Quantum/AI Bubble: Perception vs. Reality - No Evidence of Coordinated Pump and Dumps

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

Notably, not all investors suffered losses - one user reported being “up substantially from start of year,” contradicting the universal loss narrative [1]. The discussion focused heavily on risk management failures, with users advising “taking profits” and noting many investors avoid selling due to tax concerns [1].

Key findings:

- No SEC enforcement actionstargeting these stocks for market manipulation in 2025

- No FINRA warningsor investigations regarding pump and dump schemes

- No trading haltsspecifically related to market manipulation

- Extreme valuationsdocumented (P/S ratios up to 5,983 for quantum stocks) but attributed to speculative bubble dynamics, not coordinated fraud [2]

- Normal insider trading activityobserved (like QBTS Form 4 filings) without manipulation allegations [2]

WallStreetBets maintains a $500M market cap minimum to avoid pump & dump discussions, limiting coordinated manipulation of smaller stocks [2].

The disconnect between Reddit perception and regulatory findings reveals a critical distinction:

- Natural market dynamicsin emerging tech sectors with extreme volatility

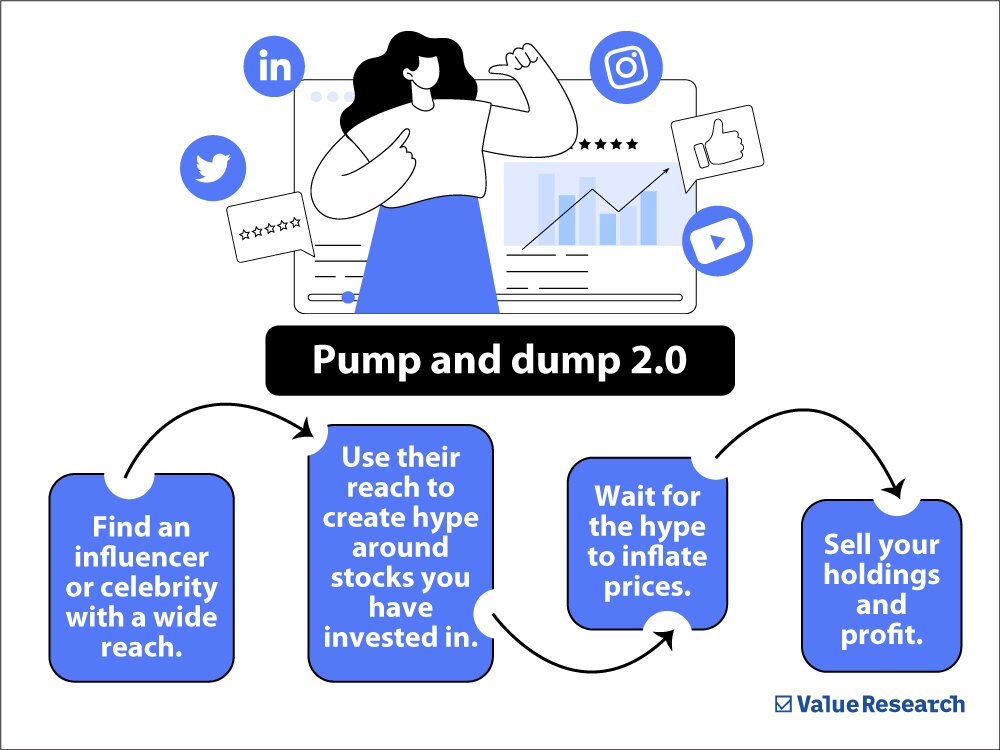

- Social media amplificationof legitimate enthusiasm creating herd behavior

- Poor risk managementby retail investors chasing trends without exit strategies

- Legitimate overvaluationconcerns rather than fraudulent price manipulation

The AI bubble concerns were widespread in 2025 but focused on legitimate overvaluation rather than fraudulent pump and dump schemes [2]. Quantum computing stocks showed particularly extreme valuations, but this reflected market enthusiasm for emerging technology rather than coordinated manipulation [2].

- Continued extreme volatility in emerging tech sectors

- Social media-driven momentum trading without fundamental analysis

- Poor risk management leading to catastrophic losses

- Tax-loss harvesting complications preventing timely exits

- Distressed valuations may create entry points for long-term investors

- Learning from bubble dynamics to develop better risk management strategies

- Focus on companies with real technology and business models (corrections noted about QS and OKLO business models)

- Potential for sector rotation as speculative excesses are wrung out

The key takeaway is that while investors suffered real losses, these resulted from speculative bubble dynamics and poor risk management rather than coordinated fraud. This distinction matters for future investment strategy and regulatory expectations.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.