Healthcare Powers U.S. Job Market Amid Looming Medicaid Spending Cuts

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

Related Stocks

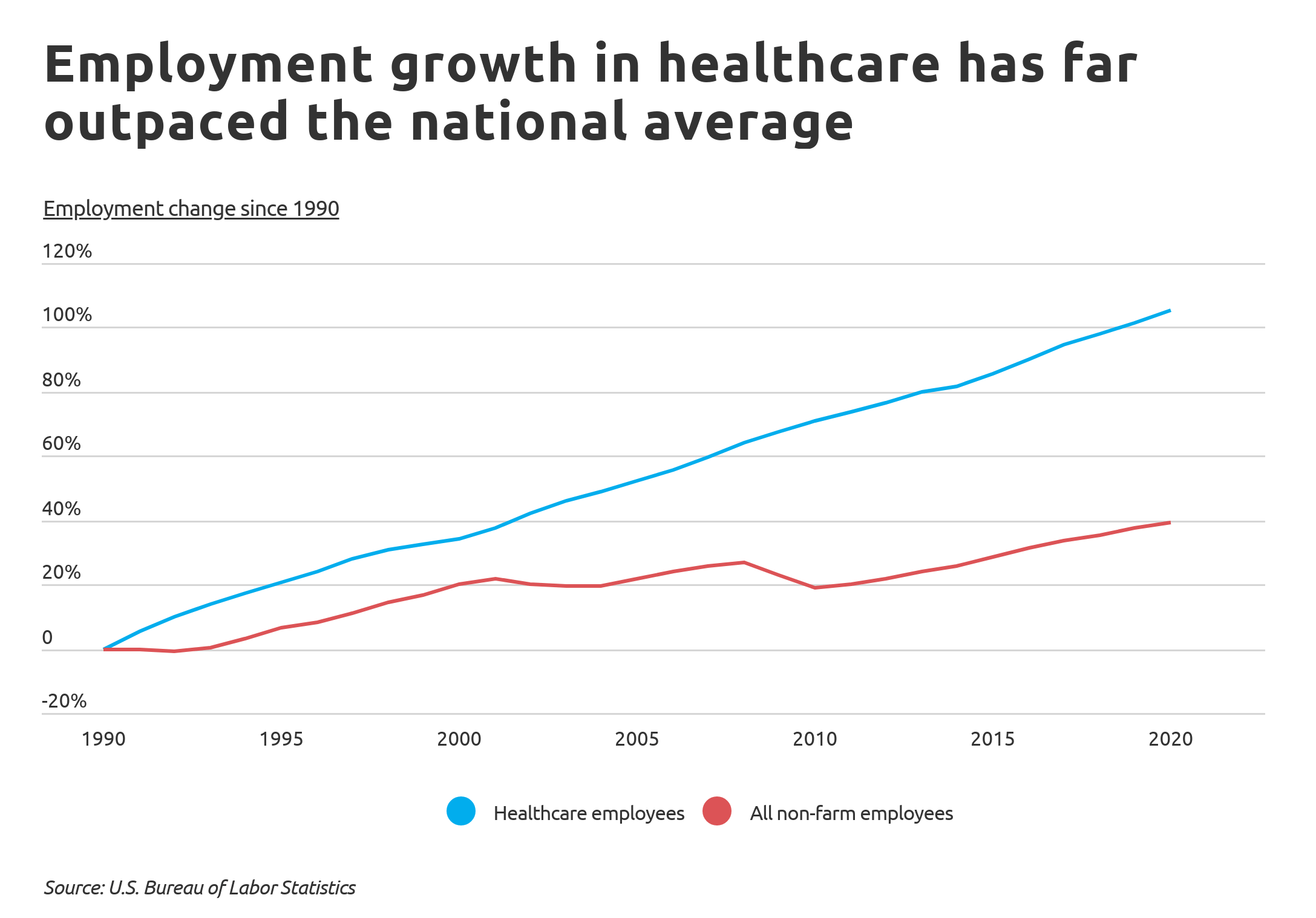

The January 2026 employment data reveals a striking concentration of job creation within the healthcare sector, with significant implications for both the broader labor market and the healthcare industry’s future trajectory. Healthcare added 82,000 positions in January, representing the largest monthly gain since July 2020 and approximately 2.5 times the 2025 monthly average of 33,000 jobs [1][2]. This performance substantially outpaced all other sectors: social assistance added 42,000 jobs, construction contributed 33,000 positions, professional and business services generated 34,000 jobs, while financial services recorded losses of 22,000 positions and the federal government shed 34,000 jobs [3].

The subsector breakdown illuminates the breadth of healthcare job creation: ambulatory healthcare services led with 50,000 new positions, followed by hospitals adding 18,000 jobs and nursing and residential care facilities contributing 13,000 positions [1][2]. Christopher Rupkey, Chief Economist at FWDBONDS, captured the employment landscape’s concerning concentration by noting that “the only jobs being filled in January are in health care and social assistance,” suggesting limited diversification across the broader economy [3].

