U.S. January 2026 Jobs Report: Healthcare Dominates as Market Volatility Increases

Unlock More Features

Login to access AI-powered analysis, deep research reports and more advanced features

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.

The January 2026 employment situation report presents a nuanced picture of the U.S. labor market that defies simple characterization. The headline numbers—130,000 jobs added and a 4.3% unemployment rate—initially appeared robust against economist expectations of 55,000-75,000 new positions [1][2][3]. However, the employment situation data released by the Bureau of Labor Statistics contained significant downward revisions to 2025 figures that fundamentally alter the interpretation of current labor market strength [1].

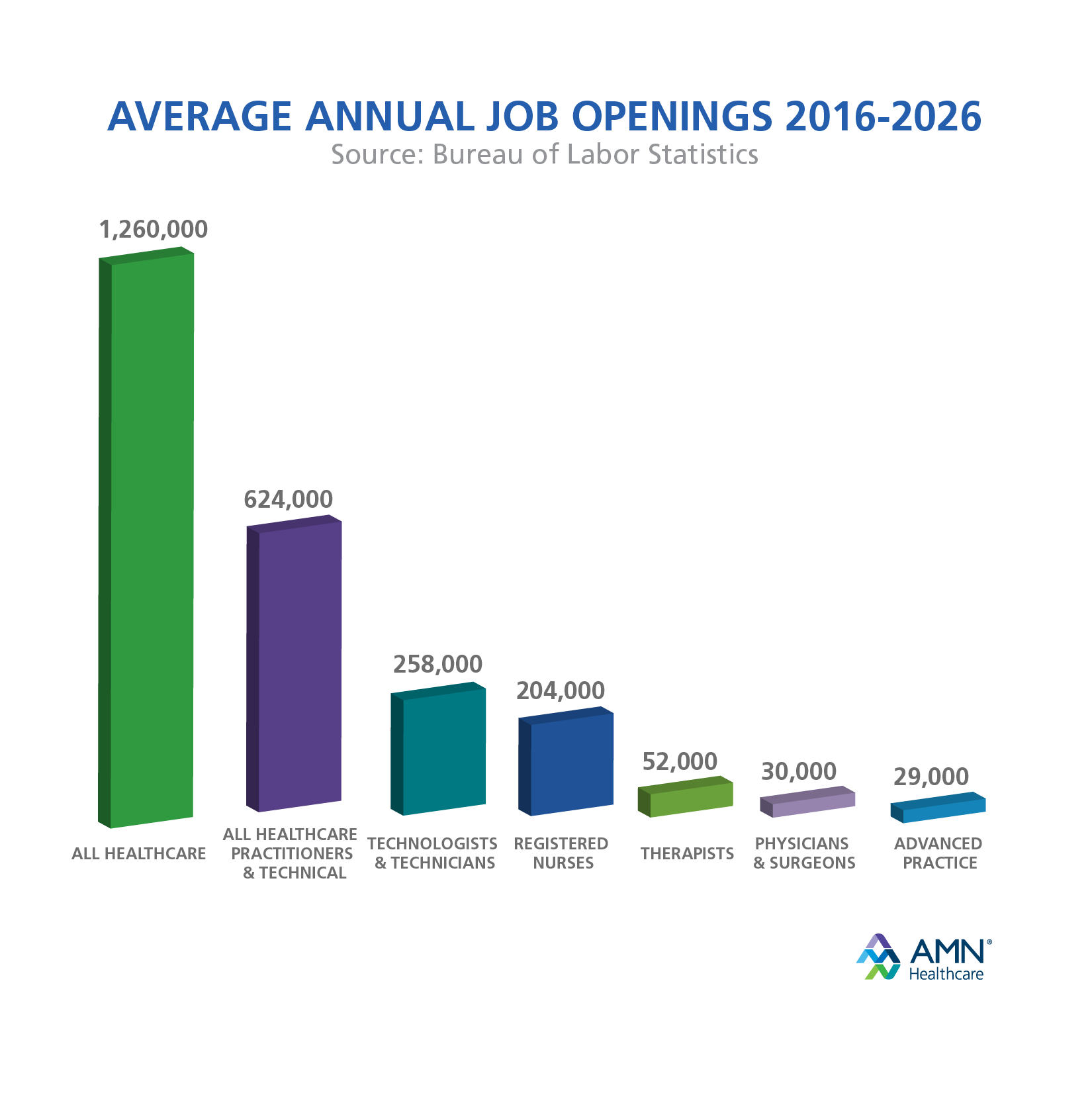

The most striking feature of the January report is the extreme concentration of job gains within the healthcare and social assistance sectors. Healthcare added 82,000 jobs while social assistance contributed an additional 42,000 positions, meaning approximately 95% of January’s total job gains (124,000 of 130,000) came from just two sectors [1][2]. This concentration raises questions about the breadth of economic expansion and whether labor market strength is broadly distributed or heavily dependent on healthcare hiring trends.

