Yen Surges as US Consumer Concerns Mount - February 2026 Market Analysis

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

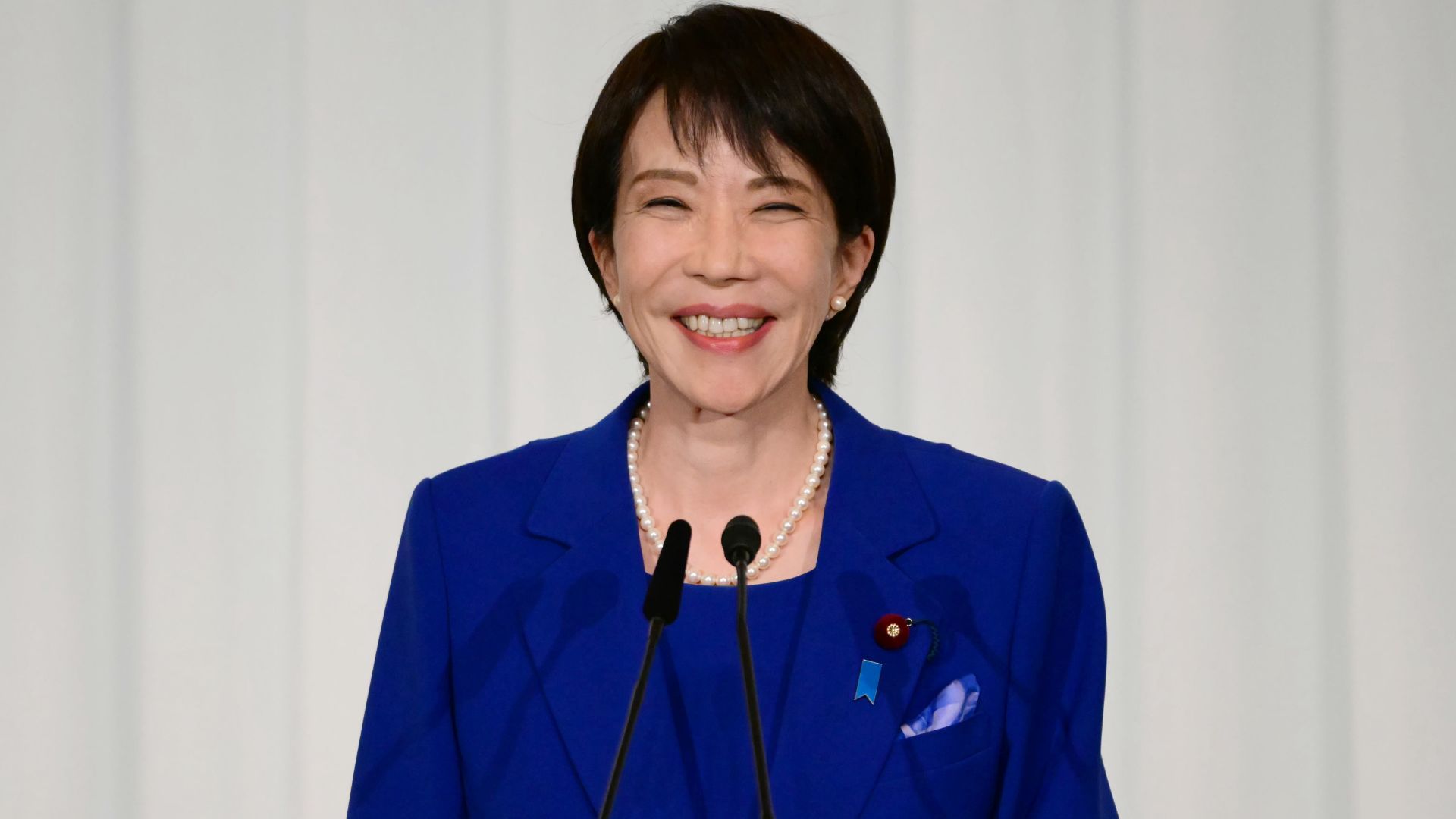

This analysis is based on the Reuters report [1] published on February 11, 2026, which documented a significant convergence of two major market-moving events: the Japanese yen’s sharp appreciation following Prime Minister Sanae Takaichi’s decisive victory in the Liberal Democratic Party leadership election, and the unexpectedly weak US December retail sales data that raised concerns about consumer spending resilience. The timing of these developments—occurring in close succession—created a notable shift in global market sentiment, affecting currency pairs, equity valuations, and fixed income markets simultaneously.