This employment strength, however, exists against a backdrop of significant federal policy changes that will likely reshape healthcare sector dynamics. The One Big Beautiful Bill Act has approved approximately $1 trillion in Medicaid cuts over the next decade, with analysis indicating that over 10 million people could lose Medicaid coverage as a result [4][5]. The Centers for Medicare and Medicaid Services oversees $1.7 trillion in annual healthcare outlays, representing approximately 24% of the federal budget, making healthcare spending a primary target for fiscal reduction efforts [5]. State-level effects will materialize beginning in 2028, when changes to Medicaid financing rules could remove an estimated $20 billion in federal matching funds from state programs [4].

The Bureau of Labor Statistics’ subsequent benchmark revision of the 12-month total job count downward by 862,000 positions introduces additional complexity to the employment analysis, potentially indicating over-counting in earlier reports and suggesting the underlying labor market may be weaker than headline figures indicate [3].

The healthcare sector’s role as the primary engine of U.S. job creation represents both a strength and a structural vulnerability. While the 82,000 healthcare jobs added in January demonstrate the sector’s robust hiring capacity and the ongoing demand for healthcare services driven by demographic factors including an aging population, the concentration of employment gains in a single sector masks weakness elsewhere in the economy. The federal government’s reduction of 327,000 workers since October 2024 and the 22,000 job losses in financial services highlight the uneven nature of current labor market conditions [3].

The legislative approval of $1 trillion in Medicaid cuts over a decade represents a fundamental shift in healthcare financing that will unfold gradually but inevitably reshape the sector. Unlike acute economic shocks that produce immediate effects, the extended implementation timeline through 2028 and beyond creates a prolonged period of uncertainty that may influence hiring decisions well before actual funding reductions take effect. Healthcare providers, particularly those with significant Medicaid patient volumes, face strategic planning challenges as they attempt to position themselves for an environment of reduced federal healthcare spending.

Geographic and demographic variation will likely produce uneven impacts across the healthcare sector. States with higher Medicaid enrollment percentages face proportionally greater exposure to funding reductions, potentially creating regional disparities in healthcare employment growth. Healthcare facilities serving high proportions of Medicaid patients, rural healthcare organizations heavily dependent on federal program reimbursements, and community health centers with significant federal grant funding represent particularly vulnerable segments of the industry.

The current employment data also reveals an interesting temporal dynamic: near-term strength coexists with medium-term uncertainty. Recent hiring commitments will proceed through the coming quarters, maintaining elevated healthcare employment levels even as the policy environment becomes less favorable. This creates a potential disconnect between current labor market conditions and the structural headwinds that industry participants must navigate.

The healthcare sector faces a confluence of risks emanating from federal policy changes. The $1 trillion Medicaid reduction approved by Congress represents the most significant threat, potentially eliminating coverage for over 10 million individuals and reducing federal matching funds to states by an estimated $20 billion by 2028 [4][5]. This funding reduction will likely cascade through the healthcare system, affecting provider revenues, staffing levels, and ultimately patient access to care. Healthcare facilities with thin margins and high Medicaid dependency face particular risk of financial pressure that could trigger consolidation or closure.

The concentration of overall economic job growth in healthcare also represents a systemic risk. When a single sector accounts for the majority of net job creation, the broader economy becomes vulnerable to sector-specific shocks. Any significant downturn in healthcare employment—whether from policy changes, reimbursement rate reductions, or utilization shifts—would have outsized effects on overall labor market conditions.

Despite the headwinds, several opportunity windows exist for industry participants. Healthcare staffing companies may continue to benefit from near-term elevated hiring needs as recent commitments proceed through implementation. The extended timeline for Medicaid policy changes creates a window for strategic positioning, allowing well-capitalized providers to strengthen their competitive positions before the full effects of funding reductions materialize.

Demographic drivers remain favorable for long-term healthcare demand. The aging U.S. population will continue generating increased demand for healthcare services regardless of policy changes, providing a fundamental tailwind for the sector. Healthcare organizations that successfully navigate the transition to reduced federal spending—through operational efficiency improvements, payer mix diversification, or care delivery model innovation—may emerge stronger from the restructuring period.

Alternative care delivery models, including telehealth and retail clinic formats, may gain market share as traditional providers face financial pressure. These models often have different staffing profiles and cost structures that could prove more resilient in a reduced-reimbursement environment.

The January 2026 employment data establishes healthcare as the dominant source of U.S. job creation, with 82,000 positions added representing over 60% of total gains. Healthcare employment outpaced all other sectors significantly, with ambulatory healthcare services contributing the largest subsector gains. The employment concentration, however, reflects underlying economic weakness in other sectors rather than exclusively healthcare sector strength.

Federal healthcare spending policy represents the critical variable for healthcare sector employment outlook. The $1 trillion Medicaid cut approved over the next decade, with $20 billion in reduced federal matching funds to states beginning in 2028, creates structural headwinds that will likely decelerate healthcare hiring over the medium term. The 10+ million potential coverage losses from Medicaid reductions could decrease healthcare utilization and increase uncompensated care burdens for providers.

The Bureau of Labor Statistics’ downward revision of 862,000 positions to the 12-month job count introduces uncertainty regarding underlying labor market strength. This revision suggests potential over-counting in earlier reports and warrants careful interpretation of headline employment figures.

Industry participants should monitor Medicaid enrollment trends in their service areas, assess payer mix vulnerability to federal funding reductions, and evaluate strategic positioning for a healthcare financing environment that will undergo fundamental restructuring over the coming years. The current employment strength appears to represent a near-term phenomenon that will likely normalize as policy changes take effect through 2028 and beyond.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.