Reddit SPX 0DTE Options Trading: $8k to $235k Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

This analysis is based on a Reddit post [Event Source] published on November 14, 2025, at 22:48:34 EST, which described a remarkable trading event where a 21-year-old student reportedly transformed approximately $8,000 into $235,000 through aggressive 0DTE (zero days to expiration) SPX options trading during the week.

The trader attributed a key decision to “drug-induced intuition” that SPX would open red then recover, and announced plans to quit 0DTE/weekly options trading in favor of safer strategies after accumulating significant capital [Event Source].

The S&P 500 Index (SPX) experienced significant volatility during the relevant trading period, with price movements that align with the described strategy [0]:

- November 13: SPX closed at 6,737.49 (-1.3% decline from previous day)

- November 14: SPX recovered to 6,734.11 (+0.93% gain)

This pattern of opening lower (red) then recovering would have been profitable for appropriately structured options positions, particularly for traders who correctly anticipated the intraday reversal [0].

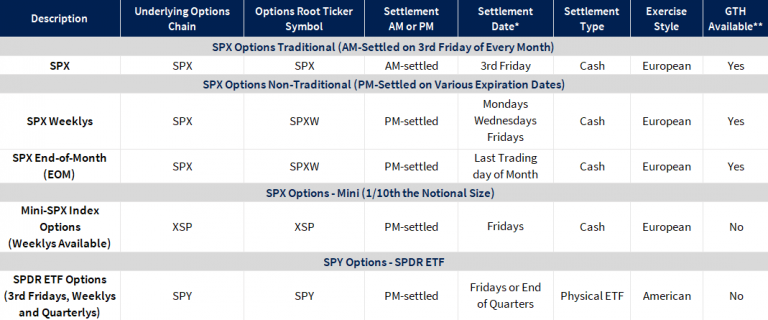

The 0DTE options market has experienced substantial growth, with approximately 48% of SPX options volume now concentrated in 0DTE contracts according to Cboe data [1]. These instruments are characterized by:

- High Leverage: Significant profit potential with minimal capital outlay

- Rapid Time Decay: Options expire same-day, creating extreme urgency

- Amplified Volatility: Can dramatically magnify both gains and losses

The reported transformation from $8,000 to $235,000 represents a

- Complete Loss Potential: 0DTE positions can result in 100% loss of premium within hours [3]

- Time Decay Acceleration: Options lose value extremely rapidly as expiration approaches

- Liquidity Risk: Difficulty exiting positions during rapid market moves

- Psychological Pressure: Same-day expiration creates intense decision-making stress

- Volatility Amplification: 0DTE positioning can exacerbate market moves during stress periods [2]

- Gamma Exposure Concentration: Market maker hedging can create feedback loops

- Regulatory Scrutiny: Potential for restrictions on 0DTE trading as market impact grows

The analysis reveals that 0DTE trading opportunities are highly time-sensitive, with success dependent on:

- Intraday volatility patterns

- Market opening dynamics

- Economic data release timing

- Options expiration cycles

Monitoring VIX1D levels (intraday volatility index for 0DTE options) provides crucial real-time risk assessment [1].

The described trading approach capitalized on SPX’s tendency to open lower and recover during the week, a pattern that was present during the relevant trading period [0]. The 2,837.5% return achieved through $8,000 to $235,000 transformation demonstrates the extreme leverage potential of 0DTE options when combined with precise market timing.

The 0DTE options market now represents approximately 48% of SPX options volume, reflecting significant retail and institutional participation [1]. This concentration has raised concerns about potential market stability impacts during periods of heightened volatility, with estimates suggesting $30 billion in forced positioning could trigger volatility shocks [2].

The trader’s decision to transition away from 0DTE trading after achieving significant capital aligns with professional risk management principles. As noted by trading experts, “Trading SPX 0DTE options can offer lucrative opportunities, but it requires skill and a deep understanding of volatility, time decay, and risk management” [3].

Decision-makers should track:

- VIX1D Levels: Real-time intraday volatility measurement [1]

- SPX Gamma Exposure: Market maker positioning that can amplify price movements

- Volume Distribution: Changes in 0DTE versus longer-dated options participation

- Regulatory Developments: Potential policy changes affecting 0DTE trading

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.