Toyota Motor Corporation (TM): Q3 FY2026 Analysis - Strategic Resilience Amid Tariff Headwinds

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Toyota Motor Corporation has demonstrated remarkable resilience in the face of escalating global trade tensions, reporting Q3 FY2026 results that exceeded market expectations and prompting a raised full-year operating profit outlook despite an estimated

| Metric | Q3 FY2026 Result | vs. Prior Year | vs. Consensus |

|---|---|---|---|

Revenue |

¥13.46 billion (+8.6% YoY) | Strong growth | Exceeding estimates |

Operating Margin |

8.78% (TTM) | Stable | Above sector average |

EPS (Q2 FY26) |

$4.85 | — | +44.35% surprise |

Net Profit Margin |

9.38% (TTM) | Robust | Industry-leading |

Toyota’s Q3 results reflect sequential improvement following the implementation of targeted cost-reduction initiatives and sustained demand for its hybrid vehicle lineup globally[1].

Toyota has

| Manufacturer | Estimated Tariff Cost (FY2026) | Import Dependency (US Sales) | Operating Profit Impact |

|---|---|---|---|

Toyota |

$9.7 billion (1.45 trillion yen) | ~20% | Forecast Raised (+30% YoY) |

Hyundai |

~$3 billion (4.1 trillion won) | ~60% | -19.5% Decline |

Volkswagen |

Significant exposure | High | Under pressure |

Toyota’s tariff resilience stems from its

Toyota’s approach to managing tariff pressures has been multifaceted:

- Aggressive U.S. Manufacturing Expansion: A recent$912 million investmentadded252 new U.S. manufacturing jobs, with particular focus on hybrid production capacity[2]

- Cost Discipline: Successful implementation of cost-reduction programs across global operations

- Pricing Power Maintenance: Strategic decision to absorb rather than pass on tariff costs, preserving customer loyalty

- Diversified Geographic Revenue: Strong demand outside the U.S. offsetting domestic margin pressure

Toyota solidified its position as the

| Rank | Manufacturer | 2025 Global Sales |

|---|---|---|

| 1 | Toyota |

10.5 million |

| 2 | Volkswagen Group | 9.0 million |

| 3 | Hyundai Motor Group | 7.27 million |

Toyota’s U.S. market performance was particularly noteworthy, with

Toyota’s

| Vehicle Category | Share of Toyota/Lexus Sales (2025) |

|---|---|

Hybrids |

42% |

| Conventional Gasoline | 51% |

| Battery Electric Vehicles (BEVs) | <2% |

| Others | 5% |

This hybrid dominance has proven strategically valuable as:

- EV demand has plateauedglobally amid charging infrastructure constraints and affordability concerns[3]

- Hybrids offer immediate fuel efficiency benefitswithout range anxiety or charging infrastructure dependencies

- Toyota’s hybrid technology leadership( Prius, RAV4 Hybrid) provides sustainable competitive advantages

The company’s 47% electrified vehicle sales penetration in the U.S. market by 2025 positions it favorably as regulatory frameworks continue to evolve[3].