The LDP leadership result, which represented a landslide victory for Prime Minister Takaichi, carried substantial implications for Japan’s economic policy direction. Markets interpreted the outcome as potentially supportive of currency-strengthening policies, triggering a rapid reassessment of carry trade positions and safe-haven asset allocations [1]. This political development coincided with the release of US retail sales data that fundamentally challenged prevailing assumptions about consumer spending strength, creating a dual headwind scenario for risk assets.

The Japanese yen’s surge of more than 2.5% since Sunday’s election results represents a significant reversal of recent trading patterns and reflects several converging factors that market participants are actively pricing in [1]. The appreciation movement occurred amid broader US dollar weakness, as traders repositioned based on the changing risk landscape. Market sentiment has shifted toward optimism about Japan’s economic trajectory under the new government, with participants increasingly betting that policies under Prime Minister Takaichi could improve Japan’s overall economic outlook and provide structural support for currency appreciation.

The currency movement carries particular significance given the prevalence of yen-funded carry trades in global financial markets. The rapid appreciation creates potential forced unwinding dynamics, as traders who have borrowed yen to purchase higher-yielding assets may face margin pressures and need to close positions [1]. This technical aspect of the move adds a self-reinforcing element to the fundamental drivers and may amplify near-term volatility.

The yen’s strength raises important considerations for market participants engaged in carry trade strategies. Historical patterns suggest that rapid currency appreciations can trigger cascading position liquidations, particularly when leverage is elevated. Current market conditions suggest heightened sensitivity to these dynamics, with traders closely monitoring positioning indicators and liquidity conditions. The interaction between fundamental policy expectations and technical positioning creates a complex environment for currency forecasting.

The December 2025 retail sales report delivered a significant negative surprise to markets, with the headline figure coming in at 0.0% month-over-month against expectations of +0.4% [1]. This flat reading contradicted seasonal patterns that typically see holiday spending accelerate during the December period, instead indicating that consumer spending “cooled instead of accelerated” contrary to historical norms [2]. The data revealed spending declines across multiple categories, including vehicles, furniture, electronics, and clothing, suggesting broad-based consumer retrenchment rather than category-specific weakness [3].

Full-year 2025 retail sales did show a 3.7% increase, but the quarterly breakdown revealed a concerning deceleration, with momentum notably slowing in the fourth quarter [4]. This trajectory suggests that the consumer environment may be transitioning from a period of resilience to one of increasing constraint. Gregory Daco, Chief Economist at EY-Parthenon, captured this shift by noting that “this month’s data show that consumers are no longer relentlessly increasing their level of spending” [4], signaling a potential inflection point in consumer behavior.

The equity market reaction to weak consumer data was sector-differentiated, with consumer-facing industries bearing the brunt of selling pressure [0]. The Consumer Defensive sector declined 2.05%, making it the worst-performing sector on February 10, reflecting direct sensitivity to consumer spending trends. Technology stocks also experienced sharp selling pressure, with the sector declining 1.09%, while Healthcare fell 1.14% [0]. These sector declines were partially offset by strength in Basic Materials, which rose 1.21% as investors repositioned toward more economically sensitive areas of the market [0].

The NASDAQ Composite’s relative underperformance, declining 0.73% compared to the S&P 500’s 0.47% drop, suggests that growth and technology stocks—typically more sensitive to consumer spending trends and macroeconomic expectations—bore the disproportionate burden of selling pressure [0]. This pattern indicates that market participants are actively reassessing growth expectations and adjusting portfolio allocations accordingly.

US equity indices exhibited pronounced volatility in response to the data releases [0]:

| Index | February 10 Close | Daily Change |

|---|---|---|

| S&P 500 | 6,941.82 | -0.47% |

| NASDAQ Composite | 23,102.47 | -0.73% |

| Dow Jones Industrial Average | 50,188.15 | -0.01% |

| Russell 2000 | 2,679.77 | -0.45% |

The relative stability of the Dow Jones compared to the NASDAQ reflects the index composition differences, with the Dow’s higher representation of established consumer staples and healthcare companies providing relative insulation compared to the NASDAQ’s technology-heavy weighting [0].

