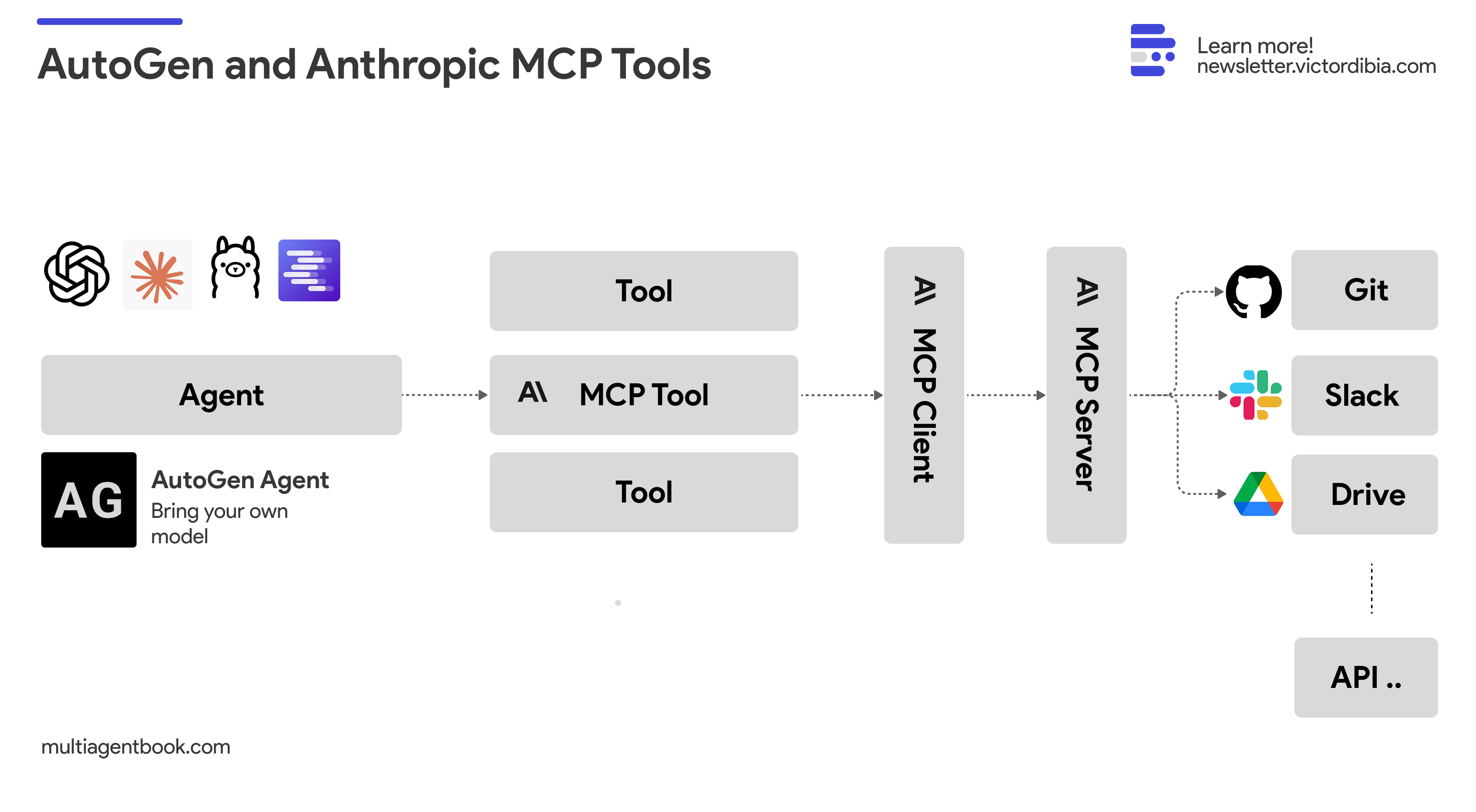

This market reaction represents a maturation of AI sentiment, moving beyond indiscriminate enthusiasm toward selective evaluation of how AI technologies will impact specific business models. As Schroders analyst Jonathan McMullan noted, the selling pressure reflects “a deepening structural debate, accelerated today by Anthropic’s legal automation tool challenging incumbents” [2]. The cascading effects have extended across global markets, affecting European software stocks, Indian IT companies, and U.S. technology giants.

The market rotation on February 3, 2026 demonstrates a clear pattern of capital reallocation from software and AI-dependent service stocks into more defensive and hardware-focused investments [0]. The Russell 2000 small-cap index gained 1.69%, while the Energy sector rose 2.97%, and Consumer Defensive improved 1.89% [0]. This rotation suggests investors are repositioning for potential AI disruption by reducing exposure to companies most vulnerable to automation while maintaining positions in infrastructure providers that benefit from continued AI buildout.

The technology sector’s performance breakdown reveals the depth of the rotation. Major losers included Microsoft (MSFT), which fell 2.87% ($12.16) to $411.21 despite beating earnings expectations, and NVIDIA (NVDA), which dropped 2.84% ($5.27) to $180.34, extending weekly losses to approximately 5.9% [0]. AMD experienced a 1.69% decline ($4.16) to $242.11, reflecting broader chip sector concerns [0]. In contrast, Walmart (WMT) rose 2.94% (+$3.65) to $127.71, becoming the first retailer in history to reach a $1 trillion market cap milestone [0][1].