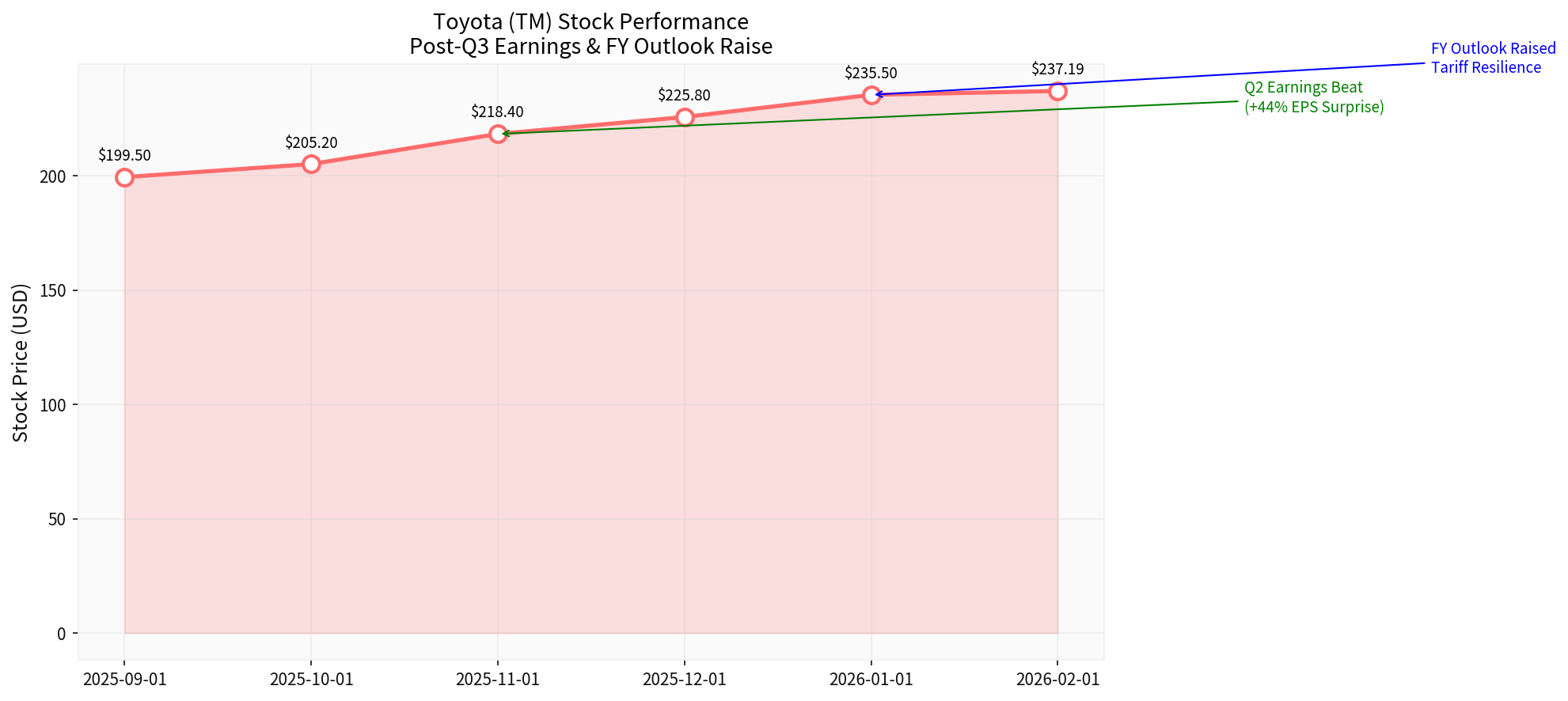

Toyota’s ADR (NYSE: TM) has delivered

| Period | Return |

|---|---|

| 1 Month | +8.38% |

| 3 Months | +19.10% |

| 6 Months | +30.68% |

| YTD | +8.87% |

| 1 Year | +21.42% |

| 3 Years | +64.96% |

The stock is trading at

| Indicator | Status | Interpretation |

|---|---|---|

Trend |

UPTREND (Breakout, pending confirmation) | Positive momentum |

MACD |

Bullish (no cross) | Strengthening |

KDJ |

Overbought territory (K:81.8, D:74.1) | Extended rally |

Key Support |

$229.04 | Immediate floor |

Key Resistance |

$242.96 | Near-term ceiling |

Next Target |

$247.63 | Extended upside |

Beta (vs S&P 500) |

0.18 | Low correlation to market |

The technical picture indicates an

Toyota’s resilient performance amid tariff pressures suggests the

- Premium for Production Localization: Companies with established localized manufacturing (Toyota, Honda) should command valuation premiums over import-dependent rivals

- Hybrid Technology Valuation: Traditional hybrids may be undervalued compared to pure EVs, with market potentially over-rotating toward BEV speculative narratives

- Operational Excellence Premium: Disciplined cost management and supply chain optimization capabilities should be rewarded in valuations

The tariff environment is

| Capability | Winners | Losers |

|---|---|---|

| U.S. manufacturing base | Toyota, Honda | Hyundai, Volkswagen |

| Hybrid technology depth | Toyota, Ford | New EV entrants |

| Cost absorption capacity | Scale players | Niche manufacturers |

Toyota’s demonstrated ability to maintain profitability despite $9.7 billion in tariff costs indicates substantial

- Hybrid Demand Acceleration: Strong U.S. and European demand for fuel-efficient vehicles should sustain revenue growth

- U.S. Manufacturing Expansion: Additional capacity coming online in 2026 will further reduce import dependency

- Margin Expansion: Cost reduction initiatives and scale benefits should drive operating margin improvement

- Leadership Stability: Management continuity (CEO Kenta Kon appointment) provides strategic execution continuity[1]

- Tariff Escalation: Further tariff increases could exceed Toyota’s absorption capacity

- EV Transition Disruption: Aggressive EV mandates could require costly technology pivot

- Currency Volatility: Yen appreciation could impact translated earnings

- Competition Intensification: Chinese manufacturers expanding into hybrid segments

With a

Toyota Motor Corporation’s Q3 FY2026 performance and raised full-year outlook represent a

- Structural Competitive Advantages: Decades of localized U.S. manufacturing have created sustainable moats

- Hybrid Strategy Validation: The hybrid-first approach has proven more resilient than pure-EV strategies amid current market conditions

- Operational Excellence: Disciplined cost management and manufacturing efficiency provide meaningful margin protection

- Valuation Opportunity: Current stock levels may underappreciate Toyota’s sustainable competitive positioning

For global automotive industry investors, Toyota’s performance suggests a

[1] Seeking Alpha - “Toyota Motor reports Q3 results; updates FY26 outlook” (February 6, 2026)

[2] CNBC - “Toyota hits record hybrids sales in 2025 as the auto giant adjusted to Trump’s tariffs” (January 29, 2026)

[3] OICA - “5 Major News Items Summarized” (January 27, 2026)

[0]金灵API数据 - Company Overview, Technical Analysis, Real-Time Quotes

阿里千问30亿补贴推广策略可持续性分析

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.