Fixed income markets responded dynamically to the weak consumer data, with Treasury yields declining across maturities as investors adjusted growth expectations and safe-haven allocations [1]. The bond market reaction suggests that participants are increasingly pricing in a potentially softer economic trajectory, with implications for monetary policy expectations. The rally in bond prices reflects both the direct impact of weaker economic data and the secondary effect of reduced inflation pressures that typically accompany consumer spending deceleration.

The December retail sales data complicates the Federal Reserve’s ongoing policy calculus, as weakening consumer activity may force a recalibration of policy priorities [1]. Expectations for Federal Reserve rate cuts have eased slightly following the data release, reflecting the complex interplay between inflation concerns and growth dynamics that policymakers must navigate [1]. The January employment report, expected on February 11, will provide additional context for labor market conditions and potential policy responses [1].

Several critical factors warrant close observation as the situation develops. First, the extent to which the new Japanese government will implement concrete currency-supportive policies remains uncertain, with market participants seeking definitive policy announcements to validate current price movements. Second, the degree to which ongoing trade tensions and tariff policies are suppressing consumer spending represents an important causal factor that requires ongoing assessment. Third, wage dynamics and whether cooling wage growth will continue to constrain consumer spending power deserve careful monitoring. Finally, the divergence between high-income consumers, who continue to spend, and lower-income households, which are pulling back, suggests a nuanced consumer landscape that defies simple characterization [4].

The market dynamics reveal several competing narratives that investors must weigh. For the yen, the bullish case rests on political stability under the new government, potential shifts in Bank of Japan policy stance, and safe-haven flows amid global uncertainty. The bearish counterargument acknowledges Japan’s persistent structural economic challenges, export dependency that could pressure currency intervention, and the possibility that global risk sentiment may override policy effects [1].

Regarding the US consumer outlook, the holiday season pullback may prove temporary, with stock market gains continuing to support high-income spending and labor market resilience providing underlying economic support. However, the December data introduces genuine uncertainty about the durability of consumer spending trends into 2026.

Reuters specifically highlighted Walmart (WMT) as a company whose gains may face pressure if consumer spending weakness persists [1]. Companies in discretionary categories showing December weakness—including automobiles, furniture, electronics, and apparel—warrant particularly close monitoring. The sector rotation patterns observed in recent trading sessions suggest that market participants are actively adjusting exposure to consumer-facing industries based on evolving spending data.

Several risk factors warrant attention from market participants. The flat retail sales reading raises cautionary flags about consumer stamina, with multiple consecutive months of weakening data potentially signaling more结构性 economic concerns [1]. The weakening consumer data introduces complexity for Federal Reserve policy formulation, as economic slowing may force a recalibration of inflation-fighting priorities against growth preservation. Japan’s policy trajectory remains uncertain, and while markets initially cheered the LDP victory, concrete policy announcements will be crucial for sustaining yen strength [1]. Finally, the rapid yen appreciation could trigger forced unwinding of carry trade positions, potentially amplifying volatility in both currency and equity markets.

Market participants should prioritize tracking several forthcoming data points and developments. The January retail sales release will provide critical information about whether the December weakness represents a temporary deviation or the beginning of a sustained trend. Federal Reserve commentary from upcoming speeches and meeting minutes will offer insights into how policymakers are assessing the economic outlook. Bank of Japan policy signals in response to currency movements deserve close attention, as does corporate earnings guidance from consumer-facing companies [1]. Treasury yield movements will continue to reflect bond market reassessment of growth expectations, providing real-time feedback on changing economic outlooks.

The analysis reveals several risk factors that warrant attention based on the data examined. The technical indicators and sector performance patterns suggest elevated near-term volatility risk for consumer-sensitive assets. Historical correlations between retail sales weakness and sector rotation patterns provide context for understanding current market dynamics. Market conditions indicate that defensive posturing may be appropriate until US consumer trends demonstrate clearer directional signals, though the extent and duration of such positioning should be calibrated to individual risk tolerances and investment timeframes.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.