The Anthropic AI launch has had particularly severe impacts on software and data analytics companies globally. Thomson Reuters (TRI.TO) slumped nearly 18% in response to concerns that AI legal automation tools could disrupt its core business [2]. European software stocks experienced similar pressure, with Britain’s RELX falling 14% and Netherlands’ Wolters Kluwer dropping approximately 13% [2]. These declines reflect market recognition that AI-native companies now face disruption risk from competing AI tools, reversing the previous narrative that AI adoption universally benefits technology stocks.

The sell-off extended to Asian markets, with Indian IT giants experiencing significant declines. TCS, Infosys, and Wipro fell between 6-8% as investors assessed how AI automation might impact their service revenue models [3]. This global contagion effect demonstrates the interconnected nature of software sector valuations and the market’s sensitivity to AI-driven disruption news. Professional services firms were also affected, with advertising giants Omnicom falling 11.2% and Publicis dropping more than 9% [2].

Despite the broader tech sell-off, hardware and chip companies have demonstrated relative resilience, benefiting from continued AI infrastructure investment [1]. Chip and hardware stocks have “almost trebled” according to Reuters analysis, supported by ongoing data center expansion and AI server deployment [1]. However, this resilience has limits, as evidenced by the declines in NVIDIA and AMD, which suggest growing investor concern about valuation sustainability in the semiconductor space.

The semiconductor sector faces several headwinds that merit attention. NVIDIA’s H200 chip exports to China remain pending a national security review, creating uncertainty about revenue growth trajectories [4]. Additionally, data center utilization concerns have emerged, with some analysts suggesting that approximately 25% of AI data center capacity may go unused, raising questions about capital expenditure sustainability [4]. AMD’s price-to-earnings ratio of 92.76 indicates elevated valuations that may be unsustainable if AI revenue growth disappoints [0].

The AI disruption risk to software business models represents the most significant immediate concern, with Anthropic’s launch serving as a catalyst that validates market fears about AI-driven automation [1][2]. This risk extends beyond immediate losers to potentially affect any software company whose products could be replicated or automated by emerging AI tools. Companies with AI-dependent business models face particular scrutiny, as their competitive advantages may erode rapidly as AI capabilities improve.

Chip sector valuation concerns present a moderate-to-high risk, particularly for companies with elevated price-to-earnings ratios like AMD [0]. The sustainability of semiconductor valuations depends on continued AI infrastructure investment, which faces potential headwinds from data center utilization questions and geopolitical tensions affecting global chip distribution [4].

China export restrictions on chips, particularly NVIDIA’s H200 exports pending national security review, create additional uncertainty for chip companies’ international revenue opportunities [4]. This geopolitical dimension adds complexity to investment decisions in the semiconductor space.

The rotation toward defensive sectors and small-cap value stocks may present opportunities for investors seeking to reduce AI-specific exposure while maintaining market participation. Consumer Defensive (+1.89%) and Energy (+2.97%) sectors demonstrated relative strength during the February 3 tech sell-off [0].

Companies that can successfully integrate AI capabilities into their existing business models without disrupting their core revenue streams may emerge as winners in the current environment. Walmart’s achievement of $1 trillion market cap demonstrates that non-traditional technology companies can benefit from AI adoption in operational efficiency and retail applications [0][1].

Alphabet’s upcoming earnings report will serve as a key test for AI sentiment, with investors closely examining how Google’s AI investments are translating into revenue and competitive positioning [1]. This report may provide clarity on whether AI disruption concerns are overblown or reflect genuine structural shifts in the technology landscape.

The February 4, 2026 analysis reveals several critical data points for market participants to consider. Anthropic’s January 30, 2026 AI legal automation tool launch has triggered sector-wide reassessment of software company vulnerabilities [1][2]. Technology sector decline of 2.60% on February 3, 2026 represented the worst daily performance among major sectors [0]. Major tech stock movements included Microsoft falling 2.87% to $411.21, NVIDIA dropping 2.84% to $180.34 (extending weekly losses to ~5.9%), and AMD declining 1.69% to $242.11 [0]. Walmart’s rise to $1 trillion market cap marks a retail industry milestone [0][1].

European software stocks experienced severe declines, with Thomson Reuters falling nearly 18%, RELX dropping 14%, and Wolters Kluwer declining approximately 13% [2]. Indian IT stocks (TCS, Infosys, Wipro) fell 6-8% on AI disruption concerns [3]. Small-cap strength (Russell 2000 +1.69%) and defensive sector gains suggest rotation toward value investments [0]. Key upcoming catalysts include Alphabet earnings, Fed loan-officer survey results, and ongoing geopolitical developments affecting oil, gold, and currency markets [1].

Investors should monitor enterprise software earnings reports for evidence of AI-driven demand versus disruption impacts, chip demand sustainability given data center utilization concerns, and small-cap rotation persistence as indicators of broader market sentiment shifts [0][1].

[0] Ginlix Analytical Database – Market data, real-time quotes, and quantitative analysis

[1] Reuters – “Morning Bid: AI scatters the tech herd” (https://www.reuters.com/business/finance/global-markets-view-usa-2026-02-04/)

[2] Reuters – “AI concerns pummel European software stocks” (https://www.reuters.com/business/media-telecom/ai-concerns-pummel-european-software-stocks-2026-02-03/)

[3] The Week – “Explained: Anthropic’s new AI tool causing IT stock crash” (https://www.theweek.in/news/biz-tech/2026/02/04/explained-anthropics-new-ai-tool-that-has-caused-shares-of-tcs-infosys-and-wipro-to-crash.html)

[4] Finbold – “Why Nvidia stock is crashing” (https://finbold.com/why-nvidia-stock-is-crashing-4/)

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.