The annual benchmark revision process conducted by the BLS revealed substantial overstatement in previously reported 2025 employment data. The originally reported 584,000 jobs for 2025 was revised downward to just 181,000—a reduction of 403,000 positions [1][2]. March 2025 employment alone was revised downward by 898,000 positions, representing a 0.5% revision to total nonfarm employment [1]. These revisions suggest that the underlying labor market trajectory may be weaker than headline figures indicated throughout 2025.

The New York Times’ coverage characterized this as “The Hidden Number Driving U.S. Job Growth,” highlighting how healthcare sector employment has become the dominant driver of net job creation in the U.S. economy [4]. This concentration represents both a strength and vulnerability—the healthcare sector’s growth reflects genuine demographic and structural demand, but it also means that broader economic diversification may be limited.

The stock market’s reaction on February 12, 2026, demonstrated significant concern despite the seemingly positive headline numbers. The S&P 500 fell 1.79% to close at 6,832.77, the NASDAQ dropped 2.36% to 22,597.15, and the Dow Jones declined 1.71% to 49,451.99 [0]. The Russell 2000, often viewed as a barometer of domestic small-cap health, fell 2.58% to 2,615.83, suggesting particular weakness among smaller domestic companies [0].

Several factors drove the negative market response. First, Bank of America analysts noted that the “broad-based strength” in the labor market “vindicates our view that the Fed won’t cut” interest rates under Chair Powell [5]. Rate-sensitive sectors including real estate and utilities experienced pressure as the probability of Federal Reserve rate cuts diminished. Second, some Wall Street analysts questioned the 130,000 figure as potentially “inflated” and due for future downward revision [5]. Third, the combination of stronger labor data with recent disappointing consumer spending (flat in December versus +0.4% expected) created conflicting economic signals that increased uncertainty [8].

The contraction in federal government employment—down 34,000 positions in January and down 10.9% since October 2024—signals ongoing fiscal drag from reduced government spending [1]. Similarly, financial activities lost 22,000 jobs in January alone and 49,000 positions since the May 2025 peak, suggesting structural challenges in the financial sector [1].

The analysis reveals several risk considerations that warrant attention.

From an analytical perspective, the jobs report provides insight into sector-specific dynamics that may inform understanding of economic rotation patterns. The concentration in healthcare reflects structural demographic trends that may continue regardless of broader economic conditions. The divergence between headline strength and market reaction creates opportunities to observe how financial markets price complex, mixed-signal data.

The January 2026 employment report delivers headline numbers that exceeded expectations (130,000 jobs versus 55,000-75,000 forecast) while simultaneously revealing significant downward revisions to prior year data (2025 revised from 584,000 to 181,000 jobs) [1][2]. Healthcare dominated job creation with 82,000 positions added, representing 63% of total gains, while federal government (-34,000) and financial activities (-22,000) contracted [1].

The unemployment rate declined to 4.3% from 4.4%, while labor force participation remained at 62.5% [1]. Market reaction was negative across major indices, with the S&P 500 falling 1.79%, NASDAQ dropping 2.36%, and the Russell 2000 declining 2.58% [0].

The Federal Reserve’s path forward becomes less clear as stronger labor market data reduces expectations for rate cuts while simultaneously raising questions about inflation dynamics in a tighter employment environment [5][6]. The discrepancy between headline strength and market pessimism reflects investor concerns about data reliability, reduced rate cut probability, and the narrow sectoral composition of job gains.

Insights are generated using AI models and historical data for informational purposes only. They do not constitute investment advice or recommendations. Past performance is not indicative of future results.

About us: Ginlix AI is the AI Investment Copilot powered by real data, bridging advanced AI with professional financial databases to provide verifiable, truth-based answers. Please use the chat box below to ask any financial question.